Question

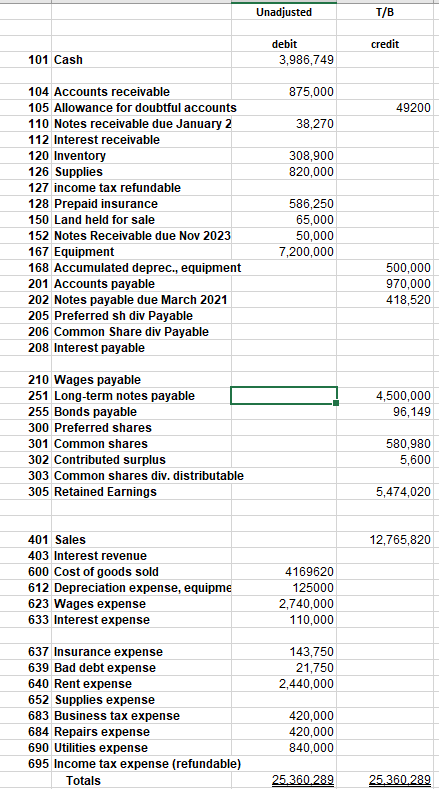

The Amsterdam Incorporated has a fiscal year end of June 30 th . The bookkeeper has been ill and was unable to complete the recording

The Amsterdam Incorporated has a fiscal year end of June 30th. The bookkeeper has been ill and was unable to complete the recording of the items to follow. You have been called upon to complete the work and present the financial statements for the year ended June 30, 2020.

Information regarding unrecorded or unadjusted events:

- Depreciation expense must be adjusted. The acquisition of the equipment was on October 1, 2018. Residual value was $200,000 with a useful life of 14 years.

- Supplies at June 30, 2020, after a physical count, was determined to be $386,000

- Utilities expense not paid for June 2020 amounting to $76,500 was not included in the records as the invoice arrived after preparation.

- Total expired insurance for the year is $575,000

- Accrued wages earned by the employees are $110,000

- The company pays $22,000 of interest on all the notes payable per month on the 20th of the month. Of the Long term notes payable, $500,000 will be paid by June 30, 2021

- Interest on the notes receivable in the sum of $2,900 has not been recorded or received and $15,000 of the notes receivable due November 2023 will be received by June 30, 2021

- It was determined that $10,900 of accounts receivable will not be collectible

- After an aged analysis of the accounts receivable, it was estimated that the possible uncollectable amount is $53,200

- A 2: 1 split took place for the common shares on March 31, 2020

- Preferred shares totaling 10,000 were issued for cash at $4 per share on May 15, 2020

- Declared a 5% common share dividend on June 4, 2020 to be issued June 18, 2020, The shares were trading at $5.20 and $5.00 respectively on those dates.

- Record the dividend event on June 18, 2020

- Redeemed 20,000 common shares on June 25, 2020 paying $3.90 per share

- The bonds payable represent a bond issue with a par of $100,000, 9% semi-annual due December 31, 2024 when the market rate was 10%.

- The effective income tax rate is 25%.

Additional data related to the unadjusted trial balance (i.e. prior to above events being recorded):

Preferred shares $1.00 cumulative unlimited shares authorized

None issued

Common shares unlimited authorized

84,000 shares issued and outstanding

Required:

- Prepare the adjusting entries in proper form

- Prepare the adjusted trial balance as at June 30 2020 (You may use ledgers, T accounts or a worksheet to determine the balances for the adjusted trial balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started