the affordable mortgage payment is $2625, please help me calculate the affordable home purchase price.

the affordable mortgage payment is $2625, please help me calculate the affordable home purchase price.

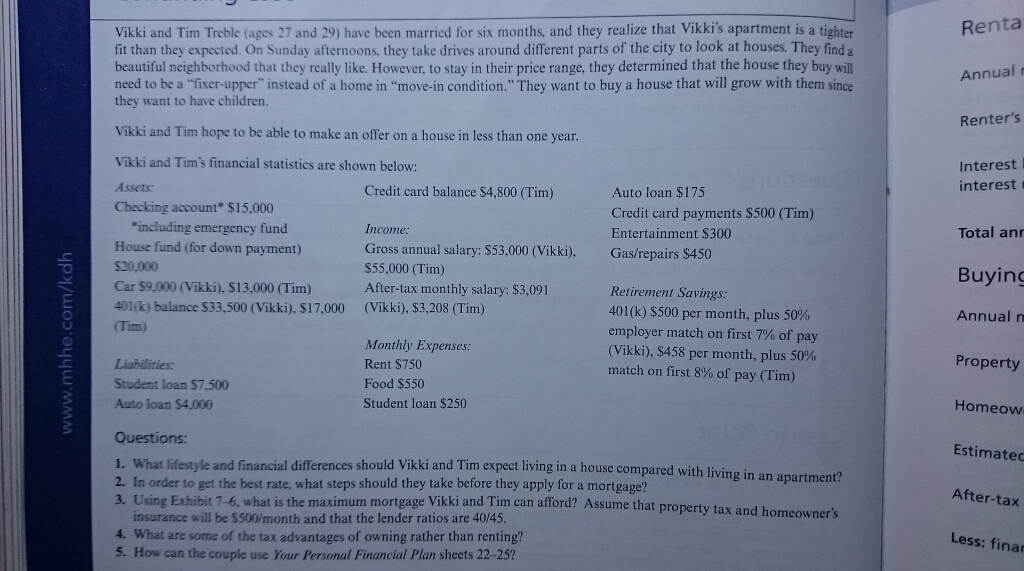

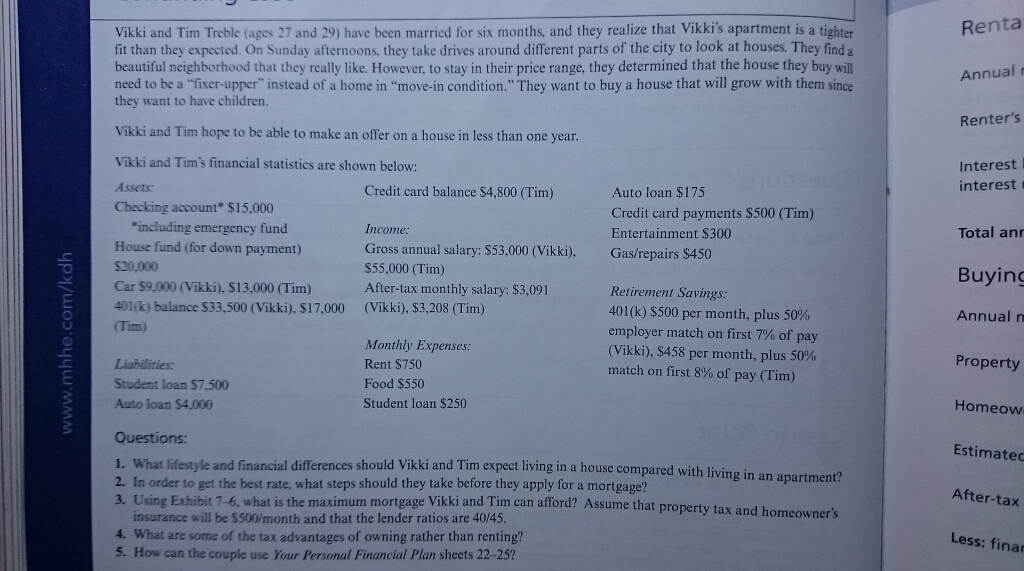

Vikki and Tim Treble (ages 27 and 29) have been married for six months, and they realize that Vikki's apartment is a tighter fit than they expected. On Sunday afternoons, they take drives around different parts of the city to look at houses. They find a beautiful neighborhood that they really like. However, to stay in their price range, they determined that the house they buy will need to be a "fixer-upper" instead of a home in "move-in condition." They want to buy a house that will grow with them since they want to have children. Vikki and Tim hope to be able to make an offer on a house in less than one year. Questions: What lifestyle and financial differences should Vikki and Tim expect living in a house compared with living in an apartment? In order to get the best rate, what steps should they take before they apply for a mortgage? Using Exhibit 7-6. what is the maximum mortgage Vikki and Tim can afford? Assume that property tax and homeowner's insurance will be S500/month and that the lender ratios are 40/45. What are some of the tax advantages of owning rather than renting? How can the couple use Your Personal Financial Plan sheets 22-25? Vikki and Tim Treble (ages 27 and 29) have been married for six months, and they realize that Vikki's apartment is a tighter fit than they expected. On Sunday afternoons, they take drives around different parts of the city to look at houses. They find a beautiful neighborhood that they really like. However, to stay in their price range, they determined that the house they buy will need to be a "fixer-upper" instead of a home in "move-in condition." They want to buy a house that will grow with them since they want to have children. Vikki and Tim hope to be able to make an offer on a house in less than one year. Questions: What lifestyle and financial differences should Vikki and Tim expect living in a house compared with living in an apartment? In order to get the best rate, what steps should they take before they apply for a mortgage? Using Exhibit 7-6. what is the maximum mortgage Vikki and Tim can afford? Assume that property tax and homeowner's insurance will be S500/month and that the lender ratios are 40/45. What are some of the tax advantages of owning rather than renting? How can the couple use Your Personal Financial Plan sheets 22-25

the affordable mortgage payment is $2625, please help me calculate the affordable home purchase price.

the affordable mortgage payment is $2625, please help me calculate the affordable home purchase price.