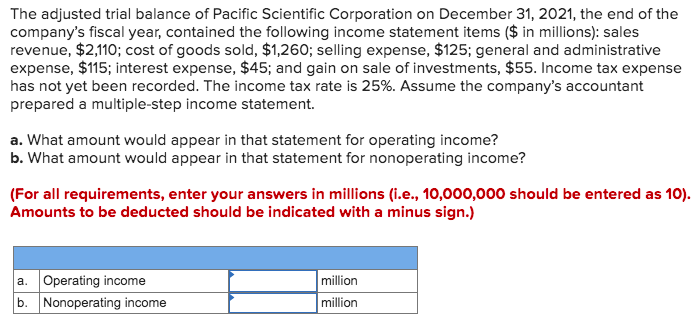

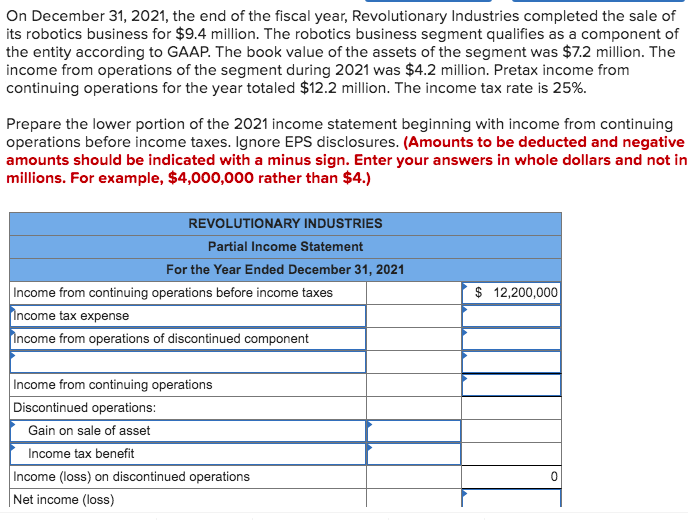

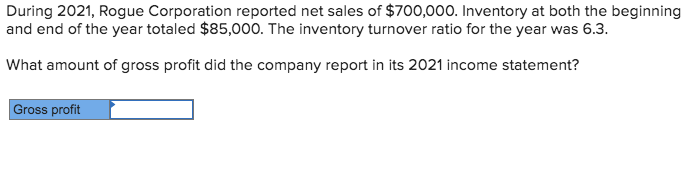

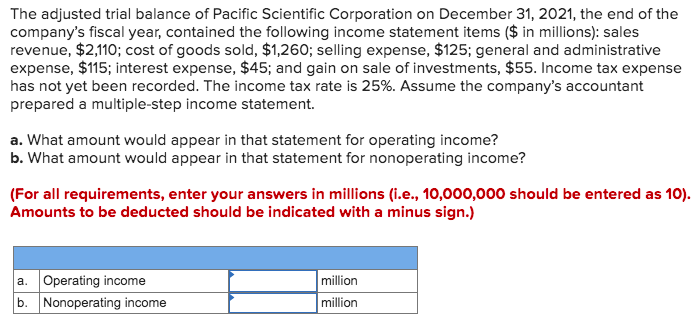

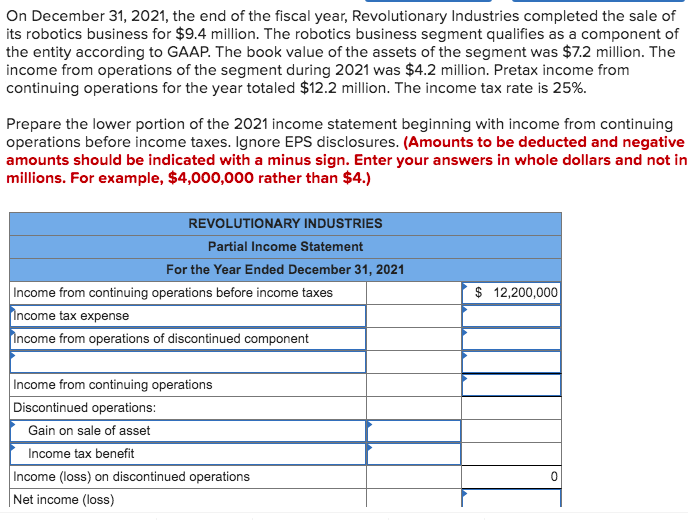

The adjusted trial balance of Pacific Scientific Corporation on December 31, 2021, the end of the company's fiscal year, contained the following income statement items ($ in millions): sales revenue, $2,110; cost of goods sold, $1,260; selling expense, $125; general and administrative expense, $115; interest expense, $45; and gain on sale of investments, $55. Income tax expense has not yet been recorded. The income tax rate is 25%. Assume the company's accountant prepared a multiple-step income statement. a. What amount would appear in that statement for operating income? b. What amount would appear in that statement for nonoperating income? (For all requirements, enter your answers in millions (i.e., 10,000,000 should be entered as 10). Amounts to be deducted should be indicated with a minus sign.) million a. Operating income b. Nonoperating income million On December 31, 2021, the end of the fiscal year, Revolutionary Industries completed the sale of its robotics business for $9.4 million. The robotics business segment qualifies as a component of the entity according to GAAP. The book value of the assets of the segment was $7.2 million. The income from operations of the segment during 2021 was $4.2 million. Pretax income from continuing operations for the year totaled $12.2 million. The income tax rate is 25%. Prepare the lower portion of the 2021 income statement beginning with income from continuing operations before income taxes. Ignore EPS disclosures. (Amounts to be deducted and negative amounts should be indicated with a minus sign. Enter your answers in whole dollars and not in millions. For example, $4,000,000 rather than $4.) REVOLUTIONARY INDUSTRIES Partial Income Statement For the Year Ended December 31, 2021 Income from continuing operations before income taxes Income tax expense Income from operations of discontinued component $ 12,200,000 Income from continuing operations Discontinued operations: Gain on sale of asset Income tax benefit Income (loss) on discontinued operations Net income (loss) 0 During 2021, Rogue Corporation reported net sales of $700,000. Inventory at both the beginning and end of the year totaled $85,000. The inventory turnover ratio for the year was 6.3. What amount of gross profit did the company report in its 2021 income statement? Gross profit