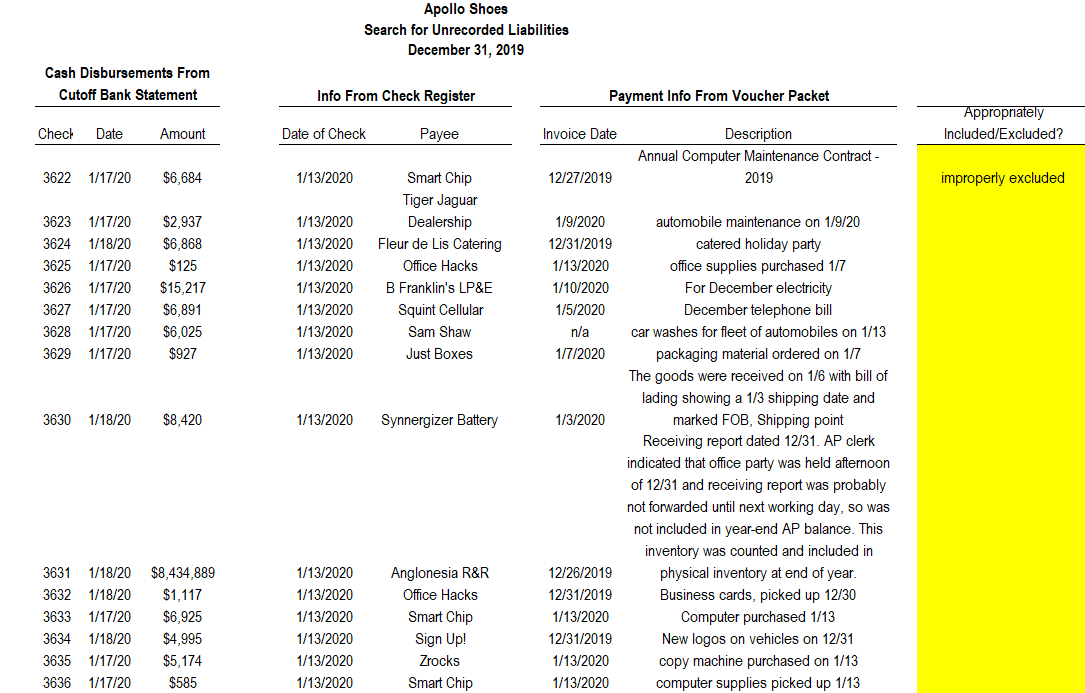

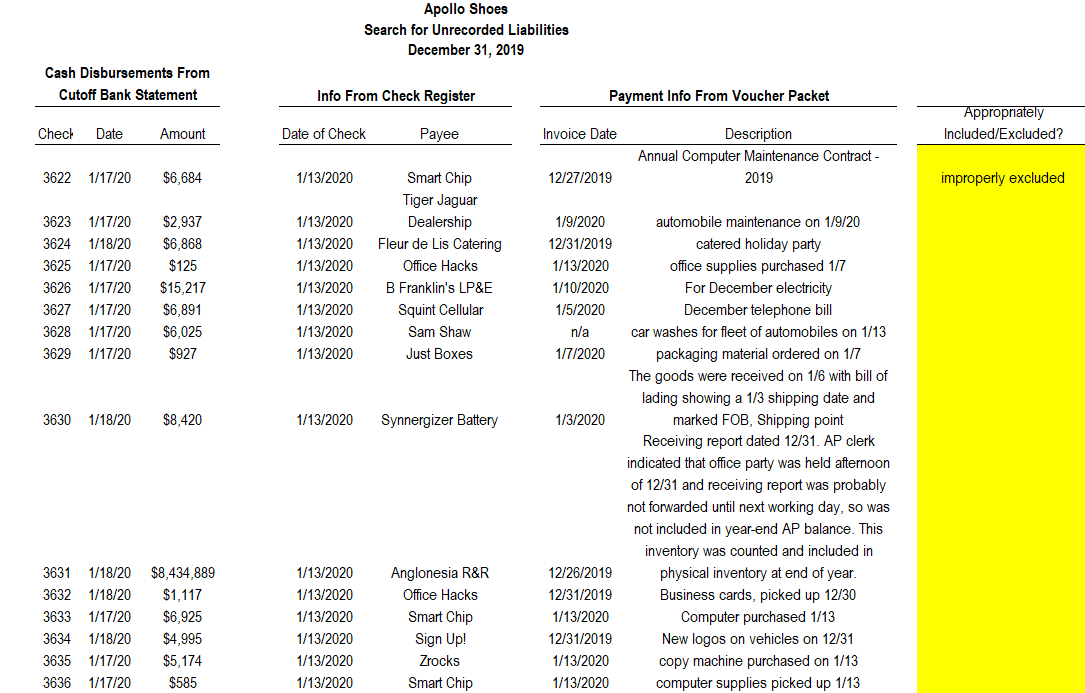

The amount associated with check #3623 was _____________________ in/from Accounts Payable as of 12/31/19.

The amount associated with check #3624 was _____________________ in/from Accounts Payable as of 12/31/19.

The amount associated with check #3626 was _____________________ in/from Accounts Payable as of 12/31/19.

The amount associated with check #3627 was _____________________ in/from Accounts Payable as of 12/31/19.

The amount associated with check #3630 was _____________________ in/from Accounts Payable as of 12/31/19.

The amount associated with check #3631 was _____________________ in/from Accounts Payable as of 12/31/19.

The amount associated with check #3632 was _____________________ in/from Accounts Payable as of 12/31/19.

The amount associated with check #3633 was _____________________ in/from Accounts Payable as of 12/31/19.

The amount associated with check #3634 was _____________________ in/from Accounts Payable as of 12/31/19.

The amount associated with check #3635 was _____________________ in/from Accounts Payable as of 12/31/19.

Choose all question by:

Properly included

Improperly included

Properly excluded

Improperly excluded

| | Footnotes | | | | | | |

| A | We recommend management record the following adjustment with respect to this error: |

| | DR Maintenance Expense | $6,684 | | | |

| | | CR A/P | | | | $6,684 | |

| | | | | |

| | | | | | | | |

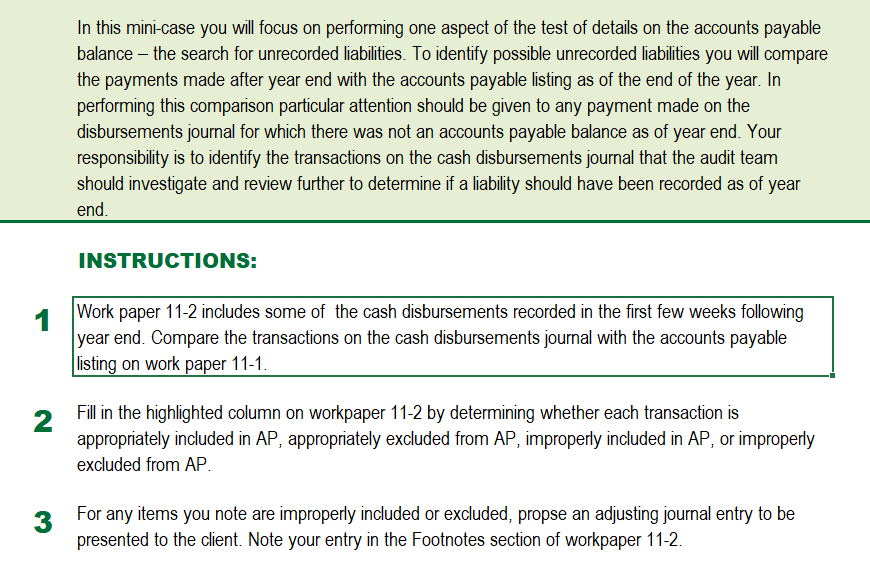

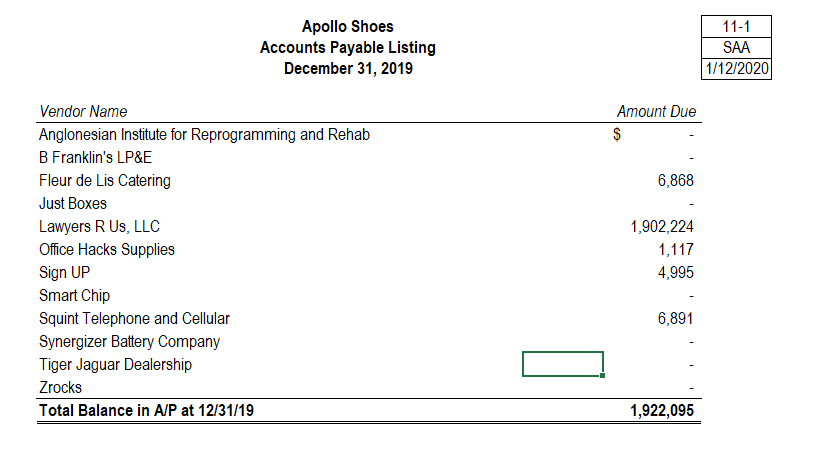

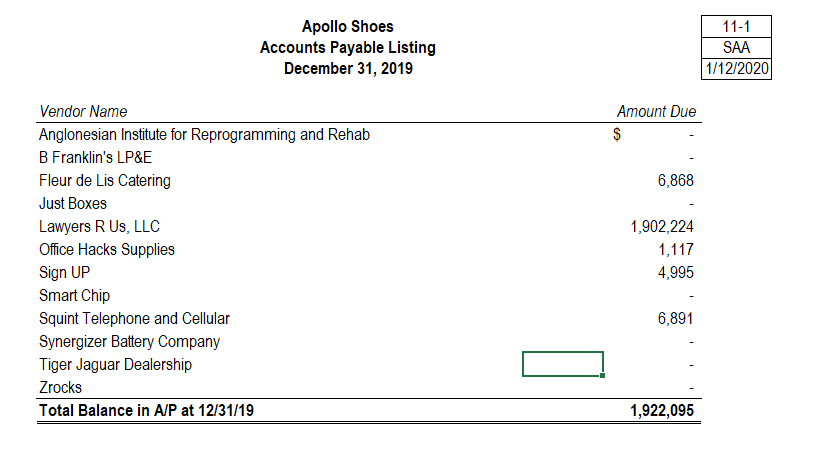

In this mini-case you will focus on performing one aspect of the test of details on the accounts payable balance the search for unrecorded liabilities. To identify possible unrecorded liabilities you will compare the payments made after year end with the accounts payable listing as of the end of the year. In performing this comparison particular attention should be given to any payment made on the disbursements journal for which there was not an accounts payable balance as of year end. Your responsibility is to identify the transactions on the cash disbursements journal that the audit team should investigate and review further to determine if a liability should have been recorded as of year end. INSTRUCTIONS: 1 Work paper 11-2 includes some of the cash disbursements recorded in the first few weeks following year end. Compare the transactions on the cash disbursements journal with the accounts payable listing on work paper 11-1. 2 Fill in the highlighted column on workpaper 11-2 by determining whether each transaction is appropriately included in AP, appropriately excluded from AP, improperly included in AP, or improperly excluded from AP. 3 For any items you note are improperly included or excluded, propse an adjusting journal entry to be presented to the client. Note your entry in the Footnotes section of workpaper 11-2. Apollo Shoes Accounts Payable Listing December 31, 2019 11-1 SAA 1/12/2020 Amount Due $ 6,868 Vendor Name Anglonesian Institute for Reprogramming and Rehab B Franklin's LP&E Fleur de Lis Catering Just Boxes Lawyers R Us, LLC Office Hacks Supplies Sign UP Smart Chip Squint Telephone and Cellular Synergizer Battery Company Tiger Jaguar Dealership Zrocks Total Balance in A/P at 12/31/19 1,902,224 1,117 4,995 6,891 1,922,095 In this mini-case you will focus on performing one aspect of the test of details on the accounts payable balance the search for unrecorded liabilities. To identify possible unrecorded liabilities you will compare the payments made after year end with the accounts payable listing as of the end of the year. In performing this comparison particular attention should be given to any payment made on the disbursements journal for which there was not an accounts payable balance as of year end. Your responsibility is to identify the transactions on the cash disbursements journal that the audit team should investigate and review further to determine if a liability should have been recorded as of year end. INSTRUCTIONS: 1 Work paper 11-2 includes some of the cash disbursements recorded in the first few weeks following year end. Compare the transactions on the cash disbursements journal with the accounts payable listing on work paper 11-1. 2 Fill in the highlighted column on workpaper 11-2 by determining whether each transaction is appropriately included in AP, appropriately excluded from AP, improperly included in AP, or improperly excluded from AP. 3 For any items you note are improperly included or excluded, propse an adjusting journal entry to be presented to the client. Note your entry in the Footnotes section of workpaper 11-2. Apollo Shoes Accounts Payable Listing December 31, 2019 11-1 SAA 1/12/2020 Amount Due $ 6,868 Vendor Name Anglonesian Institute for Reprogramming and Rehab B Franklin's LP&E Fleur de Lis Catering Just Boxes Lawyers R Us, LLC Office Hacks Supplies Sign UP Smart Chip Squint Telephone and Cellular Synergizer Battery Company Tiger Jaguar Dealership Zrocks Total Balance in A/P at 12/31/19 1,902,224 1,117 4,995 6,891 1,922,095