Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The annual budget preparation was initially delayed for the period 1 July 2023 - 30 June 2024. A draft budget (refer to Appendix 2) has

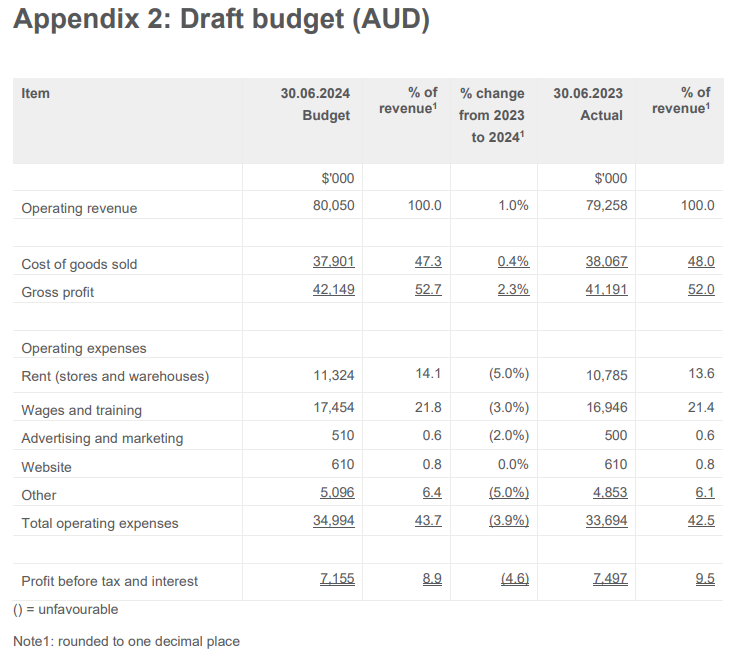

The annual budget preparation was initially delayed for the period 1 July 2023 - 30 June 2024. A draft budget (refer to Appendix 2) has now been prepared for the CFO, who has asked you to review it. Your notes from a recent budget meeting identified the following internal and external factors as areas that may have an influence on the draft budget: - The total retail footwear industry forecast for growth is 3\%. Growth in the online market segment is expected to be higher than the shopfront market segment. - No change is expected in the product sales mix. - Competition is expected to remain intense from the two competitors who are online-only providers. They are continuing to spend more than the industry averages on advertising and marketing. - The industry has low barriers to entry for online competitors. Another major competitor is expected in this segment from December 2023, offering an online-only service. - No change is expected in foreign exchange rates, and the trend to source cheaper products is expected to continue. - Spending on staff training remains a high priority. The company recognises that employees need exceptional interpersonal skills to support a positive customer instore experience. - Fifty per cent (50\%) of Skite's stores will have new rental agreements which are expected to have an increase of 3% above the prevailing inflation rate. - Inflation is expected to be 5% during the period. - No new stores are budgeted in 2024 for Skite. Required You now need to examine the draft budget for the year ended 30 June 2024 and write a report to the CFO (background information from Part A may be used for Part B). 1. In your report, analyse four (4) areas of significance in the budget. As part of each analysis, justify why the area is significant. Two (2) areas must relate to revenue and two (2) areas to expense categories. 2. After receiving your report from Task 1 above, the CFO queried why an incremental budget process based on the inflation rate was not used. Evaluate the appropriateness of applying an incremental budget methodology for the budget for the year ended 30 June 2024, including four (4) justifications. Appendix 2: Draft budget (AUD)

The annual budget preparation was initially delayed for the period 1 July 2023 - 30 June 2024. A draft budget (refer to Appendix 2) has now been prepared for the CFO, who has asked you to review it. Your notes from a recent budget meeting identified the following internal and external factors as areas that may have an influence on the draft budget: - The total retail footwear industry forecast for growth is 3\%. Growth in the online market segment is expected to be higher than the shopfront market segment. - No change is expected in the product sales mix. - Competition is expected to remain intense from the two competitors who are online-only providers. They are continuing to spend more than the industry averages on advertising and marketing. - The industry has low barriers to entry for online competitors. Another major competitor is expected in this segment from December 2023, offering an online-only service. - No change is expected in foreign exchange rates, and the trend to source cheaper products is expected to continue. - Spending on staff training remains a high priority. The company recognises that employees need exceptional interpersonal skills to support a positive customer instore experience. - Fifty per cent (50\%) of Skite's stores will have new rental agreements which are expected to have an increase of 3% above the prevailing inflation rate. - Inflation is expected to be 5% during the period. - No new stores are budgeted in 2024 for Skite. Required You now need to examine the draft budget for the year ended 30 June 2024 and write a report to the CFO (background information from Part A may be used for Part B). 1. In your report, analyse four (4) areas of significance in the budget. As part of each analysis, justify why the area is significant. Two (2) areas must relate to revenue and two (2) areas to expense categories. 2. After receiving your report from Task 1 above, the CFO queried why an incremental budget process based on the inflation rate was not used. Evaluate the appropriateness of applying an incremental budget methodology for the budget for the year ended 30 June 2024, including four (4) justifications. Appendix 2: Draft budget (AUD) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started