Question

The Albanian government is auctioning the rights to mine copper in the east of the country. Mines International plc (MI) is considering the amount they

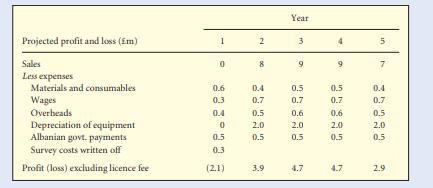

The Albanian government is auctioning the rights to mine copper in the east of the country. Mines International plc (MI) is considering the amount they would be prepared to pay as a lump sum for the five-year licence. The auction is to take place very soon and the cash will have to be paid immediately following the auction. In addition to the lump sum the Albanian government will expect annual payments of £500,000 to cover ‘administration’. If MI wins the licence, production would not start until one year later because it will take a year to prepare the site and buy in equipment. To begin production MI would have to commission the manufacture of specialist engineering equipment costing £9.5m, half of which is payable immediately, with the remainder due in one year. MI has already conducted a survey of the site which showed a potential productive life of four years with its new machine. The survey cost £300,000 and is payable immediately. The accounts department have produced the following projected profit and loss accounts

The following additional information is available:

a Payments and receipts arise at the year ends unless otherwise stated.

b The initial lump sum payment has been excluded from the projected accounts as this is unknown at the outset.

c The customers of MI demand and receive a credit period of three months.

d The suppliers of materials and consumables grant a credit period of three months.

e The overheads contain an annual charge of £200,000 which represents an apportionment of head office costs. This is an expense which would be incurred whether or not the project proceeds. The remainder of the overheads relate directly to the project.

f The new equipment will have a resale value at the end of the fifth year of £1.5m.

g During the whole of Year 3 a specialised item of machinery will be needed, which is currently being used by another division of MI. This division will therefore incur hire costs of £100,000 for the period the machinery is on loan.

h The project will require additional cash reserves of £1m to be held in Albania throughout the project for operational purposes. These are recoverable at the end of the project.

i The Albanian government will make a one-off refund of ‘administration’ charges one and a half months after the end of the fifth year of £200,000. The company’s cost of capital is 12 per cent. Ignore taxation, inflation and exchange rate movements and controls.

Required

a Calculate the maximum amount MI should bid in the auction.

b What would be the Internal Rate of Return on the project if MI did not have to pay for the licence?

Projected profit and loss (Em) Sales Less expenses Materials and consumables Wages Overheads Depreciation of equipment Albanian govt. payments. Survey costs written off Profit (loss) excluding licence fee 1 0.6 0.3 0.4 0 0.5 0.3 (2.1) 2 00 0.4 0.7 0.5 2.0 0.5 3.9 Year 3 40 0.5 0.7 0.6 2.0 0.5 4.7 4 a 0.5 0.7 0.6 2.0 0.5 4.7 5 in 0.4 0.7 0.5 2.0 0.5 2.9

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the maximum amount MI should bid in the auction we need to determine the present value of the expected cash flows associated with the project The maximum bid should not exceed the prese...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started