Answered step by step

Verified Expert Solution

Question

1 Approved Answer

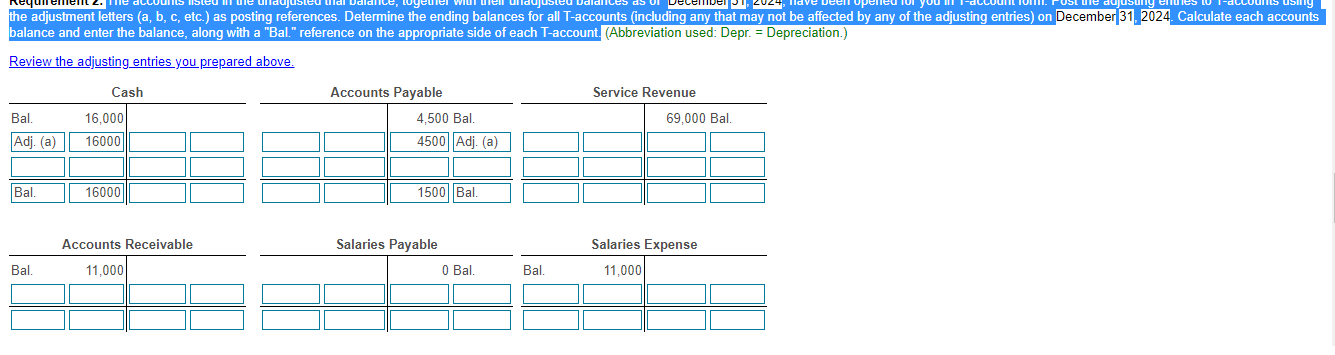

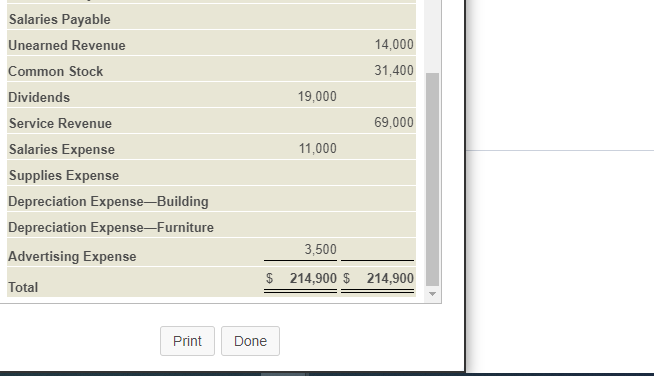

the adjustment letters (a, b, c, etc.) as posting references. Determine the ending balances for all T-accounts (including any that may not be affected

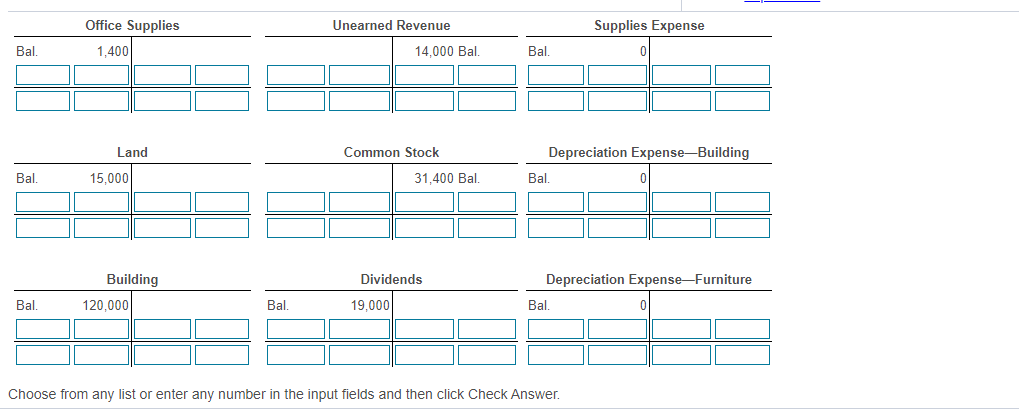

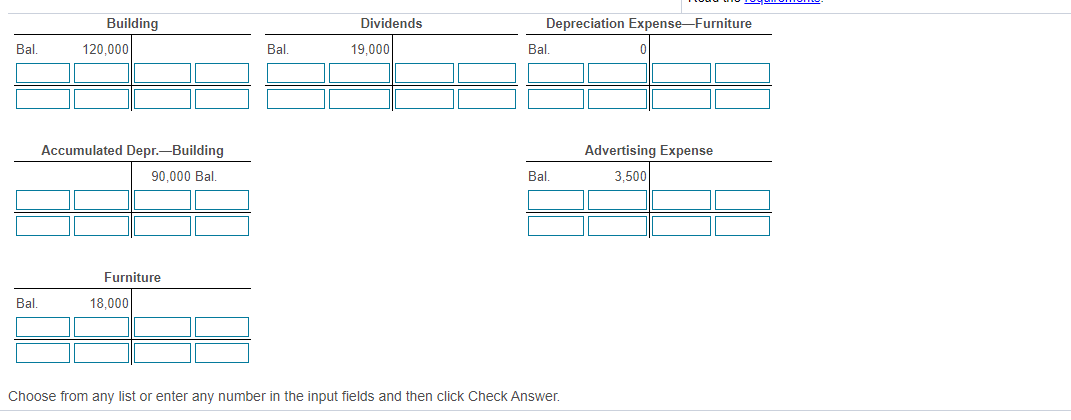

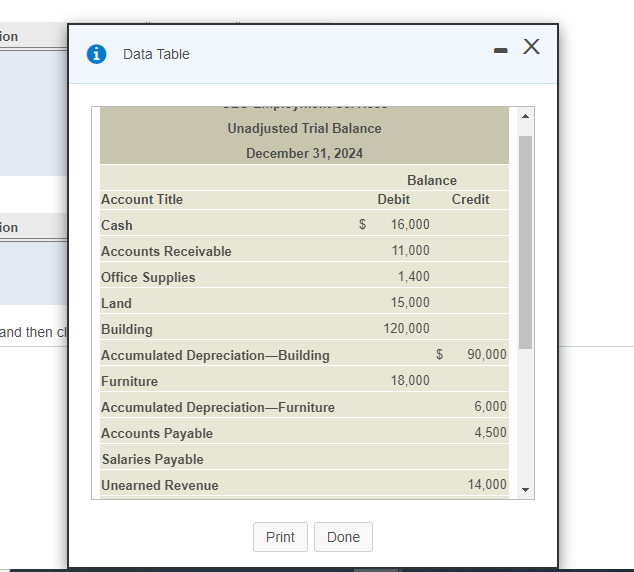

the adjustment letters (a, b, c, etc.) as posting references. Determine the ending balances for all T-accounts (including any that may not be affected by any of the adjusting entries) on December 31, 2024. Calculate each accounts balance and enter the balance, along with a "Bal." reference on the appropriate side of each T-account. (Abbreviation used: Depr. = Depreciation.) Review the adjusting entries you prepared above. Cash Bal. Adj. (a) 16,000 16000 Bal. 16000 Accounts Payable 4,500 Bal. 4500 Adj. (a) 1500 Bal. Service Revenue 69,000 Bal. Accounts Receivable Salaries Payable Salaries Expense Bal. 11,000 0 Bal. Bal. 11,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started