Answered step by step

Verified Expert Solution

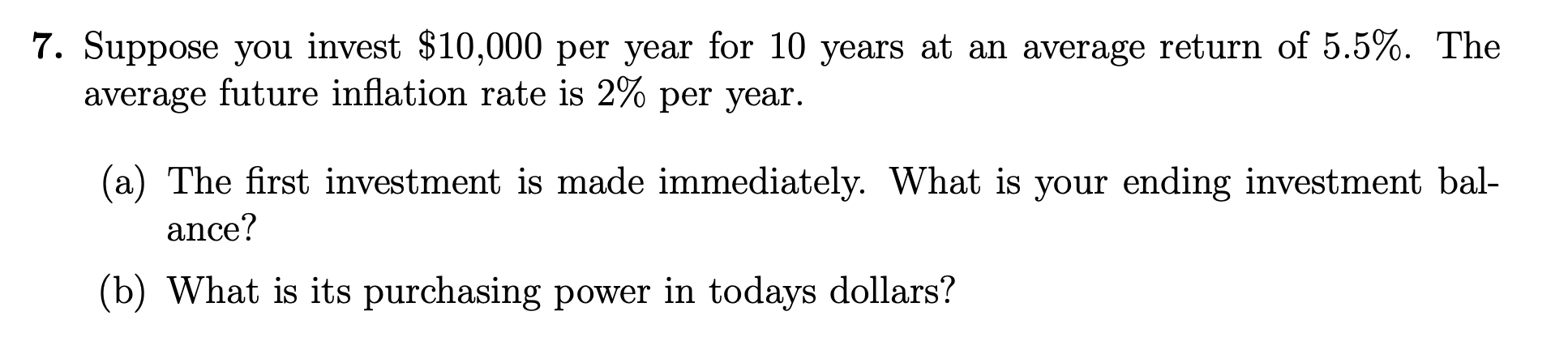

Question

1 Approved Answer

The answer for this question is provided above, but for part B, I am confused by the NPV. How was this calculated? I know the

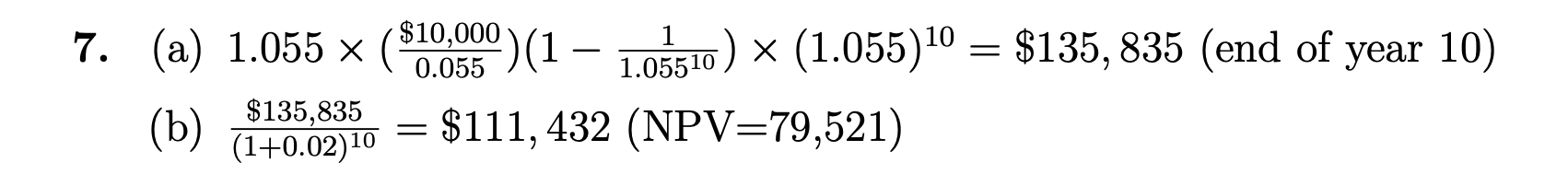

The answer for this question is provided above, but for part B, I am confused by the NPV. How was this calculated? I know the formula is NPV = Present Value - investment... but the Present value is $111,432, and isn't the investment then $100,000 ($10,000 per year over 10 years?). Even when adjusting for the 2% inflation, the investment is around $91,000, so I have no idea where the $79,521 comes from... is this just wrong??

7. Suppose you invest $10,000 per year for 10 years at an average return of 5.5%. The average future inflation rate is 2% per year. (a) The first investment is made immediately. What is your ending investment bal- ance? (b) What is its purchasing power in todays dollars? 7. (a) 1.055 x $10,000 (1 0.055 1.05510 :) x (1.055)10 = $135,835 (end of year 10) $111, 432 (NPV=79,521) $135,835 (b) (1+0.02)10 =Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started