Answered step by step

Verified Expert Solution

Question

1 Approved Answer

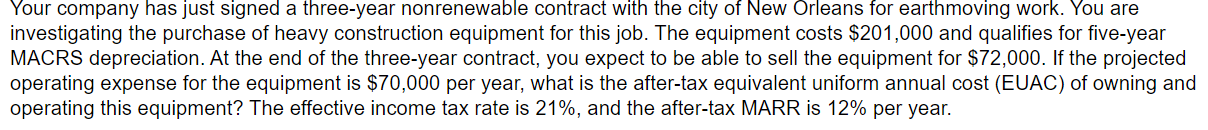

The after-tax equivalent uniform annual cost is $______? (Round to nearest dollar) Your company has just signed a three-year nonrenewable contract with the city of

The after-tax equivalent uniform annual cost is $______? (Round to nearest dollar)

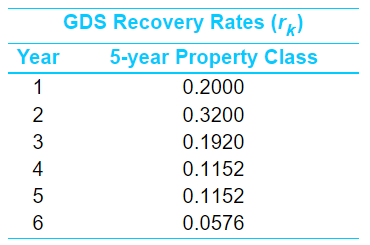

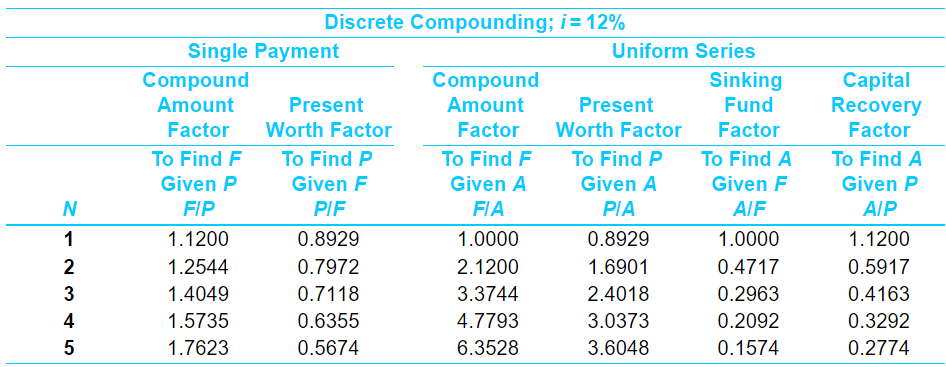

Your company has just signed a three-year nonrenewable contract with the city of New Orleans for earthmoving work. You are investigating the purchase of heavy construction equipment for this job. The equipment costs $201,000 and qualifies for five-year MACRS depreciation. At the end of the three-year contract, you expect to be able to sell the equipment for $72,000. If the projected operating expense for the equipment is $70,000 per year, what is the after-tax equivalent uniform annual cost (EUAC) of owning and operating this equipment? The effective income tax rate is 21%, and the after-tax MARR is 12% per year. GDS Recovery Rates (ra) Year 5-year Property Class 1 0.2000 2 0.3200 3 0.1920 4 0.1152 5 0.1152 6 0.0576 Discrete Compounding; i = 12% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P. To Find A Given P Given F Given A Given A Given F FIP PIF FIA PIA AIF 1.1200 0.8929 1.0000 0.8929 1.0000 1.2544 0.7972 2.1200 1.6901 0.4717 1.4049 0.7118 3.3744 2.4018 0.2963 1.5735 0.6355 4.7793 3.0373 0.2092 1.7623 0.5674 6.3528 3.6048 0.1574 N 1 2 3 4 5 Capital Recovery Factor To Find A Given P AIP 1.1200 0.5917 0.4163 0.3292 0.2774 Your company has just signed a three-year nonrenewable contract with the city of New Orleans for earthmoving work. You are investigating the purchase of heavy construction equipment for this job. The equipment costs $201,000 and qualifies for five-year MACRS depreciation. At the end of the three-year contract, you expect to be able to sell the equipment for $72,000. If the projected operating expense for the equipment is $70,000 per year, what is the after-tax equivalent uniform annual cost (EUAC) of owning and operating this equipment? The effective income tax rate is 21%, and the after-tax MARR is 12% per year. GDS Recovery Rates (ra) Year 5-year Property Class 1 0.2000 2 0.3200 3 0.1920 4 0.1152 5 0.1152 6 0.0576 Discrete Compounding; i = 12% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P. To Find A Given P Given F Given A Given A Given F FIP PIF FIA PIA AIF 1.1200 0.8929 1.0000 0.8929 1.0000 1.2544 0.7972 2.1200 1.6901 0.4717 1.4049 0.7118 3.3744 2.4018 0.2963 1.5735 0.6355 4.7793 3.0373 0.2092 1.7623 0.5674 6.3528 3.6048 0.1574 N 1 2 3 4 5 Capital Recovery Factor To Find A Given P AIP 1.1200 0.5917 0.4163 0.3292 0.2774Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started