Answered step by step

Verified Expert Solution

Question

1 Approved Answer

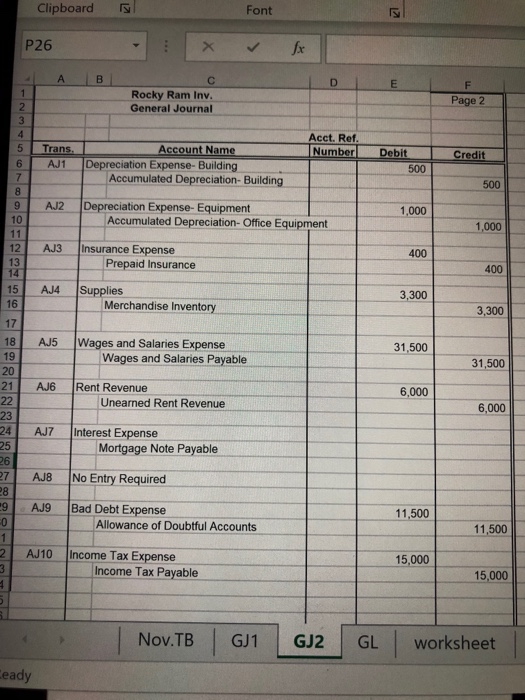

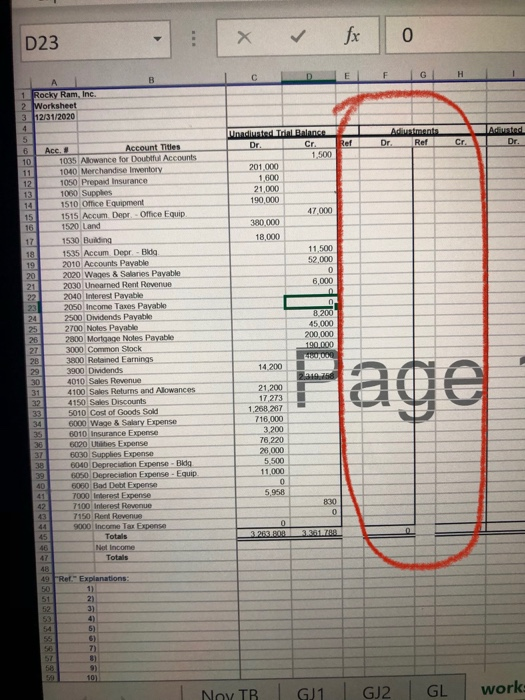

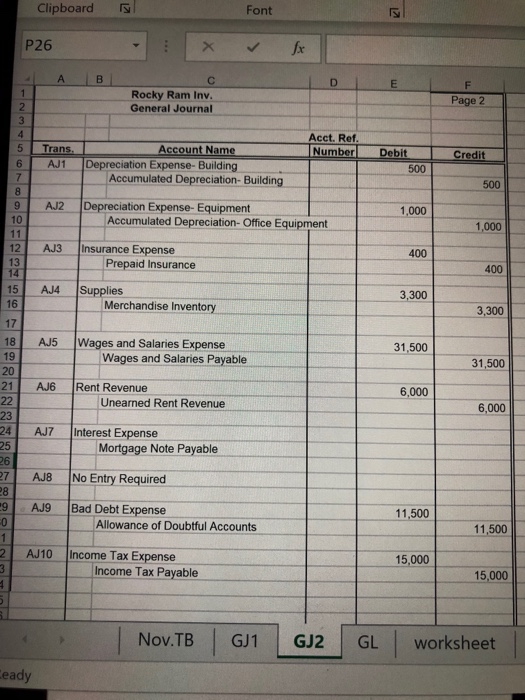

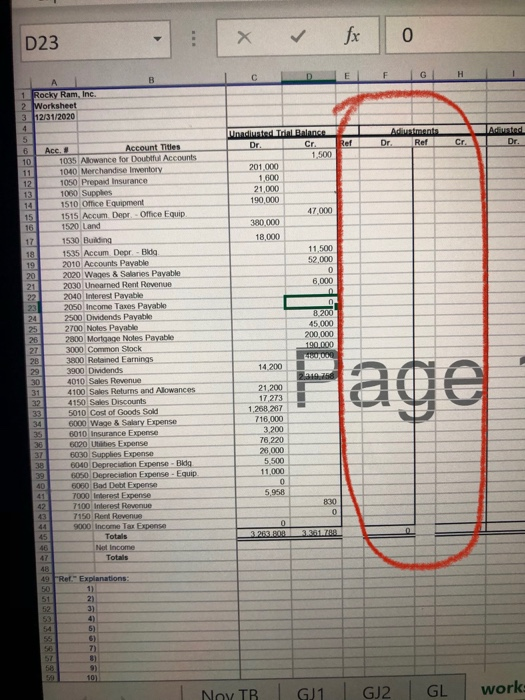

The adjustment columns that are circled in red is the part that needs to be completed. Use the journal entries in photo #2 to complete

The adjustment columns that are circled in red is the part that needs to be completed. Use the journal entries in photo #2 to complete the debit and credit adjustment columns. Thank you in advance!

6 Then use the adjusting journal entries to complete the adjustments columns on the worksheet. Be sure to include the appropriate reference for exch debit and credit entered, i.e. 1), 2), 3), etc. 7 Total the debit and credit adjustment columns on the worksheet. Debits must equal credits. If debits do not equal credits check for the common errors suggested in Step Clipboard Font 17 P26 B E Rocky Ram Inv. General Journal F Page 2 2 3 4 5 Acct. Ref. Number Trans. AJ1 Credit 6 Account Name Depreciation Expense - Building Accumulated Depreciation-Building Debit 500 500 8 AJ2 Depreciation Expense-Equipment Accumulated Depreciation - Office Equipment 1,000 1,000 AJ3 10 11 12 13 14 15 16 Insurance Expense Prepaid Insurance 400 400 AJ4 Supplies Merchandise Inventory 3,300 3,300 AJ5 Wages and Salaries Expense Wages and Salaries Payable 31,500 31,500 AJE Rent Revenue Unearned Rent Revenue 6,000 6,000 17 18 19 20 21 22 23 24 25 26 27 28 9 0 1 AJZ Interest Expense Mortgage Note Payable 8 No Entry Required AJE Bad Debt Expense Allowance of Doubtful Accounts 11,500 11,500 2 AJ10 Income Tax Expense Income Tax Payable 15,000 3 15,000 Nov.TB GJ1 GJ2 GL worksheet Ceady D23 0 C D F G H Adiustments Dr. Ref Adiunted Dr Ref Cr. A 1 Rocky Ram, Inc. 2 Worksheet 3 12/31/2020 4 5 B Ace.. Account Titles 10 1035 Allowance for Doubtful Accounts 11 1040 Merchandise Inventory 12 1050 Prepard Insurance 13 1060 Supplies 1510 Office Equipment 15 1515 Accum Depr - Office Equip 16 1520 Land 17 1530 Building 18 1535 Accum Depr - Bldg 19 2010 Accounts Payable 20 2020 Wages & Sales Payable 21 2030 Uneamed Rent Revenue 22 2040 Interest Payable 23 2050 Income Taxes Payable 24 2500 Dividends Payable 25 2700 Notes Payable 26 2800 Mortgage Notes Payable 27 3000 Common Stock 28 3800 Rolained Earnings 29 3900 Dividends 30 4010 Sales Revenue 31 4100 Sales Returns and Alowances 32 4150 Sales Discounts 33 5010 Cost of Goods Sold 34 6000 Wage & Salary Expense 6010 Insurance Expense 6020 Utilities Expense 6030 Supplies Expense 6040 Depreciation Expense - Bldg 39 6050 Depreciation Expense - Equip 40 5060 Bad Debt Expense 7000 Interest Expense 7100 Interest Revenue 7150 Rent Revenue 44 9000 Income Tax Expense 45 Totals Not Income 47 Totals Unndinned To Biance Dr Cr 1,500 201 000 1,600 21 000 190,000 47.000 380.000 18.000 11.500 52.000 0 6,000 A 0 8200 45.000 200,000 190.000 ADO 14 200 2010 768 21,200 17,273 1,268,207 716.000 3.200 78 220 20 000 5500 11 000 0 5958 830 0 0 3.263.80 49 Rer Explanations: 2) 51 52 5) 58 9) 10) GJ1 Noy TB work: GJ2 GL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started