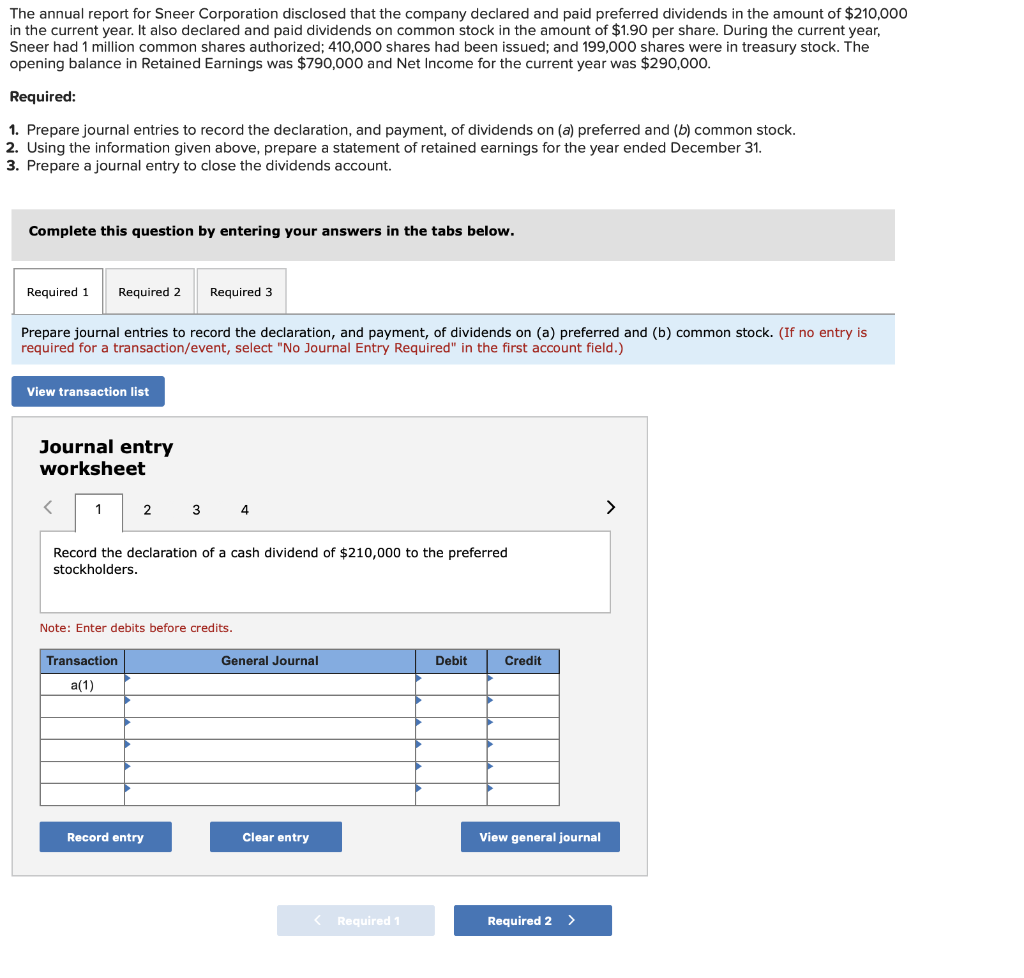

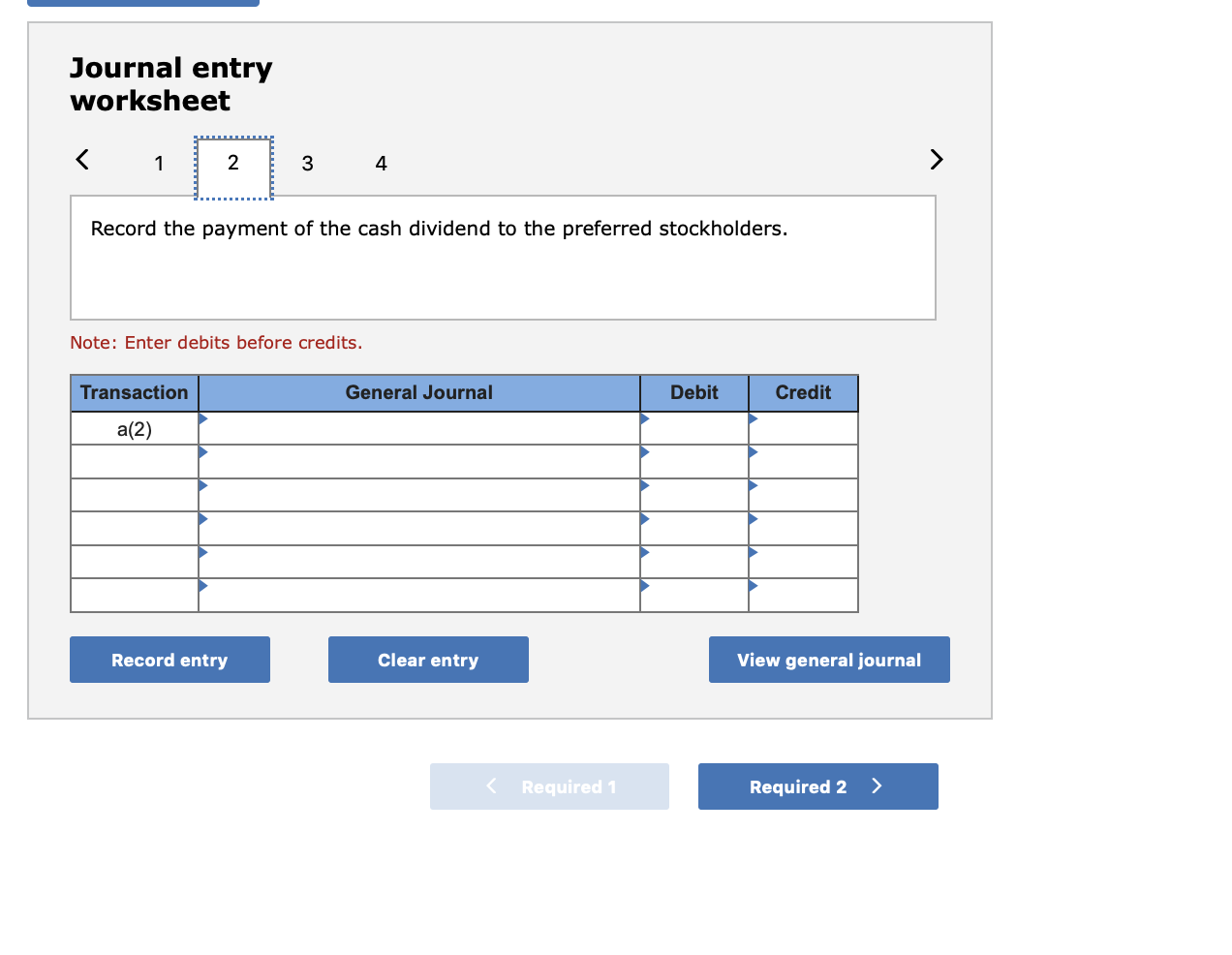

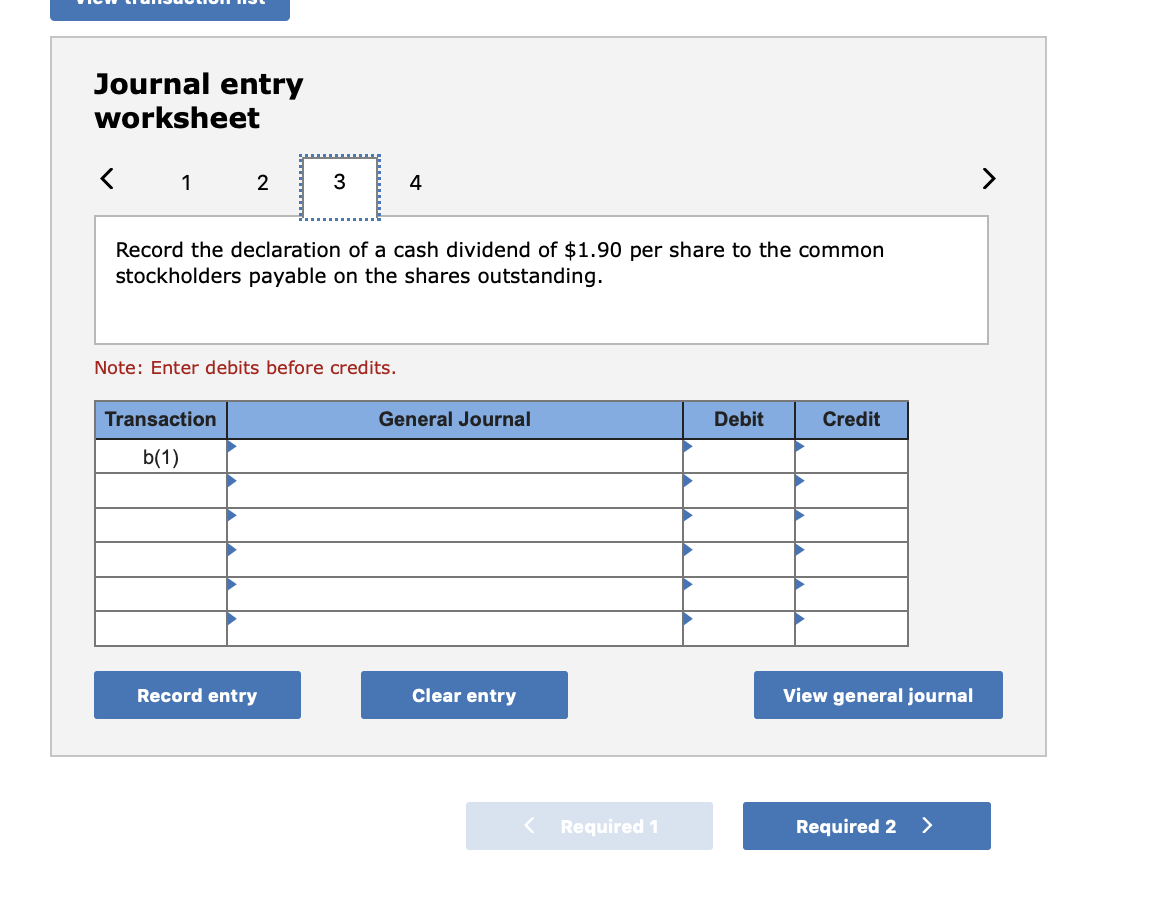

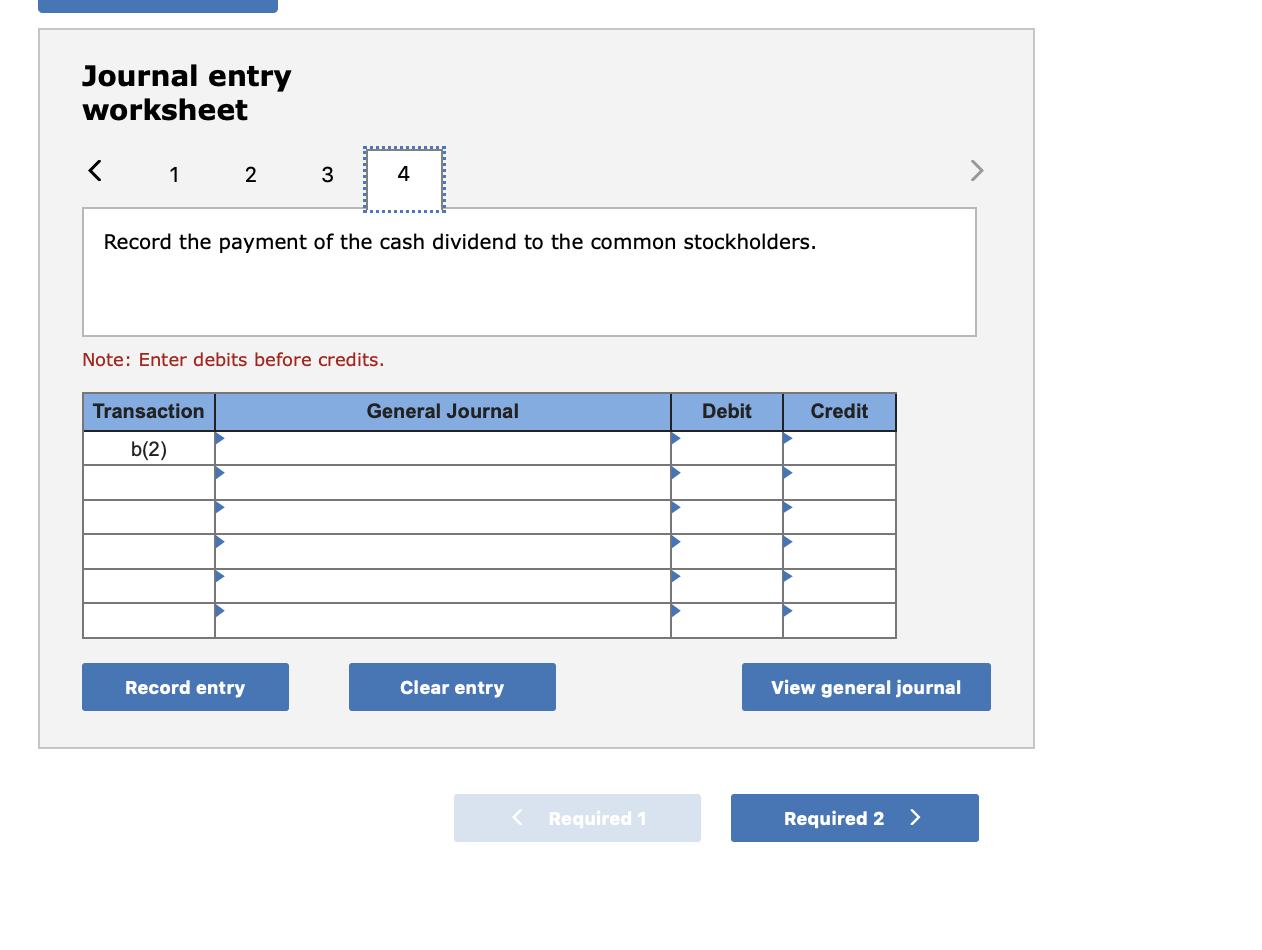

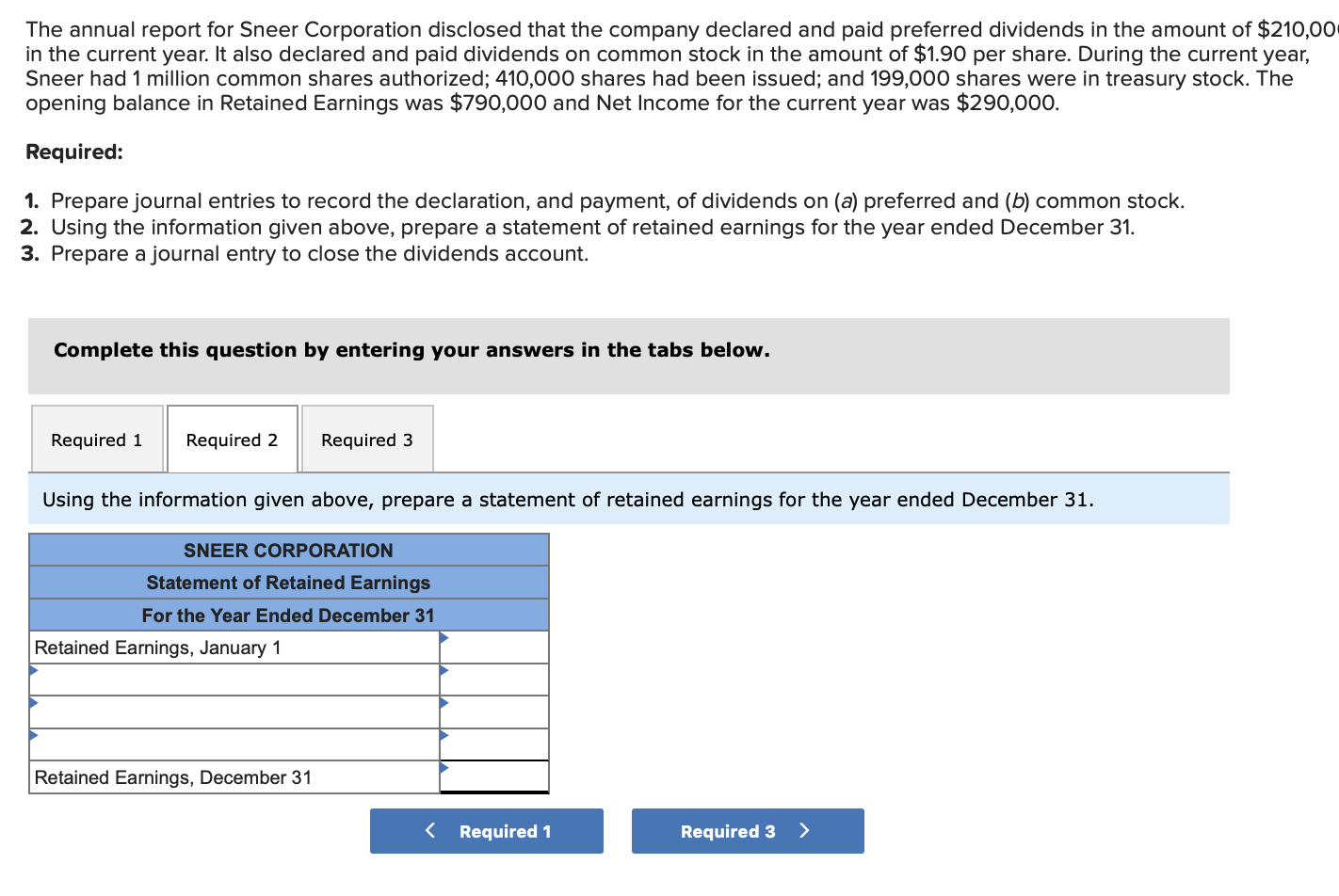

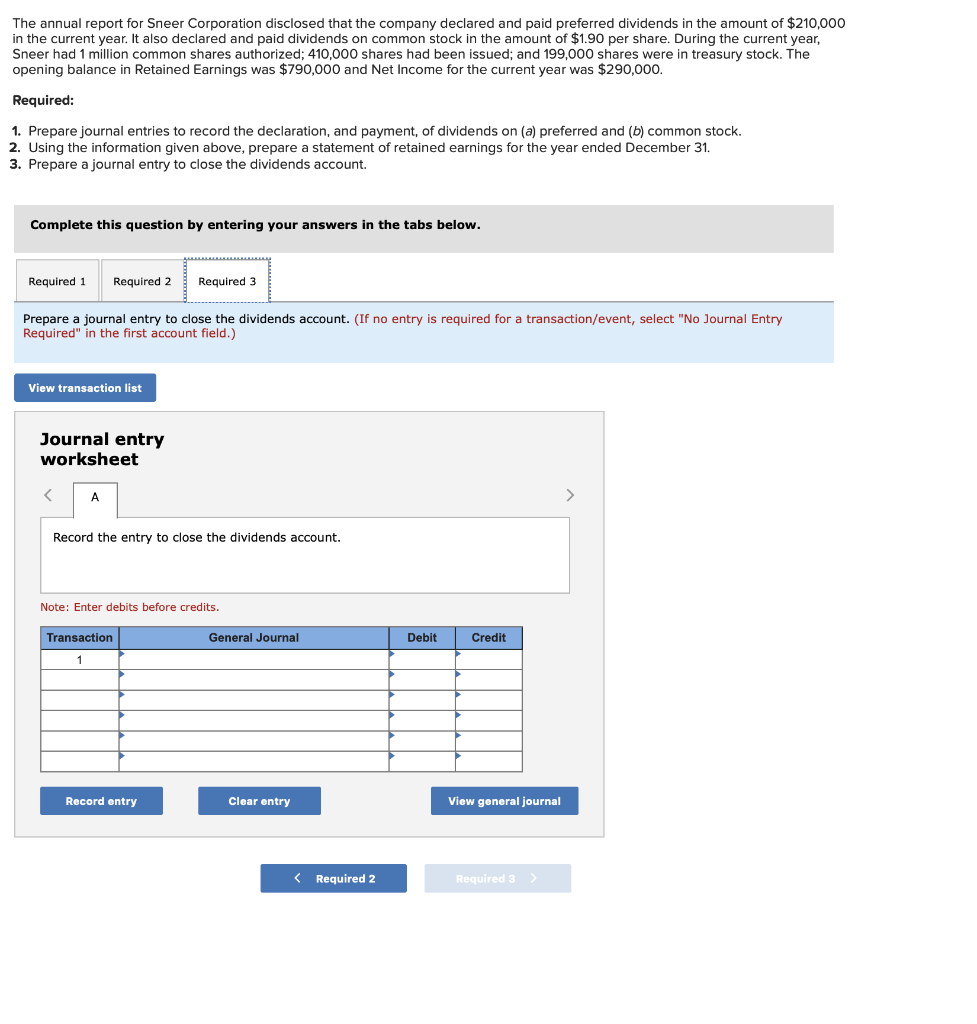

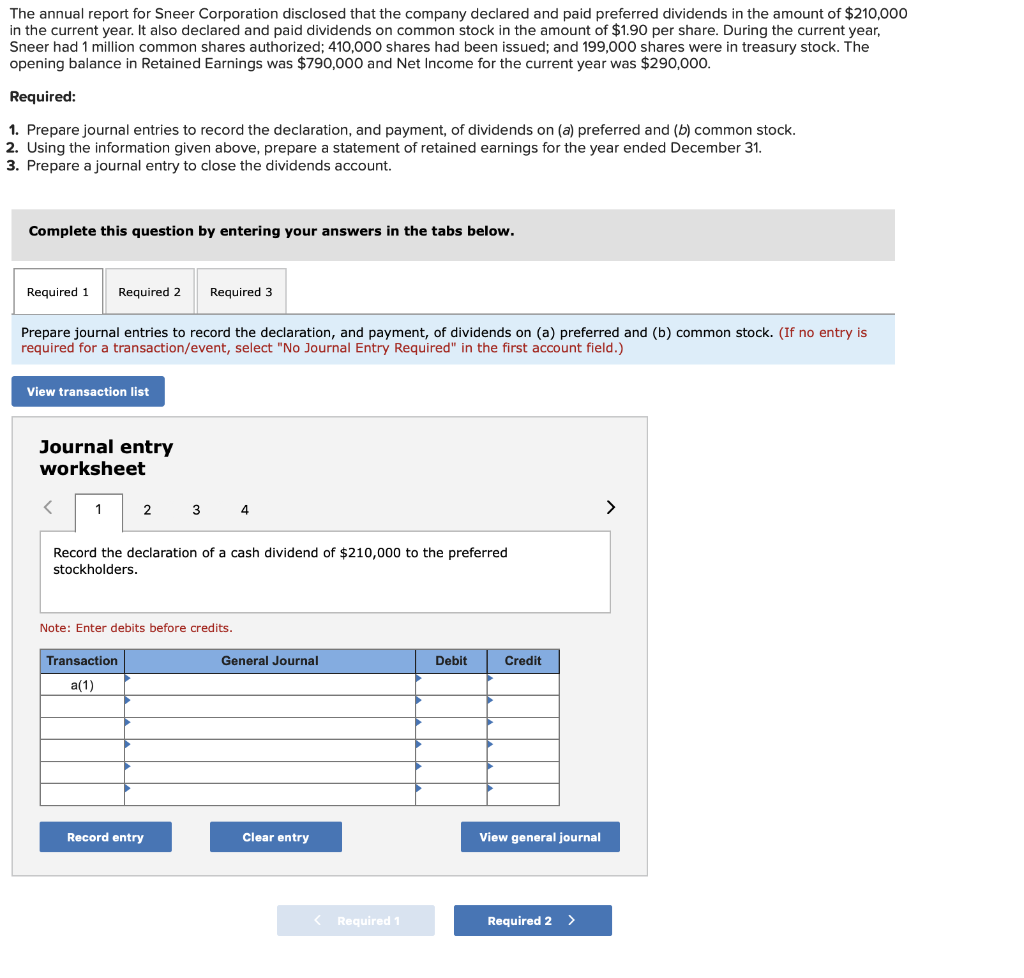

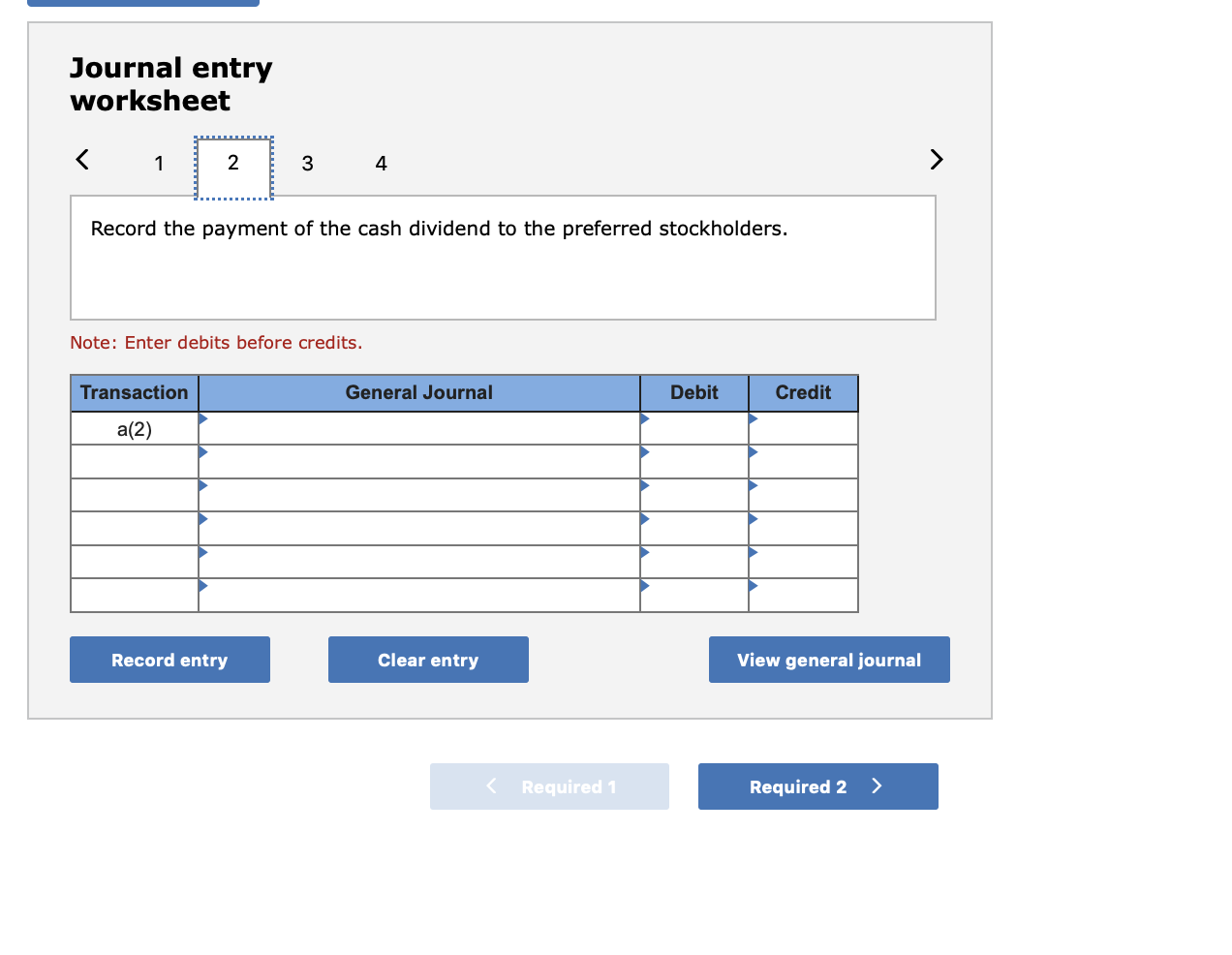

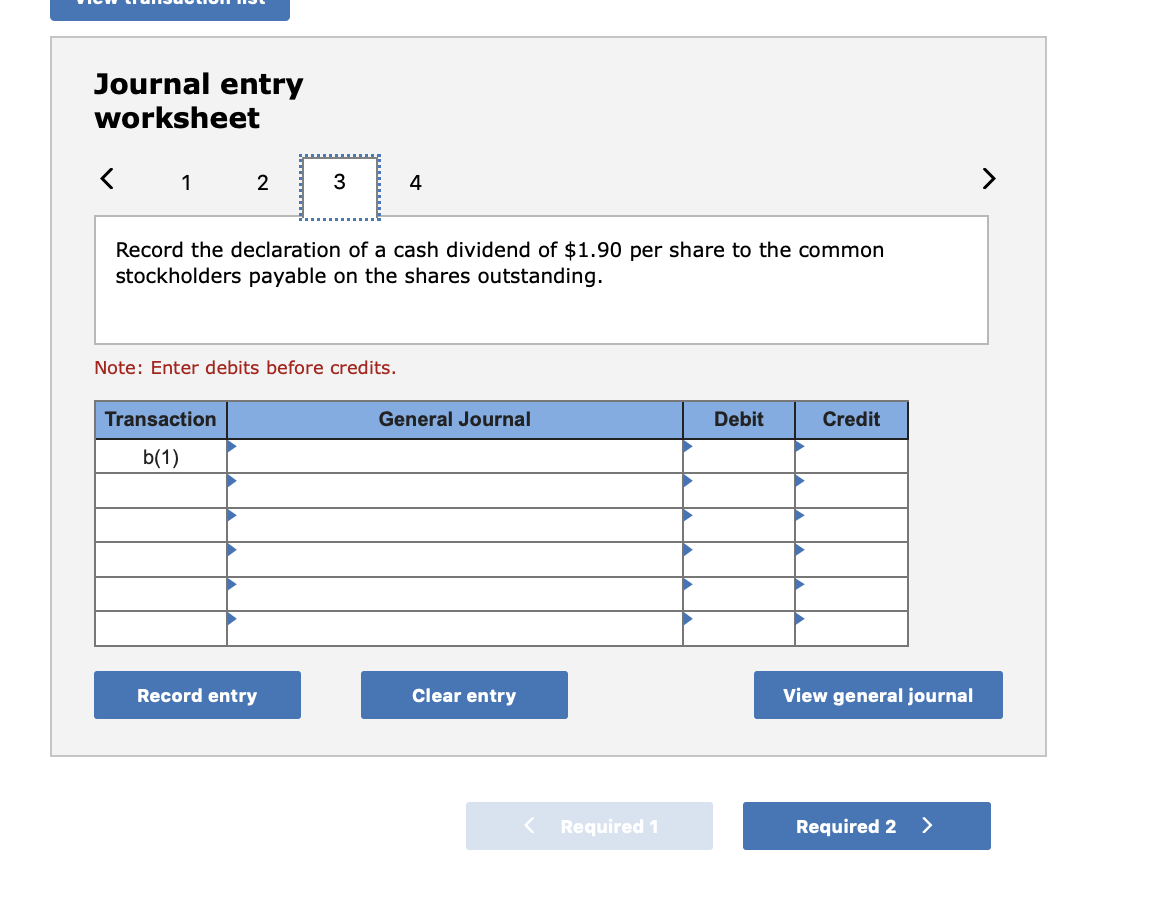

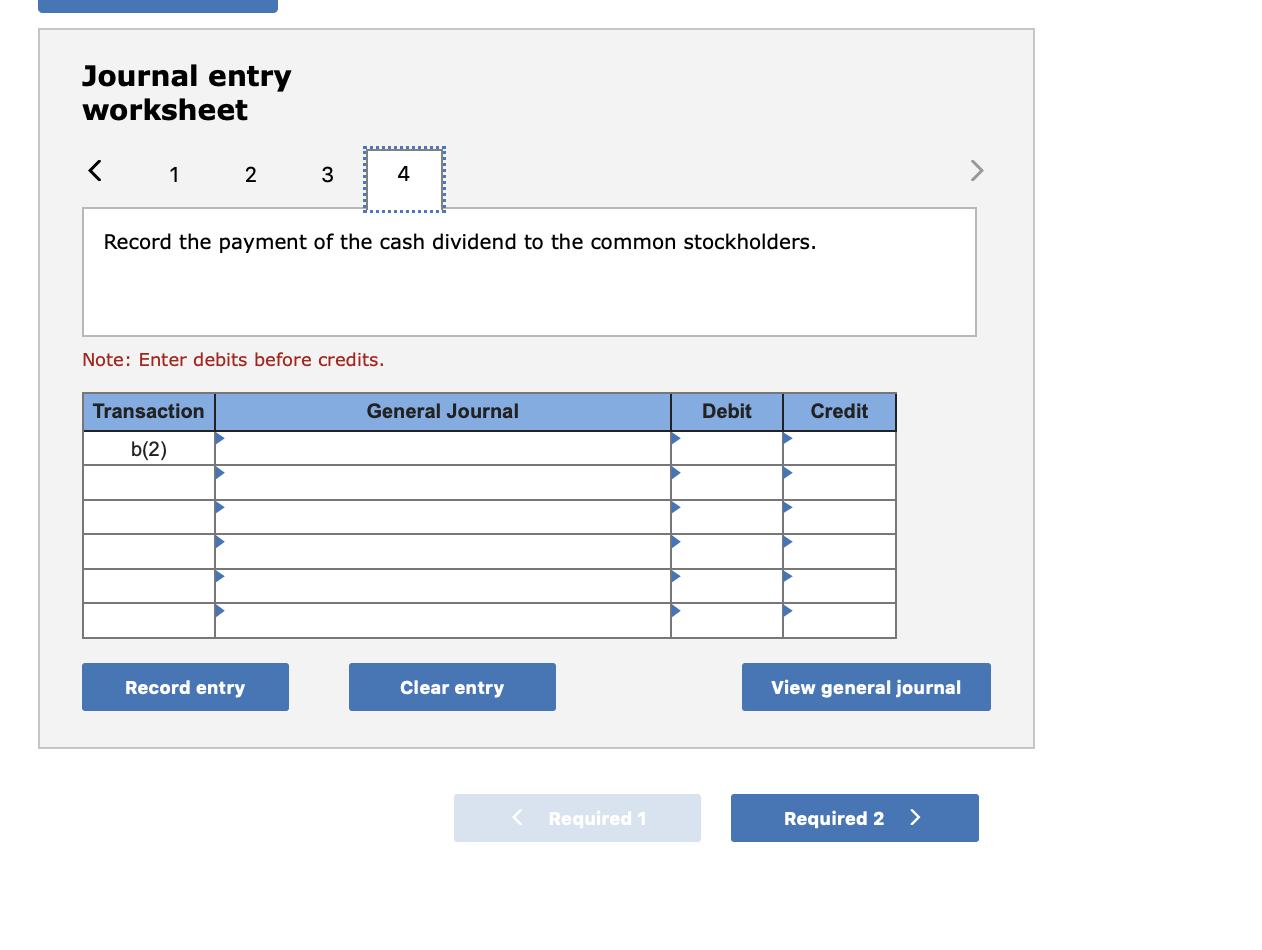

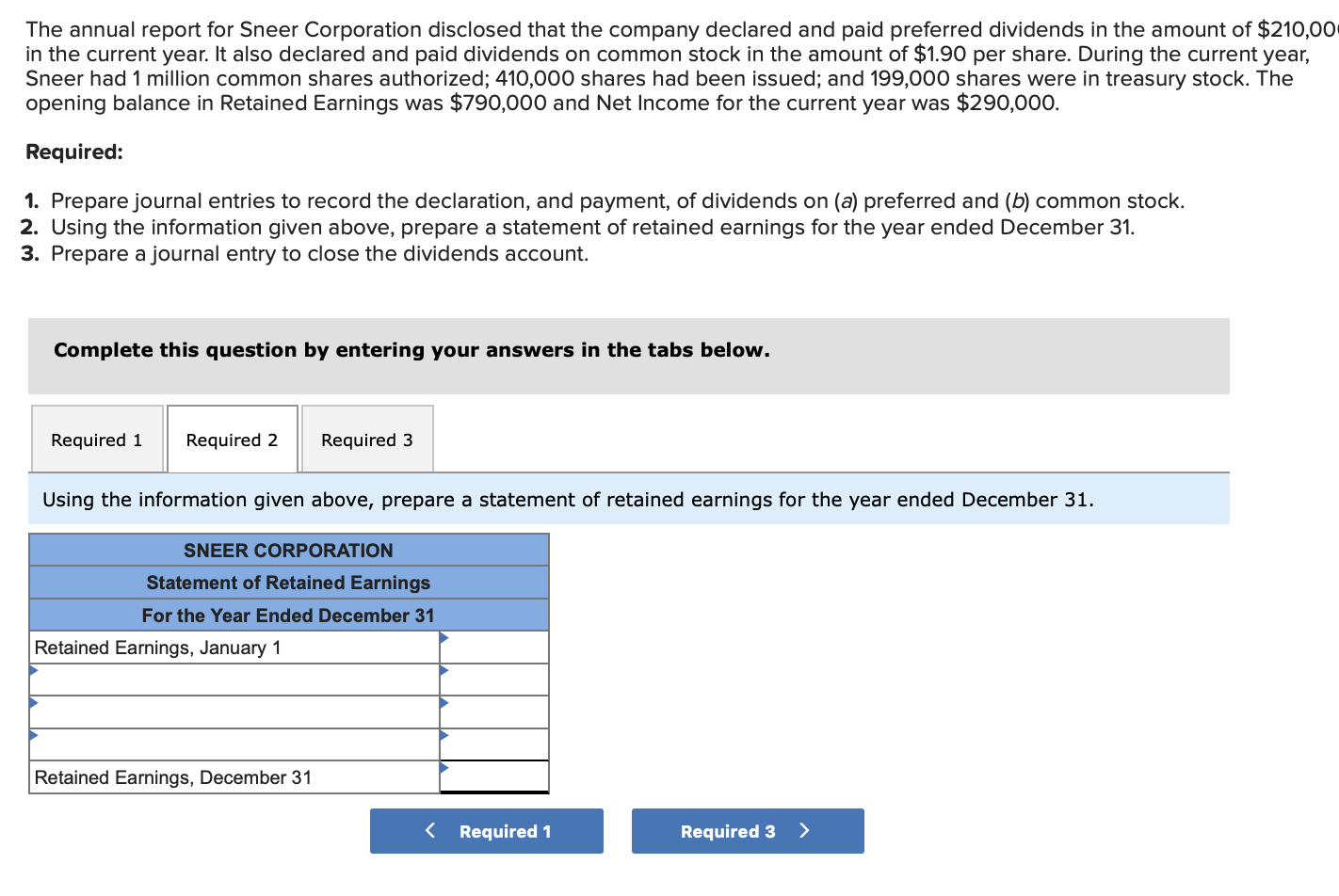

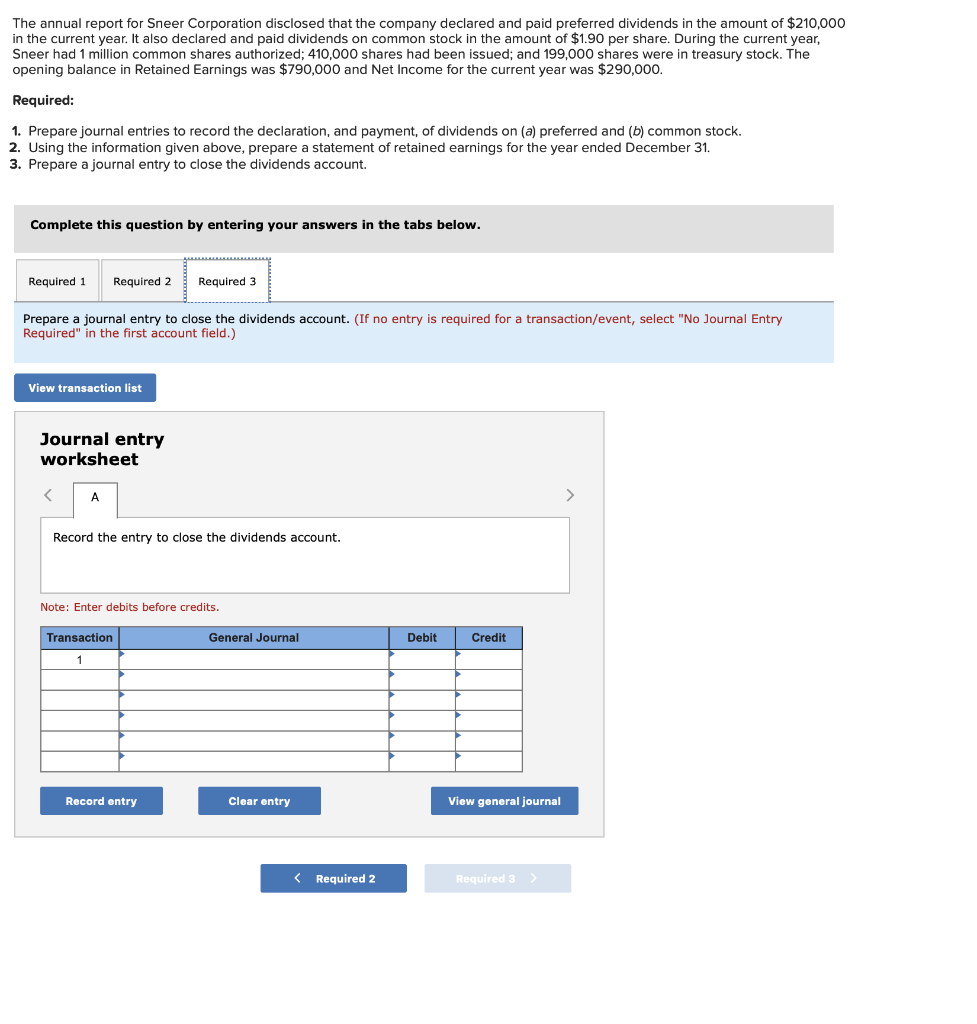

The annual report for Sneer Corporation disclosed that the company declared and paid preferred dividends in the amount of $210,000 in the current year. It also declared and paid dividends on common stock in the amount of $1.90 per share. During the current year, Sneer had 1 million common shares authorized; 410,000 shares had been issued; and 199,000 shares were in treasury stock. The opening balance in Retained Earnings was $790,000 and Net Income for the current year was $290,000. Required: 1. Prepare journal entries to record the declaration, and payment, of dividends on (a) preferred and (b) common stock. 2. Using the information given above, prepare a statement of retained earnings for the year ended December 31. 3. Prepare a journal entry to close the dividends account. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare journal entries to record the declaration, and payment, of dividends on (a) preferred and (b) common stock. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 2 3 4 Record the declaration of a cash dividend of $210,000 to the preferred stockholders. Note: Enter debits before credits. Transaction General Journal Debit a(1) Record entry Clear entry View general journal Required 1 Required 2 > Journal entry worksheet Journal entry worksheet 1 2 3 Record the declaration of a cash dividend of $1.90 per share to the common stockholders payable on the shares outstanding. Note: Enter debits before credits. Transaction General Journal Debit Credit b(1) Record entry Clear entry View general journal Required 1 Required 2 > Journal entry worksheet The annual report for Sneer Corporation disclosed that the company declared and paid preferred dividends in the amount of $210,00 in the current year. It also declared and paid dividends on common stock in the amount of $1.90 per share. During the current year, Sneer had 1 million common shares authorized; 410,000 shares had been issued; and 199,000 shares were in treasury stock. The opening balance in Retained Earnings was $790,000 and Net Income for the current year was $290,000. Required: 1. Prepare journal entries to record the declaration, and payment, of dividends on (a) preferred and (b) common stock. 2. Using the information given above, prepare a statement of retained earnings for the year ended December 31. 3. Prepare a journal entry to close the dividends account. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Using the information given above, prepare a statement of retained earnings for the year ended December 31. SNEER CORPORATION Statement of Retained Earnings For the Year Ended December 31 Retained Earnings, January 1 Retained Earnings, December 31 The annual report for Sneer Corporation disclosed that the company declared and paid preferred dividends in the amount of $210,000 in the current year. It also declared and paid dividends on common stock in the amount of $1.90 per share. During the current year, Sneer had 1 million common shares authorized; 410,000 shares had been issued; and 199,000 shares were in treasury stock. The opening balance in Retained Earnings was $790,000 and Net Income for the current year was $290,000. Required: 1. Prepare journal entries to record the declaration, and payment, of dividends on (a) preferred and (b) common stock. 2. Using the information given above, prepare a statement of retained earnings for the year ended December 31. 3. Prepare a journal entry to close the dividends account. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a journal entry to close the dividends account. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the entry to close the dividends account. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal Required 2 Required 3