Question

The annual report can be downloaded from the respective banks website. Your analysis should address the following: a. Provide brief background of the bank that

The annual report can be downloaded from the respective banks website. Your analysis should address the following:

a. Provide brief background of the bank that you have selected including competitive environment ofthe industry

b. Analyze the trend (past 3 years) of the banks performance (including calculation) of revenue, profitability, loans and deposits.

c. Evaluate the key risk, e.g credit risk, liquidity risk, business risk and performance risk (includingcalculation).

d. Discuss the financial challenges of the bank in the local and globalmarkets basedonyour riskevaluationandperformanceanalysis.

e. Provide your recommendation for the improvement of the banks performance and risk mitigation.

PLEASE SOLVE MY QUESTION

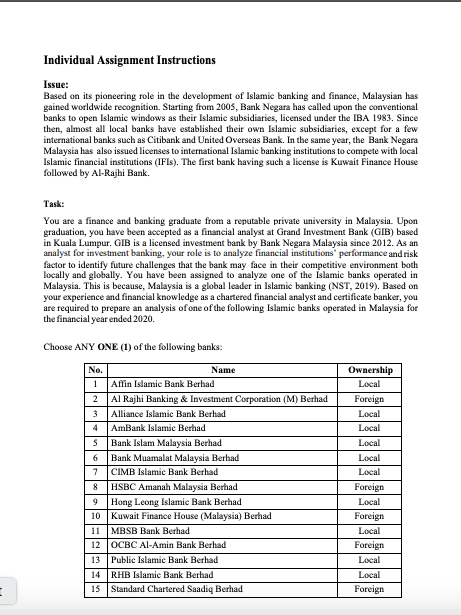

: Individual Assignment Instructions Issue: Based on its pioneering role in the development of Islamic banking and finance, Malaysian has gained worldwide recognition. Starting from 2005, Bank Negara has called upon the conventional banks to open Islamic windows as their Islamic subsidiaries, licensed under the IBA 1983. Since then, almost all local banks have established their own Islamic subsidiaries, except for a few international banks such as Citibank and United Overseas Bank. In the same year, the Bank Negara Malaysia has also issued licenses to international Islamic banking institutions to compete with local Islamic financial institutions (IFIs). The first bank having such a license is Kuwait Finance House followed by Al-Rajhi Bank. Task: You are a finance and banking graduate from a reputable private university in Malaysia. Upon graduation, you have been accepted as a financial analyst at Grand Investment Bank (GIB) based in Kuala Lumpur. GIB is a licensed investment bank by Bank Negara Malaysia since 2012. As an analyst for investment banking, your role is to analyze financial institutions' performance and risk factor to identify future challenges that the bank may face in their competitive environment both locally and globally. You have been assigned to analyze one of the Islamic banks operated in Malaysia. This is because, Malaysia is a global leader in Islamic banking (NST, 2019). Based on your experience and financial knowledge as a chartered financial analyst and certificate banker, you are required to prepare an analysis of one of the following Islamic banks operated in Malaysia for the financial year ended 2020. Choose ANY ONE (1) of the following banks: No. 1 2 3 4 5 6 7 8 9 10 11 12 13 15 Name Affin Islamic Bank Berhad Al Rajhi Banking & Investment Corporation (M) Berhad Alliance Islamic Bank Berhad AmBank Islamic Berhad Bank Islam Malaysia Berhad Bank Muamalat Malaysia Berhad CIMB Islamic Bank Berhad HSBC Amanah Malaysia Berhad Hong Leong Islamic Bank Berhad Kuwait Finance House (Malaysia) Berhad MBSB Bank Berhad OCBC Al-Amin Bank Berhad Public Islamic Bank Berhad RHB Islamic Bank Berhad Standard Chartered Saadiq Berhad Ownership Local Foreign Local Local Local Local Local Foreign Local Foreign Local Foreign Local Local Foreign : Individual Assignment Instructions Issue: Based on its pioneering role in the development of Islamic banking and finance, Malaysian has gained worldwide recognition. Starting from 2005, Bank Negara has called upon the conventional banks to open Islamic windows as their Islamic subsidiaries, licensed under the IBA 1983. Since then, almost all local banks have established their own Islamic subsidiaries, except for a few international banks such as Citibank and United Overseas Bank. In the same year, the Bank Negara Malaysia has also issued licenses to international Islamic banking institutions to compete with local Islamic financial institutions (IFIs). The first bank having such a license is Kuwait Finance House followed by Al-Rajhi Bank. Task: You are a finance and banking graduate from a reputable private university in Malaysia. Upon graduation, you have been accepted as a financial analyst at Grand Investment Bank (GIB) based in Kuala Lumpur. GIB is a licensed investment bank by Bank Negara Malaysia since 2012. As an analyst for investment banking, your role is to analyze financial institutions' performance and risk factor to identify future challenges that the bank may face in their competitive environment both locally and globally. You have been assigned to analyze one of the Islamic banks operated in Malaysia. This is because, Malaysia is a global leader in Islamic banking (NST, 2019). Based on your experience and financial knowledge as a chartered financial analyst and certificate banker, you are required to prepare an analysis of one of the following Islamic banks operated in Malaysia for the financial year ended 2020. Choose ANY ONE (1) of the following banks: No. 1 2 3 4 5 6 7 8 9 10 11 12 13 15 Name Affin Islamic Bank Berhad Al Rajhi Banking & Investment Corporation (M) Berhad Alliance Islamic Bank Berhad AmBank Islamic Berhad Bank Islam Malaysia Berhad Bank Muamalat Malaysia Berhad CIMB Islamic Bank Berhad HSBC Amanah Malaysia Berhad Hong Leong Islamic Bank Berhad Kuwait Finance House (Malaysia) Berhad MBSB Bank Berhad OCBC Al-Amin Bank Berhad Public Islamic Bank Berhad RHB Islamic Bank Berhad Standard Chartered Saadiq Berhad Ownership Local Foreign Local Local Local Local Local Foreign Local Foreign Local Foreign Local Local ForeignStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started