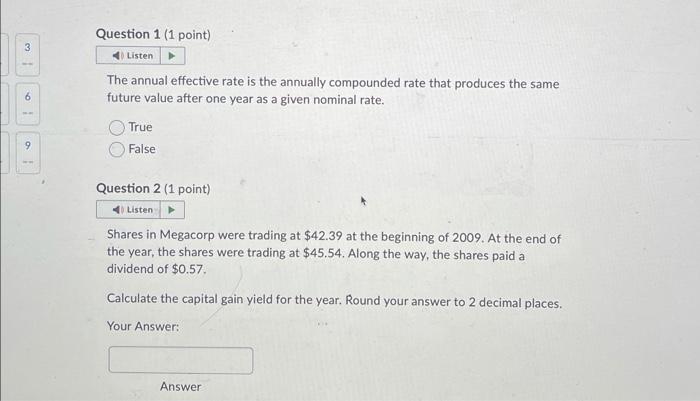

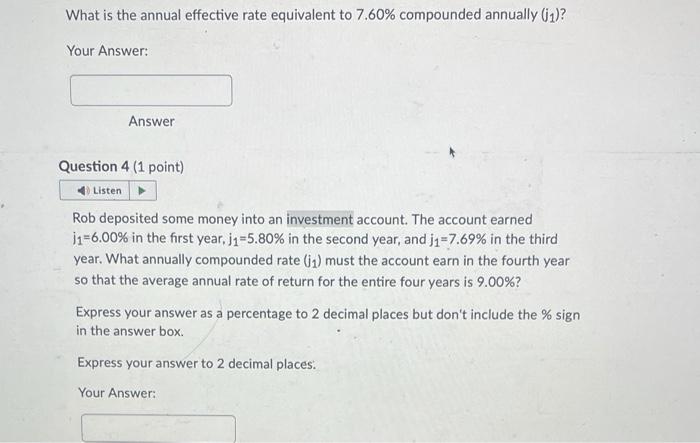

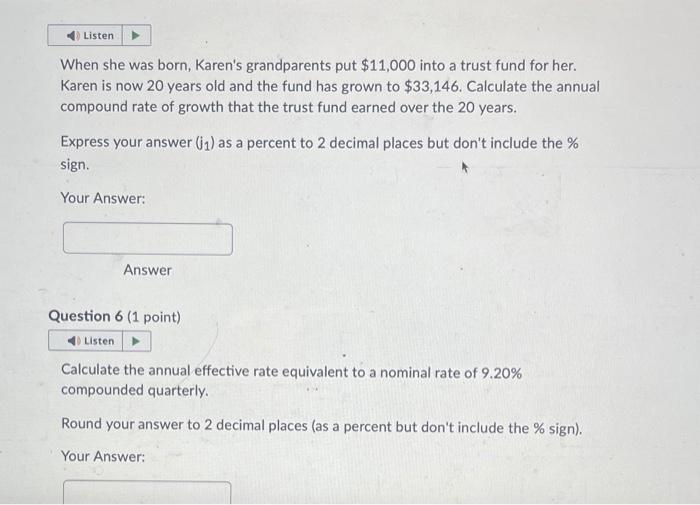

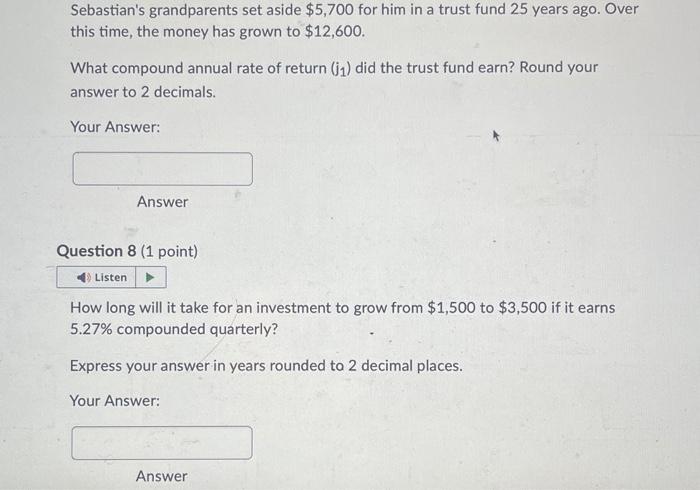

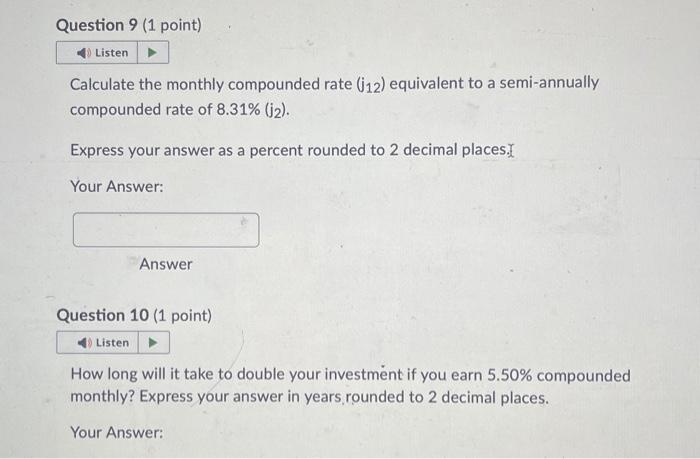

The annual effective rate is the annually compounded rate that produces the same future value after one year as a given nominal rate. True False Question 2 (1 point) Shares in Megacorp were trading at $42.39 at the beginning of 2009 . At the end of the year, the shares were trading at $45.54. Along the way, the shares paid a dividend of $0.57 Calculate the capital gain yield for the year. Round your answer to 2 decimal places. Your Answer: Answer What is the annual effective rate equivalent to 7.60% compounded annually (j1) ? Your Answer: Answer Question 4 (1 point) Rob deposited some money into an investment account. The account earned j1=6.00% in the first year, j1=5.80% in the second year, and j1=7.69% in the third year. What annually compounded rate (j1) must the account earn in the fourth year so that the average annual rate of return for the entire four years is 9.00% ? Express your answer as a percentage to 2 decimal places but don't include the % sign in the answer box. Express your answer to 2 decimal places. Your Answer: When she was born, Karen's grandparents put $11,000 into a trust fund for her. Karen is now 20 years old and the fund has grown to $33,146. Calculate the annual compound rate of growth that the trust fund earned over the 20 years. Express your answer (i1) as a percent to 2 decimal places but don't include the % sign. Your Answer: Answer Question 6 (1 point) Calculate the annual effective rate equivalent to a nominal rate of 9.20% compounded quarterly. Round your answer to 2 decimal places (as a percent but don't include the % sign). Your Answer: Sebastian's grandparents set aside $5,700 for him in a trust fund 25 years ago. Over this time, the money has grown to $12,600. What compound annual rate of return (j1) did the trust fund earn? Round your answer to 2 decimals. Your Answer: Answer Question 8 ( 1 point) How long will it take for an investment to grow from $1,500 to $3,500 if it earns 5.27% compounded quarterly? Express your answer in years rounded to 2 decimal places. Your Answer: Answer Calculate the monthly compounded rate (j12) equivalent to a semi-annually compounded rate of 8.31%(j2). Express your answer as a percent rounded to 2 decimal places.] Your Answer: Answer Question 10 (1 point) How long will it take to double your investment if you earn 5.50% compounded monthly? Express your answer in years, rounded to 2 decimal places. Your