Answered step by step

Verified Expert Solution

Question

1 Approved Answer

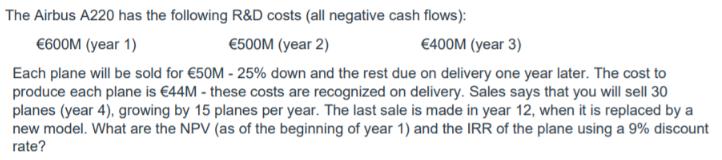

The Airbus A220 has the following R&D costs (all negative cash flows): 600M (year 1) 500M (year 2) Each plane will be sold for

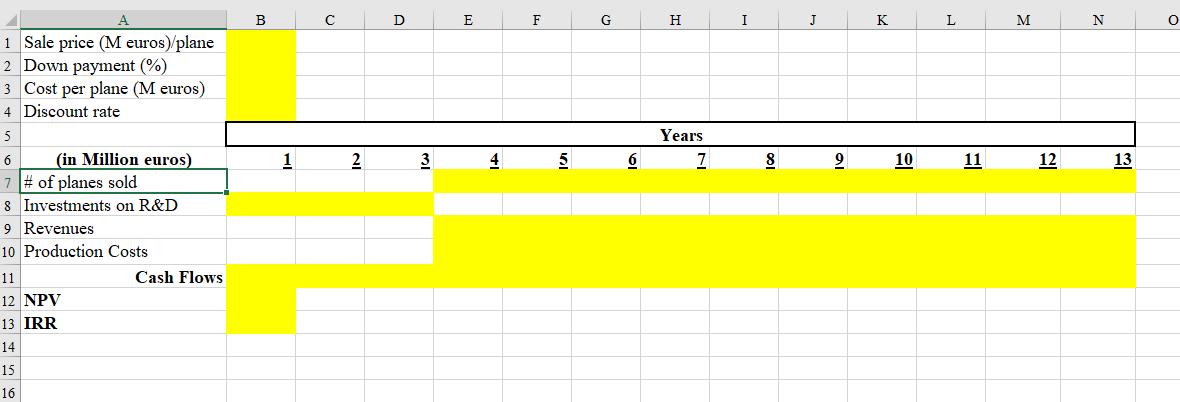

The Airbus A220 has the following R&D costs (all negative cash flows): 600M (year 1) 500M (year 2) Each plane will be sold for 50M - 25% down and the rest due on delivery one year later. The cost to produce each plane is 44M - these costs are recognized on delivery. Sales says that you will sell 30 planes (year 4), growing by 15 planes per year. The last sale is made in year 12, when it is replaced by a new model. What are the NPV (as of the beginning of year 1) and the IRR of the plane using a 9% discount rate? 400M (year 3) 1 Sale price (M euros)/plane 2 Down payment (%) 3 Cost per plane (M euros) 4 Discount rate 5 6 7 # of planes sold 8 Investments on R&D 9 Revenues 10 Production Costs (in Million euros) 11 12 NPV 13 IRR 14 15 16 Cash Flows B 1 2 D 3 E 4 F 5 G 6 H Years 7 I 8 J 9 K 10 L 11 M 12 N 13 O

Step by Step Solution

★★★★★

3.49 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Net Present Value NPV and the Internal Rate of Return IRR of the project we need to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started