Answered step by step

Verified Expert Solution

Question

1 Approved Answer

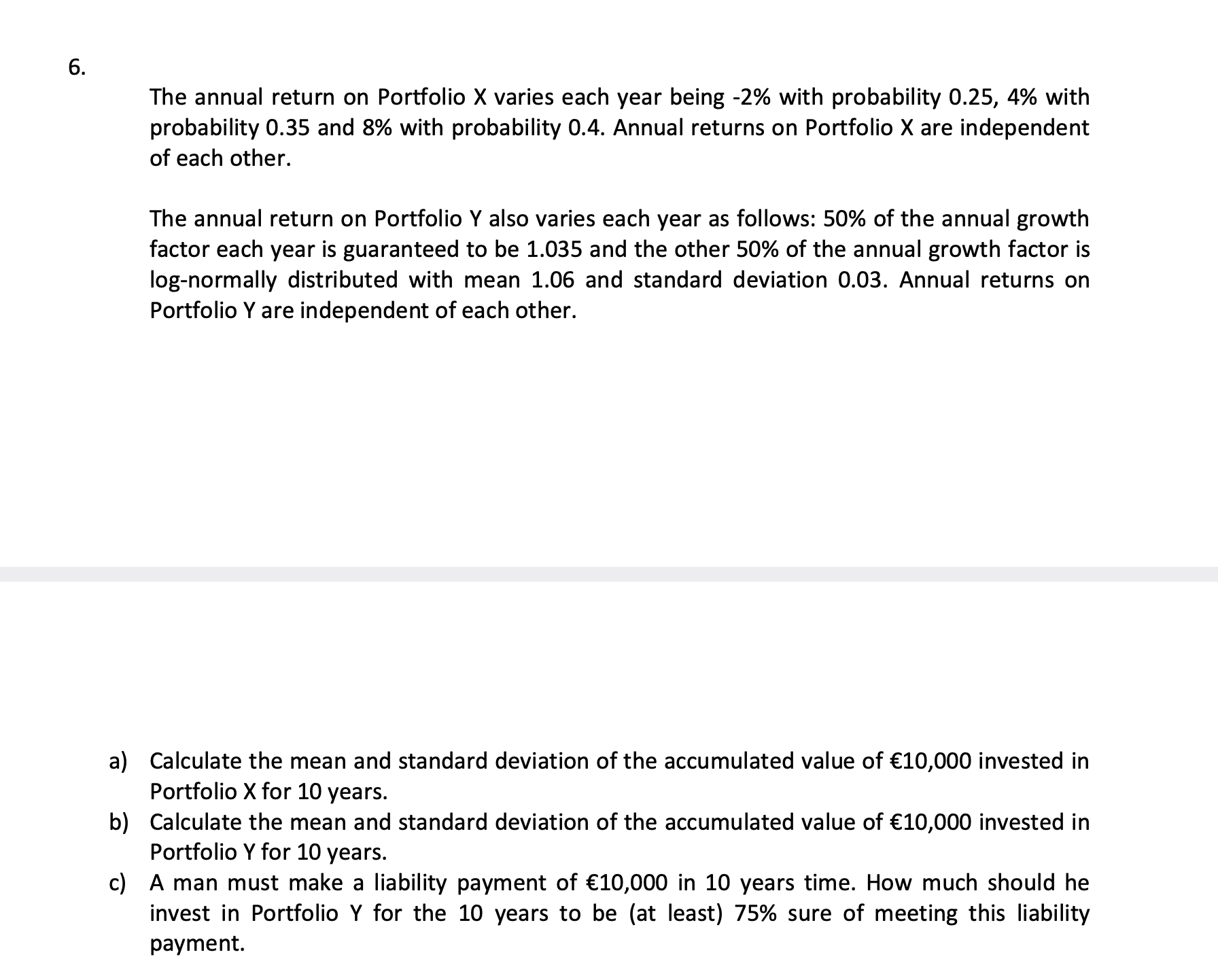

The annual return on Portfolio x varies each year being - 2 % with probability 0 . 2 5 , 4 % with probability 0

The annual return on Portfolio varies each year being with probability with

probability and with probability Annual returns on Portfolio are independent

of each other.

The annual return on Portfolio also varies each year as follows: of the annual growth

factor each year is guaranteed to be and the other of the annual growth factor is

lognormally distributed with mean and standard deviation Annual returns on

Portfolio are independent of each other.

a Calculate the mean and standard deviation of the accumulated value of invested in

Portfolio for years.

b Calculate the mean and standard deviation of the accumulated value of invested in

Portfolio for years.

c A man must make a liability payment of in years time. How much should he

invest in Portfolio for the years to be at least sure of meeting this liability

payment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started