Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The (annual compounding) yields on 1-year and 2-year, risk-free, zero-coupon bonds are 2.5% and 3.0%, respectively. a. What are the values of $100 face

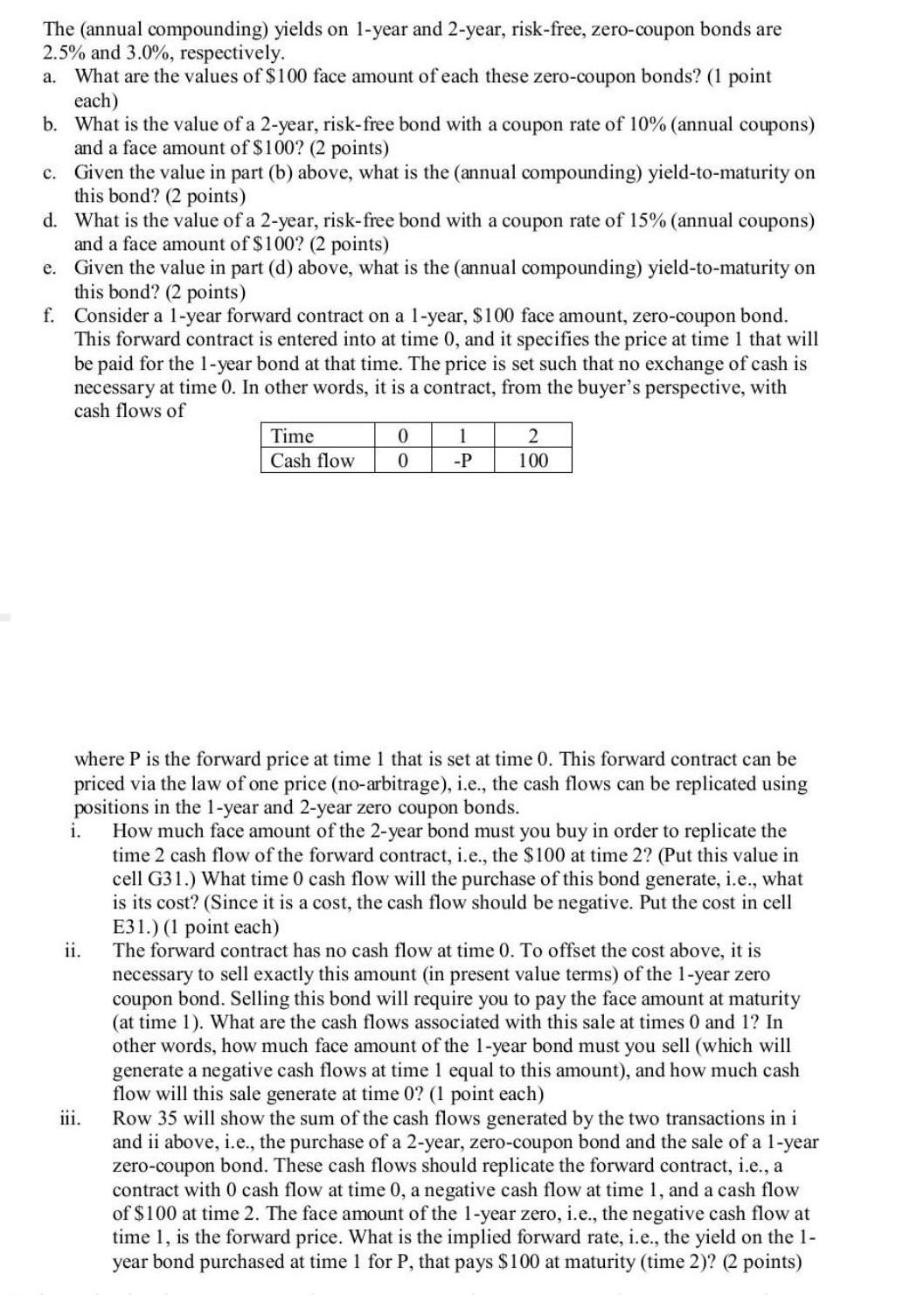

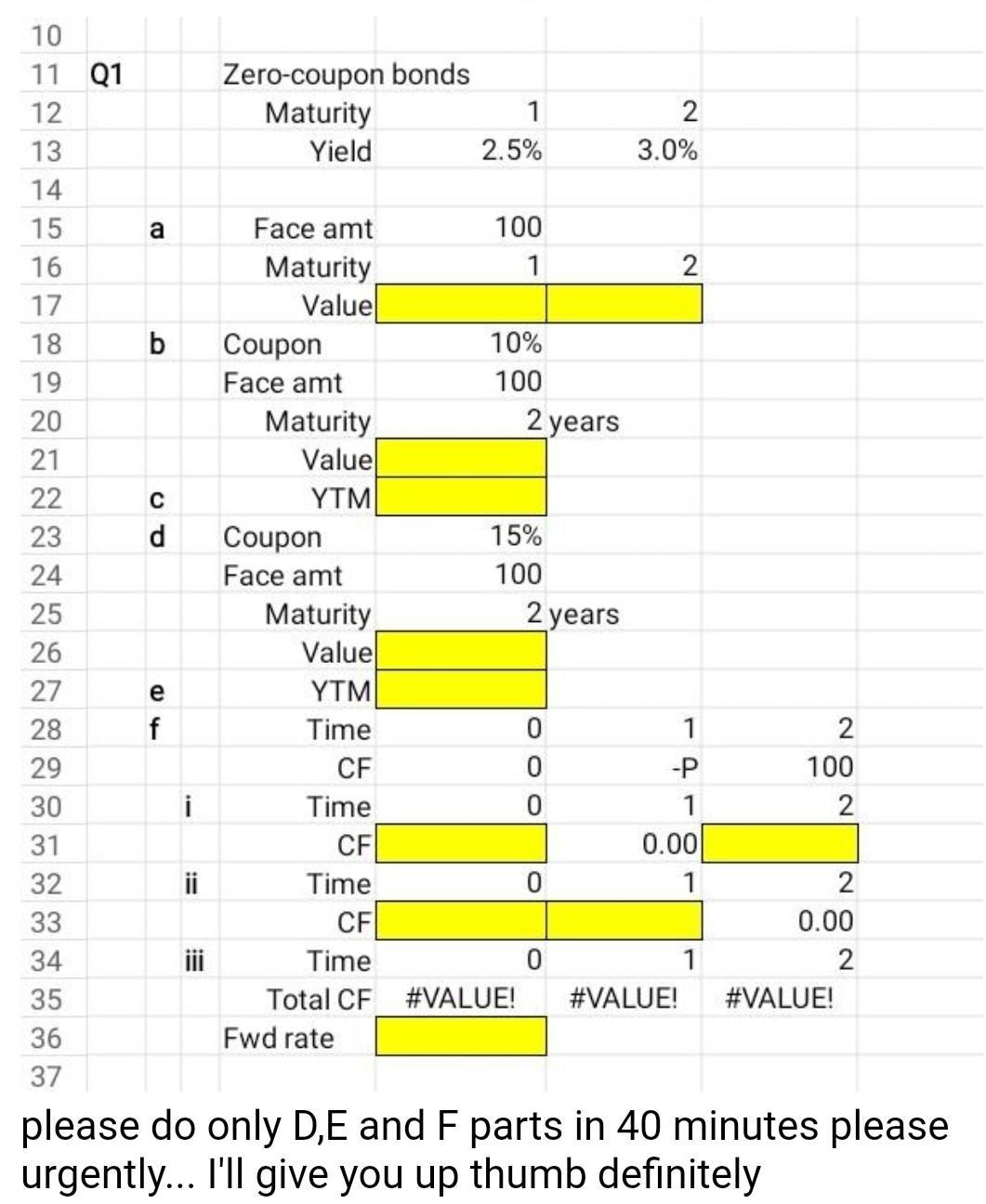

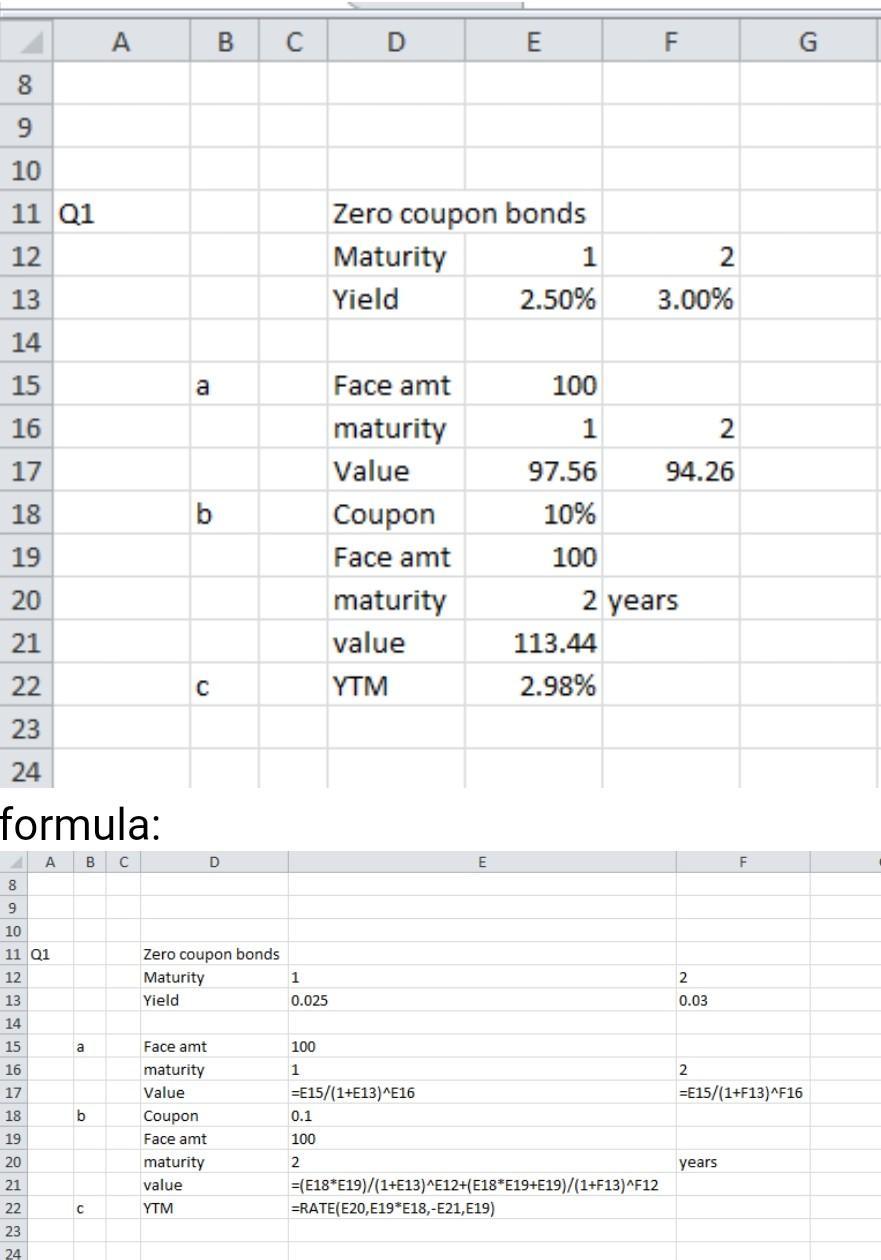

The (annual compounding) yields on 1-year and 2-year, risk-free, zero-coupon bonds are 2.5% and 3.0%, respectively. a. What are the values of $100 face amount of each these zero-coupon bonds? (1 point each) b. What is the value of a 2-year, risk-free bond with a coupon rate of 10% (annual coupons) and a face amount of $100? (2 points) c. Given the value in part (b) above, what is the (annual compounding) yield-to-maturity on this bond? (2 points) d. What is the value of a 2-year, risk-free bond with a coupon rate of 15% (annual coupons) and a face amount of $100? (2 points) e. Given the value in part (d) above, what is the (annual compounding) yield-to-maturity on this bond? (2 points) f. Consider a 1-year forward contract on a 1-year, $100 face amount, zero-coupon bond. This forward contract is entered into at time 0, and it specifies the price at time 1 that will be paid for the 1-year bond at that time. The price is set such that no exchange of cash is necessary at time 0. In other words, it is a contract, from the buyer's perspective, with cash flows of 0 1 2 Time Cash flow 0 -P 100 where P is the forward price at time 1 that is set at time 0. This forward contract can be priced via the law of one price (no-arbitrage), i.e., the cash flows can be replicated using positions in the 1-year and 2-year zero coupon bonds. i. How much face amount of the 2-year bond must you buy in order to replicate the time 2 cash flow of the forward contract, i.e., the $100 at time 2? (Put this value in cell G31.) What time 0 cash flow will the purchase of this bond generate, i.e., what is its cost? (Since it is a cost, the cash flow should be negative. Put the cost in cell E31.) (1 point each) ii. The forward contract has no cash flow at time 0. To offset the cost above, it is necessary to sell exactly this amount (in present value terms) of the 1-year zero coupon bond. Selling this bond will require you to pay the face amount at maturity (at time 1). What are the cash flows associated with this sale at times 0 and 1? In other words, how much face amount of the 1-year bond must you sell (which will generate a negative cash flows at time 1 equal to this amount), and how much cash flow will this sale generate at time 0? (1 point each) iii. Row 35 will show the sum of the cash flows generated by the two transactions in i and ii above, i.e., the purchase of a 2-year, zero-coupon bond and the sale of a 1-year zero-coupon bond. These cash flows should replicate the forward contract, i.e., a contract with 0 cash flow at time 0, a negative cash flow at time 1, and a cash flow of $100 at time 2. The face amount of the 1-year zero, i.e., the negative cash flow at time 1, is the forward price. What is the implied forward rate, i.e., the yield on the 1- year bond purchased at time 1 for P, that pays $100 at maturity (time 2)? (2 points) 10 11 Q1 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 1 -P 29 30 1 31 0.00 32 1 33 34 0 1 35 #VALUE! #VALUE! #VALUE! 36 Fwd rate 37 please do only D,E and F parts in 40 minutes please urgently... I'll give you up thumb definitely 45 a b PO 14 e C d Coupon f Zero-coupon bonds Maturity Yield Face amt Maturity Value i ii Coupon Face amt Maturity Value YTM| Face amt Maturity Value YTM Time CF Time CF Time CF Time Total CF 1 2.5% 100 1 10% 100 2 years 15% 100 2 years II!!! 2 3.0% 2 2 100 2 2 0.00 2 8 9 EE 10 A 11 Q1 12 13 14 15 16 17 18 19 20 21 22 23 24 formula: A B C 8 9 10 11 Q1 12 13 14 15 16 17 18 19 20 21 22 23 24 a b C a b C B D Zero coupon bonds Maturity Yield Face amt maturity Value Coupon Face amt maturity value YTM C D E Zero coupon bonds Maturity Yield 2.50% Face amt 100 maturity 1 Value 97.56 Coupon 10% Face amt 100 maturity value YTM E 113.44 2.98% F 2 3.00% 2 94.26 2 years 1 0.025 100 1 =E15/(1+E13)^E16 0.1 100 2 =(E18*E19)/(1+E13)^E12+(E18 E19+E19)/(1+F13)^F12 =RATE(E20, E19 E18,-E21,E19) F G 2 0.03 2 =E15/(1+F13)^F16 years

Step by Step Solution

★★★★★

3.57 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

8 9 10 11 Q1 12 13 14 15 16 17 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started