Question

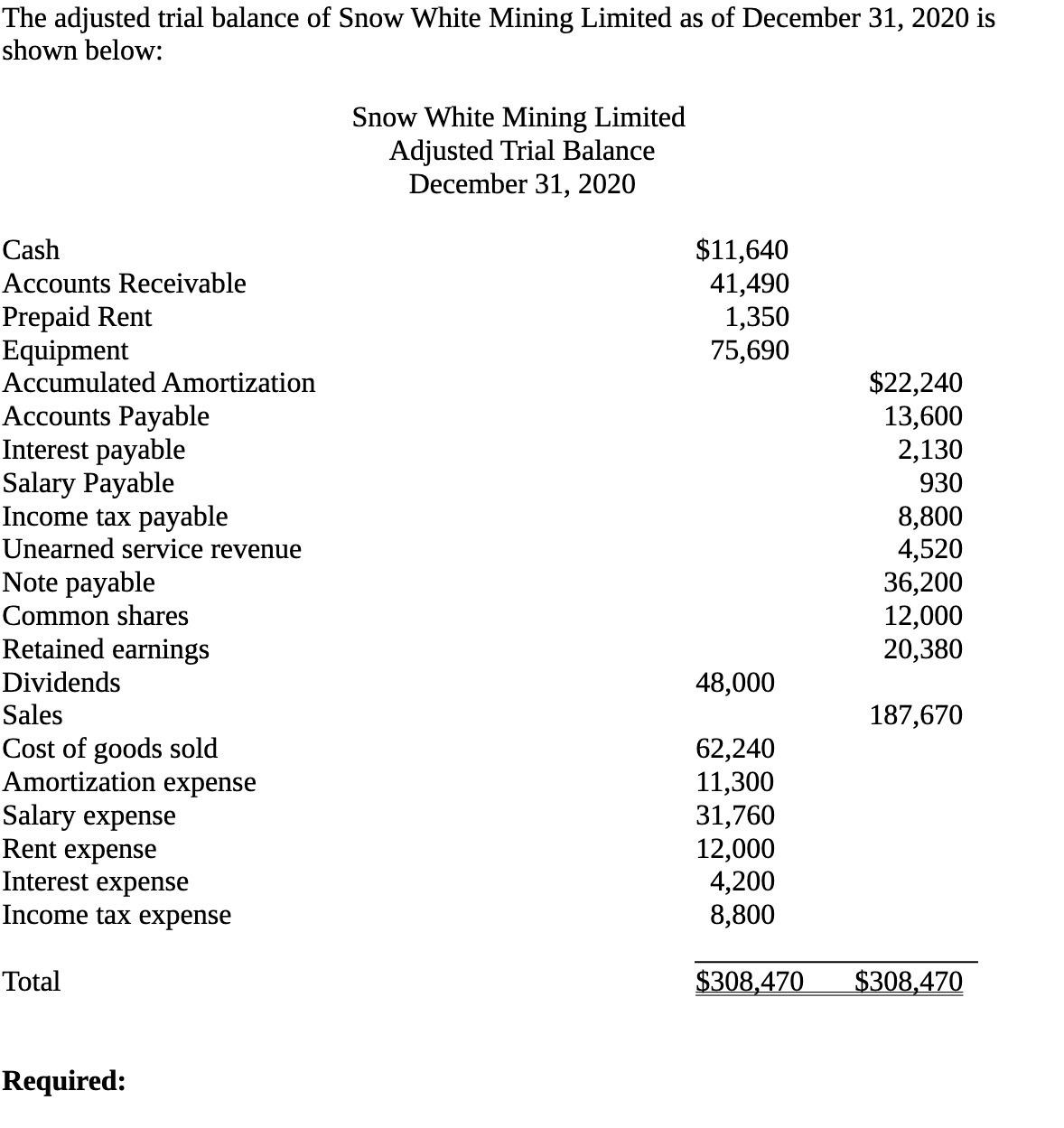

The adjusted trial balance of Snow White Mining Limited as of December 31, 2020 is shown below: Cash Accounts Receivable Prepaid Rent Equipment Accumulated

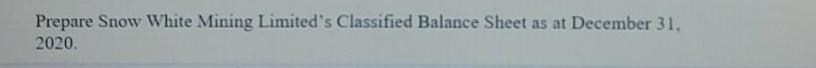

The adjusted trial balance of Snow White Mining Limited as of December 31, 2020 is shown below: Cash Accounts Receivable Prepaid Rent Equipment Accumulated Amortization Accounts Payable Interest payable Salary Payable Income tax payable Unearned service revenue Note payable Common shares Retained earnings Dividends Sales Cost of goods sold Amortization expense Salary expense Rent expense Interest expense Income tax expense Total Required: Snow White Mining Limited Adjusted Trial Balance December 31, 2020 $11,640 41,490 1,350 75,690 48,000 62,240 11,300 31,760 12,000 4,200 8,800 $22,240 13,600 2,130 930 8,800 4,520 36,200 12,000 20,380 187,670 $308,470 $308,470 Prepare Snow White Mining Limited's Classified Balance Sheet as at December 31, 2020.

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Principles

Authors: Paul D Kimmel, Donald E Kieso Jerry J Weygandt

IFRS global edition

1-119-41959-4, 470534796, 9780470534793, 9781119419594 , 978-1119419617

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App