Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Albertville City Council decided to pool the investments of its General Fund with Albertville Schools and Richwood Township in an investment pool to be

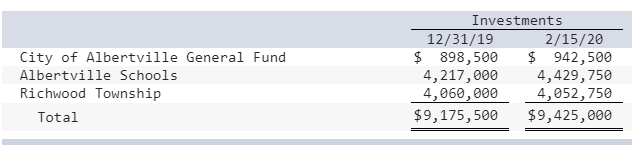

The Albertville City Council decided to pool the investments of its General Fund with Albertville Schools and Richwood Township in an investment pool to be managed by the city. Each of the pool participants had reported its investments at fair value as of the end of 2019. At the date of the creation of the pool, February 15, 2020, the fair value of the investments of each pool participant was as follows:

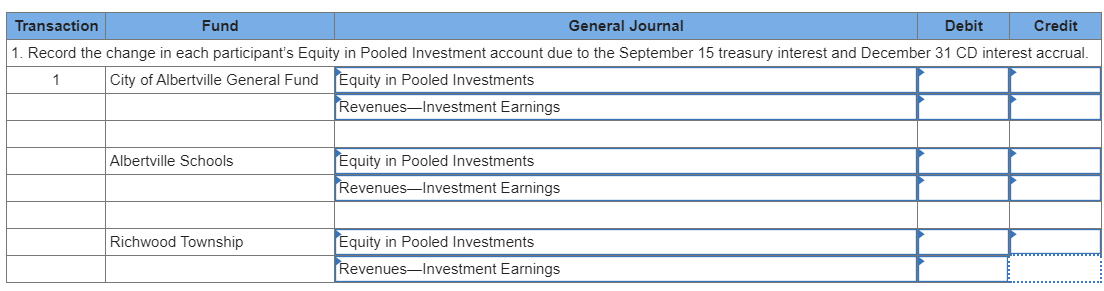

- On June 15, Richwood Township decided to withdraw $3,095,000 for a capital projects payment. At the date of the withdrawal, the fair value of the Treasury notes had increased by $38,500. Assume that the trust fund was able to redeem the CDs necessary to complete the withdrawal without a penalty but did not receive interest on the funds. On September 15, interest on Treasury notes in the amount of $67,000 was collected. Interest on CDs accrued at year-end amounted to $45,000. At the end of the year, undistributed earnings were allocated to the investment pool participants. Assume that there were no additional changes in the fair value of investments after the Richwood Township withdrawal. Round the amount of the distribution to each fund or participant to the nearest dollar. Record the change in each participant's Equity in Pooled Investment account due to the September 15 treasury interest and December 31 CD interest accrual. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started