Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Al-Majid Construction Management Company constructs and operates different communities in certain parts of UAE. The past few years have been difficult ones for

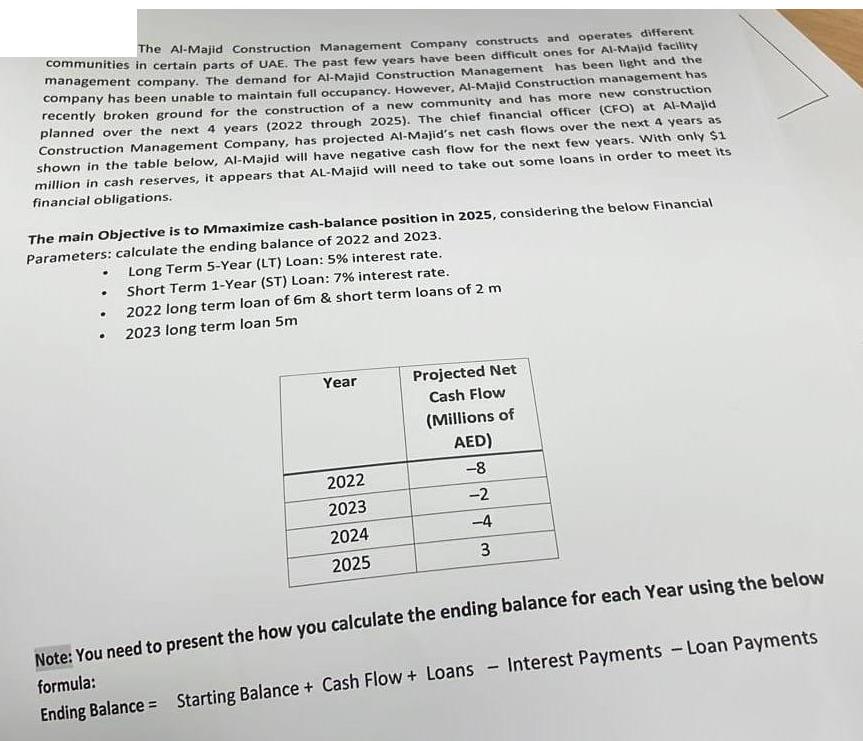

The Al-Majid Construction Management Company constructs and operates different communities in certain parts of UAE. The past few years have been difficult ones for Al-Majid facility management company. The demand for Al-Majid Construction Management has been light and the company has been unable to maintain full occupancy. However, Al-Majid Construction management has recently broken ground for the construction of a new community and has more new construction planned over the next 4 years (2022 through 2025). The chief financial officer (CFO) at Al-Majid Construction Management Company, has projected Al-Majid's net cash flows over the next 4 years as shown in the table below, Al-Majid will have negative cash flow for the next few years. With only $1 million in cash reserves, it appears that AL-Majid will need to take out some loans in order to meet its financial obligations. The main objective is to Mmaximize cash-balance position in 2025, considering the below Financial Parameters: calculate the ending balance of 2022 and 2023. . . . Long Term 5-Year (LT) Loan: 5% interest rate. Short Term 1-Year (ST) Loan: 7% interest rate. 2022 long term loan of 6m & short term loans of 2 m 2023 long term loan 5m Year 2022 2023 2024 2025 Projected Net Cash Flow (Millions of AED) -8 -2 -4 3 Note: You need to present the how you calculate the ending balance for each Year using the below formula: Ending Balance Starting Balance + Cash Flow + Loans Interest Payments - Loan Payments

Step by Step Solution

★★★★★

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the ending balance for each year 2022 and 2023 while considering the provided financial parameters you can use the following formula Endi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started