Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Alset Solar Power Company produces and assembles industrial sized solar powered batteries (SPB). The current precision is that the company will have orders

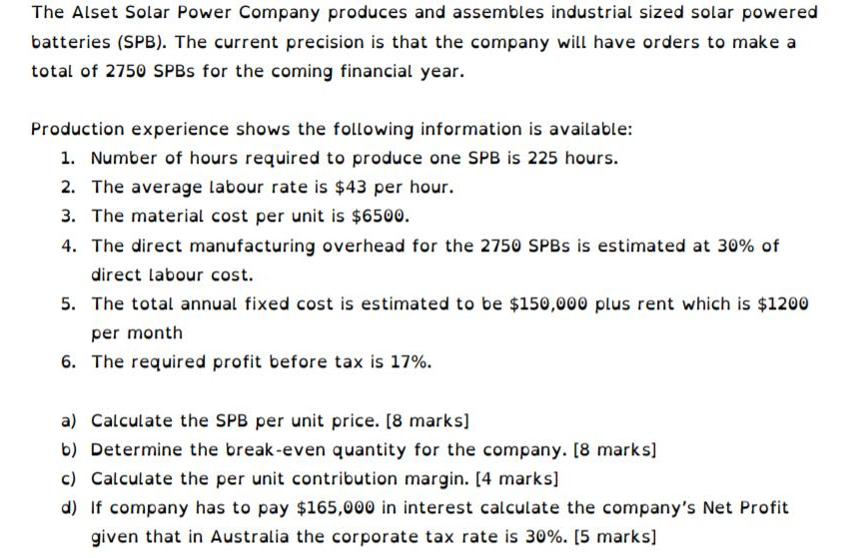

The Alset Solar Power Company produces and assembles industrial sized solar powered batteries (SPB). The current precision is that the company will have orders to make a total of 2750 SPBs for the coming financial year. Production experience shows the following information is available: 1. Number of hours required to produce one SPB is 225 hours. 2. The average labour rate is $43 per hour. 3. The material cost per unit is $6500. 4. The direct manufacturing overhead for the 2750 SPBS is estimated at 30% of direct labour cost. 5. The total annual fixed cost is estimated to be $150,000 plus rent which is $1200 per month 6. The required profit before tax is 17%. a) Calculate the SPB per unit price. [8 marks] b) Determine the break-even quantity for the company. [8 marks] c) Calculate the per unit contribution margin. [4 marks] d) If company has to pay $165,000 in interest calculate the company's Net Profit given that in Australia the corporate tax rate is 30%. [5 marks]

Step by Step Solution

★★★★★

3.26 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a SPB per unit price Direct labor cost per unit 225 hoursunit 43hour 9750 Direct manufacturing overh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started