Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The American Association of Individual Investors ( AAII ) has identified several qualitative factors that should also be considered when evaluating a company's likely future

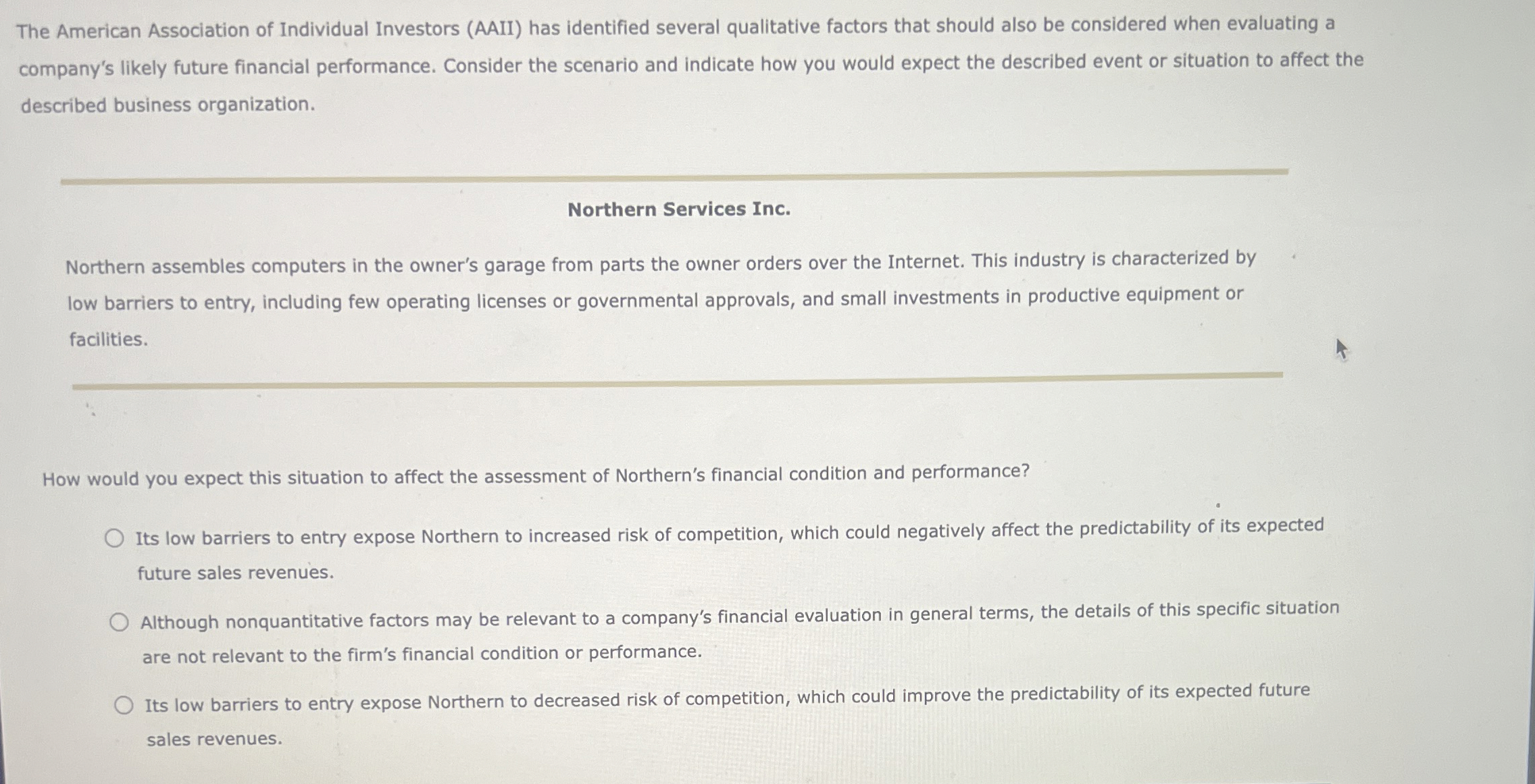

The American Association of Individual Investors AAII has identified several qualitative factors that should also be considered when evaluating a

company's likely future financial performance. Consider the scenario and indicate how you would expect the described event or situation to affect the

described business organization.

Northern Services Inc.

Northern assembles computers in the owner's garage from parts the owner orders over the Internet. This industry is characterized by

low barriers to entry, including few operating licenses or governmental approvals, and small investments in productive equipment or

facilities.

How would you expect this situation to affect the assessment of Northern's financial condition and performance?

Its low barriers to entry expose Northern to increased risk of competition, which could negatively affect the predictability of its expected

future sales revenues.

Although nonquantitative factors may be relevant to a company's financial evaluation in general terms, the details of this specific situation

are not relevant to the firm's financial condition or performance.

Its low barriers to entry expose Northern to decreased risk of competition, which could improve the predictability of its expected future

sales revenues.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started