Question

The All Year Sports Company produces a wide variety of outdoor sports equipment. Its newest division, Golf Technology, manufactures and sells a single product: AccuDriver,

The All Year Sports Company produces a wide variety of outdoor sports equipment. Its newest division, Golf Technology, manufactures and sells a single product: AccuDriver, a golf club that uses global positioning satellite technology to improve the accuracy of golfers' shots. The demand for AccuDriver is relatively insensitive to price changes. The following data are available for Golf Technology, which is an investment center for All Year Sports:

Total annual fixed costs $32,000,000

Variable cost per AccuDriver $320

Number of AccuDrivers sold each year $150,000

Average operating assets invested in the division $44,000,000

REQUIRED:

#3 Assume that All Year Sports judges the performance of its investment centres on the basis of RI rather than ROI. What is the minimum selling price that Golf Technology should charge per AccuDriver if the company's required rate of return is 22%?

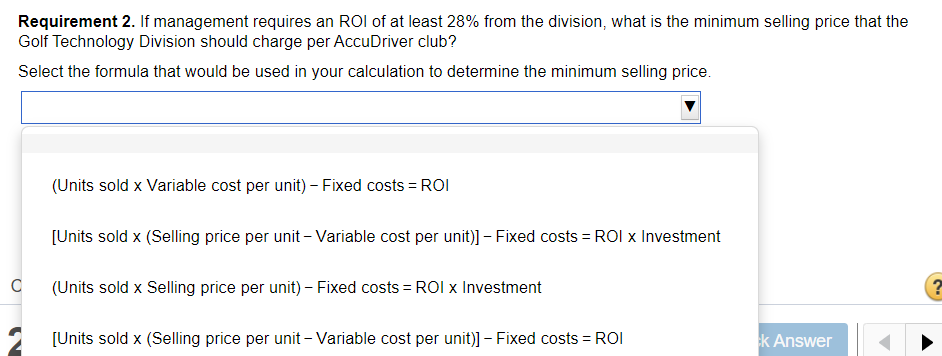

Requirement 2. If management requires an ROI of at least 28% from the division, what is the minimum selling price that the Golf Technology Division should charge per AccuDriver club? Select the formula that would be used in your calculation to determine the minimum selling price. (Units sold x Variable cost per unit) - Fixed costs = ROI [Units sold x (Selling price per unit - Variable cost per unit)] Fixed costs = ROI x Investment (Units sold x Selling price per unit) Fixed costs = ROI x Investment [Units sold x (Selling price per unit - Variable cost per unit)] Fixed costs = ROI k

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started