Question

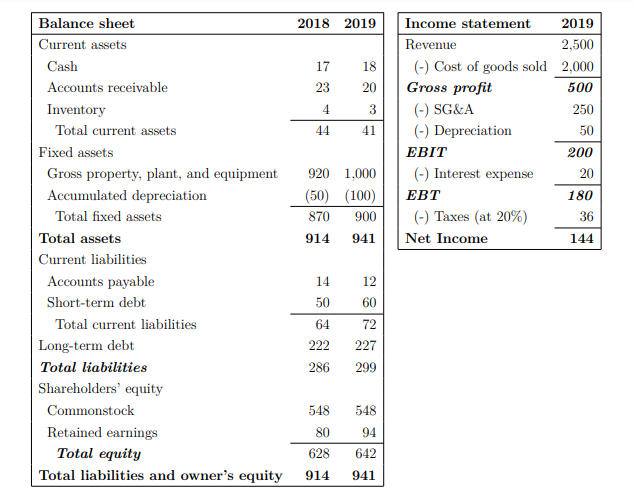

The analyst is analyzing the financial statements of another Yettobe corporation (the state- ments are in million dollars). Its stock is currently traded at $50

The analyst is analyzing the financial statements of another Yettobe corporation (the state- ments are in million dollars). Its stock is currently traded at $50 and it has 20 million shares outstanding. The firms market value of debt is 120 millions. The shareholders require a return of 15% and before-tax cost of debt is 10%. Assume that the expected long-term growth rates in FCFF, FCFE, dividends, and residual income are 4%. Using the constant growth model to compute the following:

a. [6pts] What is firm value?

b. [2pts] What is the intrinsic equity value per share using FCFF?

c. [5pts] What is the intrinsic equity value per share using FCFE?

d. [3pts] What is the intrinsic equity value per share using DDM?

e. [3pts] What is the intrinsic equity value per share using residual income model?

f. [1pt] Based on our valuations, should the analyst give a buy/hold/sell recommendation for Yettobe stock?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started