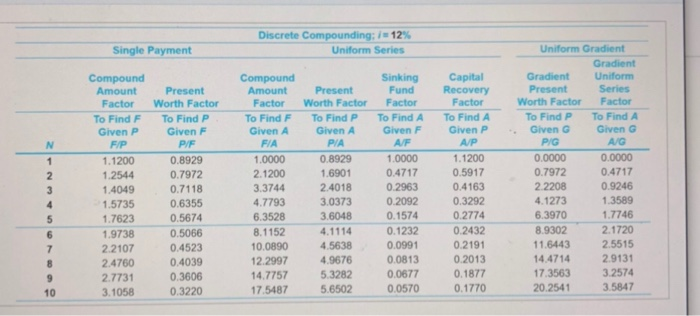

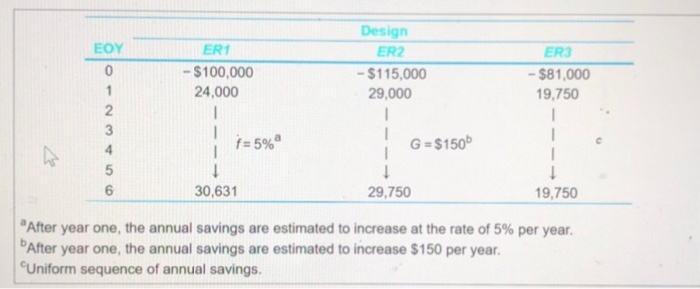

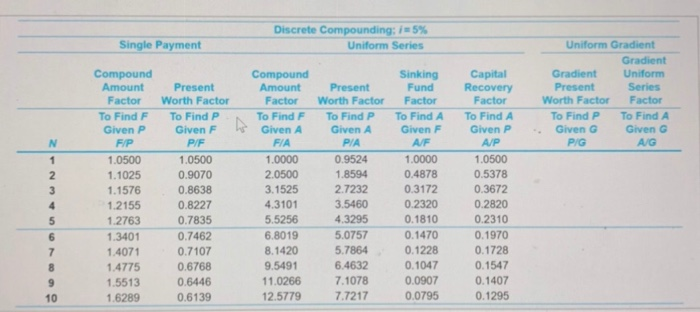

The alternatives for an engineering project to recover most of the energy presently being lost in the primary cooling stage of a chemical processing system have been reduced to three designs. The estimated capital investment amounts and annual expense savings are as shown in the table. Assume that the MARR is 12% per year, the study period is six years, and the market value is zero for all three designs. Apply an equivalent-worth analysis method to determine the preferred alternative Single Payment Discrete Compounding: 1 = 12% Uniform Series N 1 Compound Amount Present Factor Worth Factor To Find F To Find P Given P Given F F/P P/F 1.1200 0.8929 1.2544 0.7972 1.4049 0.7118 1.5735 0.6355 1.7623 0.5674 1.9738 0.5066 2.2107 0.4523 2.4760 0.4039 2.7731 0.3606 3.1058 0.3220 2 3 4 5 6 7 8 9 10 Compound Amount Present Factor Worth Factor To Find F To Find P Given A Given A FIA PIA 1.0000 0.8929 2.1200 1.6901 3.3744 2.4018 4.7793 3.0373 6.3528 3.6048 8.1152 4.1114 10.0890 4.5638 12.2997 4.9676 14.7757 5.3282 17.5487 5.6502 Sinking Fund Factor To Find A Given F AUF 1.0000 0.4717 0.2963 0.2092 0.1574 0.1232 0.0991 0.0813 0.0677 0.0570 Uniform Gradient Gradient Gradient Uniform Present Series Worth Factor Factor To Find P To Find A Given G Given G P/G AG 0.0000 0.0000 0.7972 0.4717 2.2208 0.9246 4.1273 1.3589 6.3970 1.7746 8.9302 2.1720 11.6443 2.5515 14.4714 2.9131 17.3563 3.2574 20.2541 3.5847 Capital Recovery Factor To Find A Given P AIP 1.1200 0.5917 0.4163 0.3292 0.2774 0.2432 0.2191 0.2013 0.1877 0.1770 EOY 0 ER1 - $100,000 24,000 Design ER2 - $115,000 29,000 ER3 - $81,000 19.750 1 1 1 - - 2. 3 4 5 6 f=5% G = $150 1 - 1 1 30,631 29,750 19,750 After year one, the annual savings are estimated to increase at the rate of 5% per year. After year one, the annual savings are estimated to increase $150 per year. Uniform sequence of annual savings. Discrete Compounding: 1-5% Uniform Series Single Payment Uniform Gradient Gradient Gradient Uniform Present Series Worth Factor Factor To Find P To Find A Given G Given G P/G AIG N 1 2 3 Compound Amount Factor To Find F Given P F/P 1.0500 1.1025 1.1576 1.2155 1.2763 1.3401 1.4071 1.4775 1.5513 1.6289 Present Worth Factor To Find P Given F P/F 1.0500 0.9070 0.8638 0.8227 0.7835 0.7462 0.7107 0.6768 0.6446 0.6139 Compound Amount Factor To Find F Given A FIA 1.0000 2.0500 3.1525 4.3101 5.5256 6.8019 8.1420 9.5491 11.0266 12.5779 Present Worth Factor To Find P Given A PIA 0.9524 1.8594 2.7232 3.5460 4.3295 5.0757 5.7864 6.4632 7.1078 7.7217 Sinking Fund Factor To Find A Given F AF 1.0000 0.4878 0.3172 0.2320 0.1810 0.1470 0.1228 0.1047 0.0907 0.0795 Capital Recovery Factor To Find A Given P A/P 1.0500 0.5378 0.3672 0.2820 0.2310 0.1970 0.1728 0.1547 0.1407 0.1295 5 6 7 8 9 10 The alternatives for an engineering project to recover most of the energy presently being lost in the primary cooling stage of a chemical processing system have been reduced to three designs. The estimated capital investment amounts and annual expense savings are as shown in the table. Assume that the MARR is 12% per year, the study period is six years, and the market value is zero for all three designs. Apply an equivalent-worth analysis method to determine the preferred alternative Single Payment Discrete Compounding: 1 = 12% Uniform Series N 1 Compound Amount Present Factor Worth Factor To Find F To Find P Given P Given F F/P P/F 1.1200 0.8929 1.2544 0.7972 1.4049 0.7118 1.5735 0.6355 1.7623 0.5674 1.9738 0.5066 2.2107 0.4523 2.4760 0.4039 2.7731 0.3606 3.1058 0.3220 2 3 4 5 6 7 8 9 10 Compound Amount Present Factor Worth Factor To Find F To Find P Given A Given A FIA PIA 1.0000 0.8929 2.1200 1.6901 3.3744 2.4018 4.7793 3.0373 6.3528 3.6048 8.1152 4.1114 10.0890 4.5638 12.2997 4.9676 14.7757 5.3282 17.5487 5.6502 Sinking Fund Factor To Find A Given F AUF 1.0000 0.4717 0.2963 0.2092 0.1574 0.1232 0.0991 0.0813 0.0677 0.0570 Uniform Gradient Gradient Gradient Uniform Present Series Worth Factor Factor To Find P To Find A Given G Given G P/G AG 0.0000 0.0000 0.7972 0.4717 2.2208 0.9246 4.1273 1.3589 6.3970 1.7746 8.9302 2.1720 11.6443 2.5515 14.4714 2.9131 17.3563 3.2574 20.2541 3.5847 Capital Recovery Factor To Find A Given P AIP 1.1200 0.5917 0.4163 0.3292 0.2774 0.2432 0.2191 0.2013 0.1877 0.1770 EOY 0 ER1 - $100,000 24,000 Design ER2 - $115,000 29,000 ER3 - $81,000 19.750 1 1 1 - - 2. 3 4 5 6 f=5% G = $150 1 - 1 1 30,631 29,750 19,750 After year one, the annual savings are estimated to increase at the rate of 5% per year. After year one, the annual savings are estimated to increase $150 per year. Uniform sequence of annual savings. Discrete Compounding: 1-5% Uniform Series Single Payment Uniform Gradient Gradient Gradient Uniform Present Series Worth Factor Factor To Find P To Find A Given G Given G P/G AIG N 1 2 3 Compound Amount Factor To Find F Given P F/P 1.0500 1.1025 1.1576 1.2155 1.2763 1.3401 1.4071 1.4775 1.5513 1.6289 Present Worth Factor To Find P Given F P/F 1.0500 0.9070 0.8638 0.8227 0.7835 0.7462 0.7107 0.6768 0.6446 0.6139 Compound Amount Factor To Find F Given A FIA 1.0000 2.0500 3.1525 4.3101 5.5256 6.8019 8.1420 9.5491 11.0266 12.5779 Present Worth Factor To Find P Given A PIA 0.9524 1.8594 2.7232 3.5460 4.3295 5.0757 5.7864 6.4632 7.1078 7.7217 Sinking Fund Factor To Find A Given F AF 1.0000 0.4878 0.3172 0.2320 0.1810 0.1470 0.1228 0.1047 0.0907 0.0795 Capital Recovery Factor To Find A Given P A/P 1.0500 0.5378 0.3672 0.2820 0.2310 0.1970 0.1728 0.1547 0.1407 0.1295 5 6 7 8 9 10