Question

The annual cost of corporate headquarters of Bright Inc. amounting to $20,000,000 which includes the office expenses, salaries, and legal and accounting fees. The following

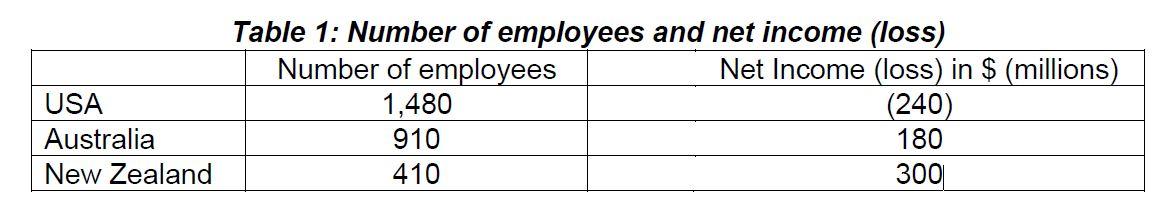

The annual cost of corporate headquarters of Bright Inc. amounting to $20,000,000 which includes the office expenses, salaries, and legal and accounting fees. The following table summarizes operating details of each of the three subsidiaries in terms of number of employees and net income or loss in the most recent year:

About the corporate cost; (a) Allocate the $20,000,000 million corporate headquarters cost of Bright Inc. to the three subsidiaries in USA, Australia and New Zealand using: 1. number of employees in each operating company as the allocation base. 2. net income of each operating company as the allocation base. (b) Write a report to the management of Bright Inc. to explain about the advantages and disadvantages of allocating corporate headquarters costs using (1) employees and (2) net income as allocation bases.

Table 1: Number of employees and net income (loss)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started