Answered step by step

Verified Expert Solution

Question

1 Approved Answer

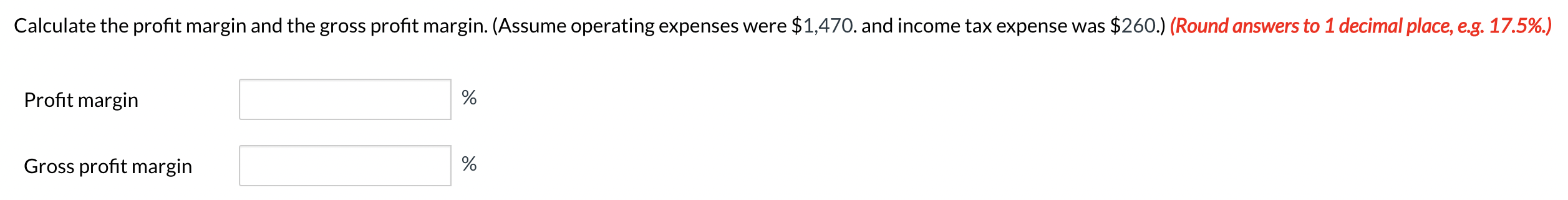

The answer in the red box is wrong. I would like to ask for the answer to the last question. Blue Spruce Hardware Store Inc.

The answer in the red box is wrong. I would like to ask for the answer to the last question.

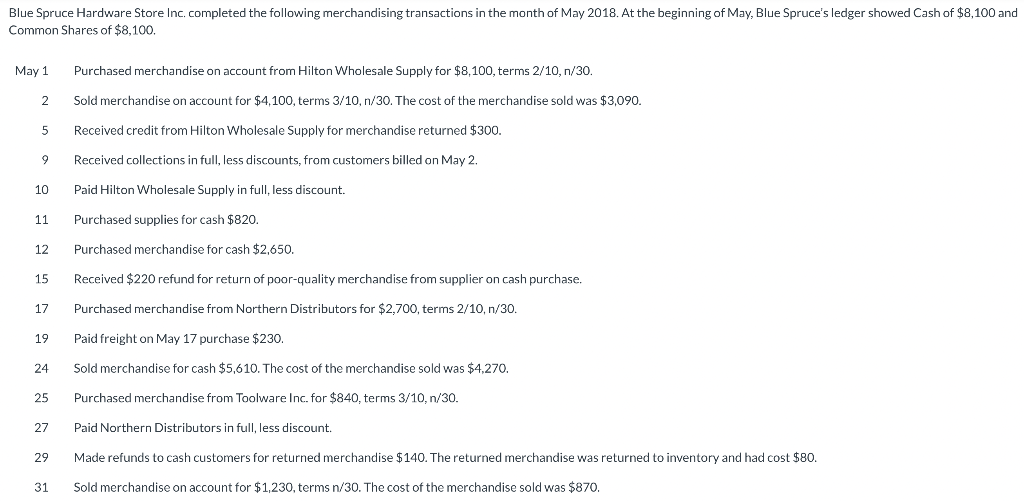

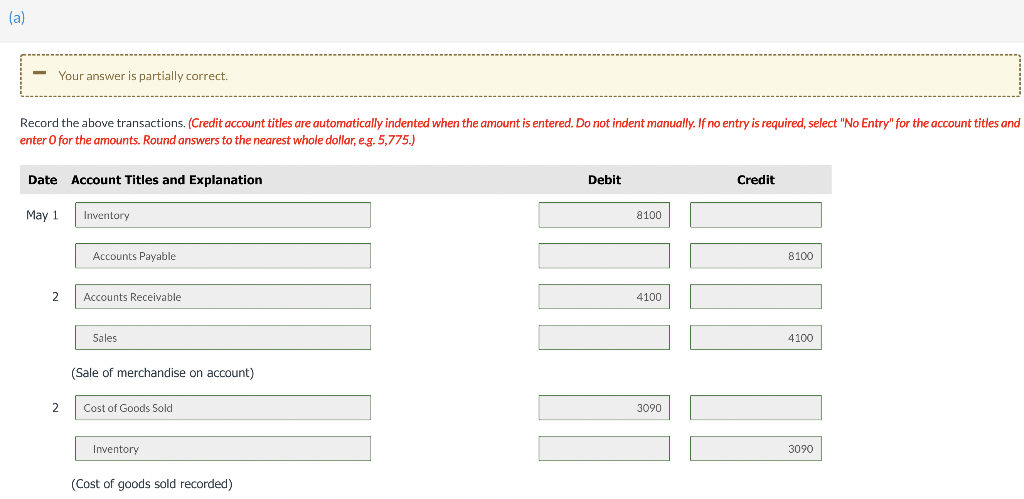

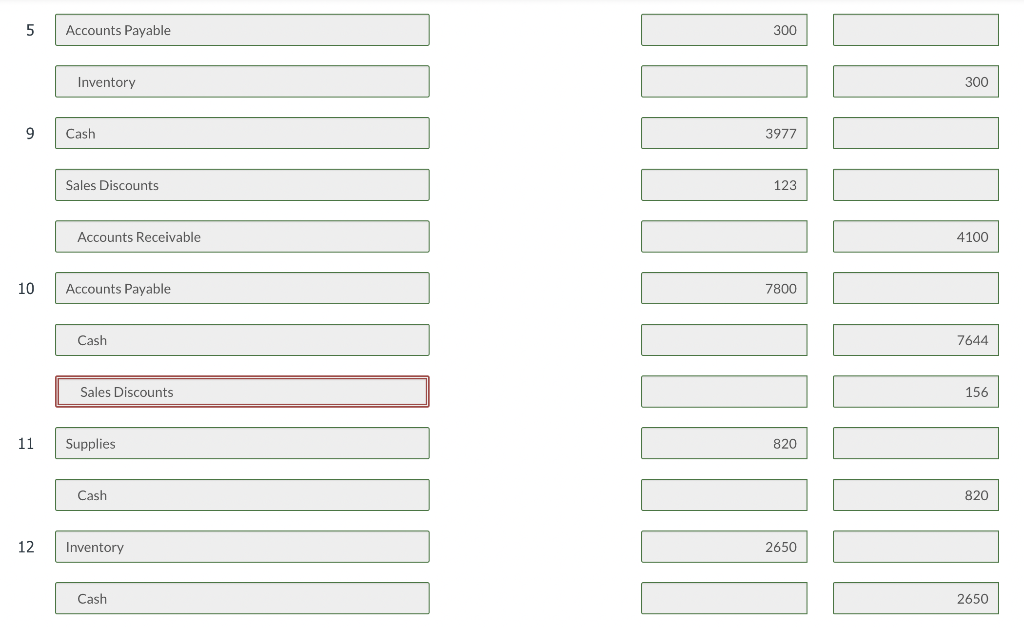

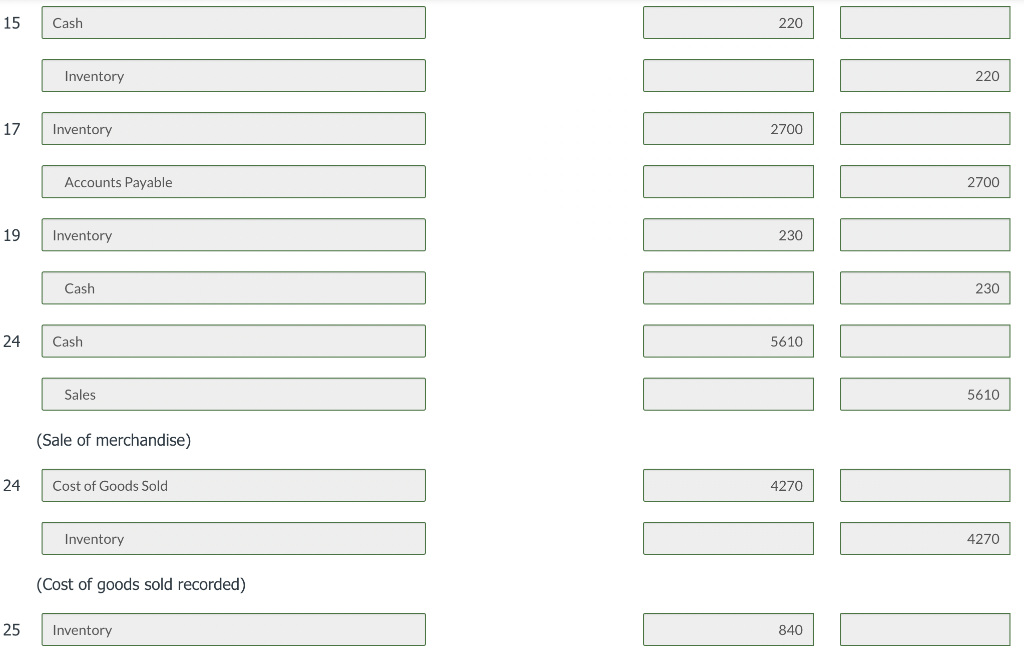

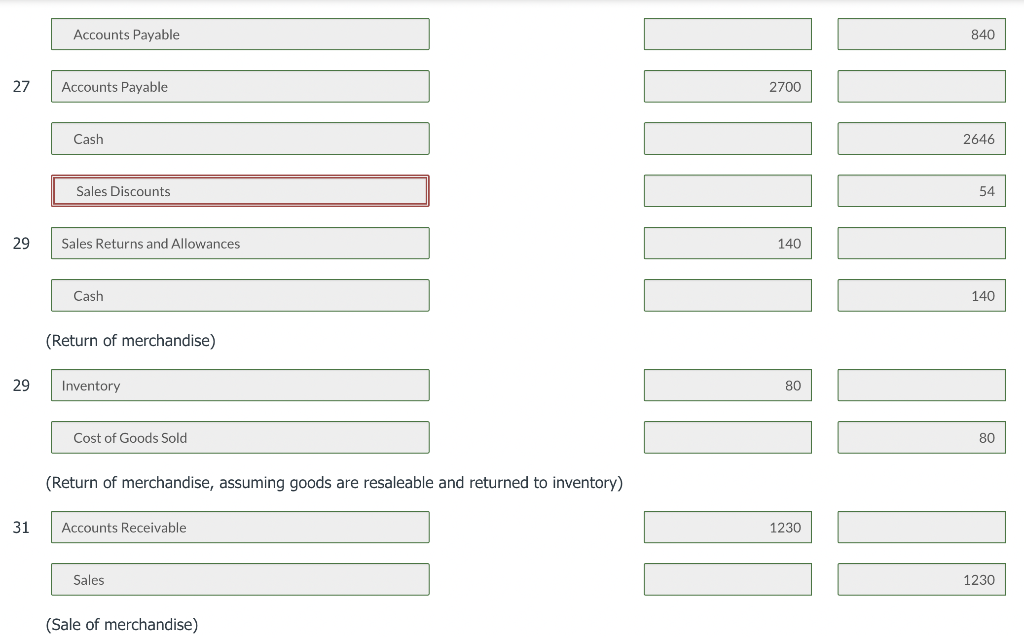

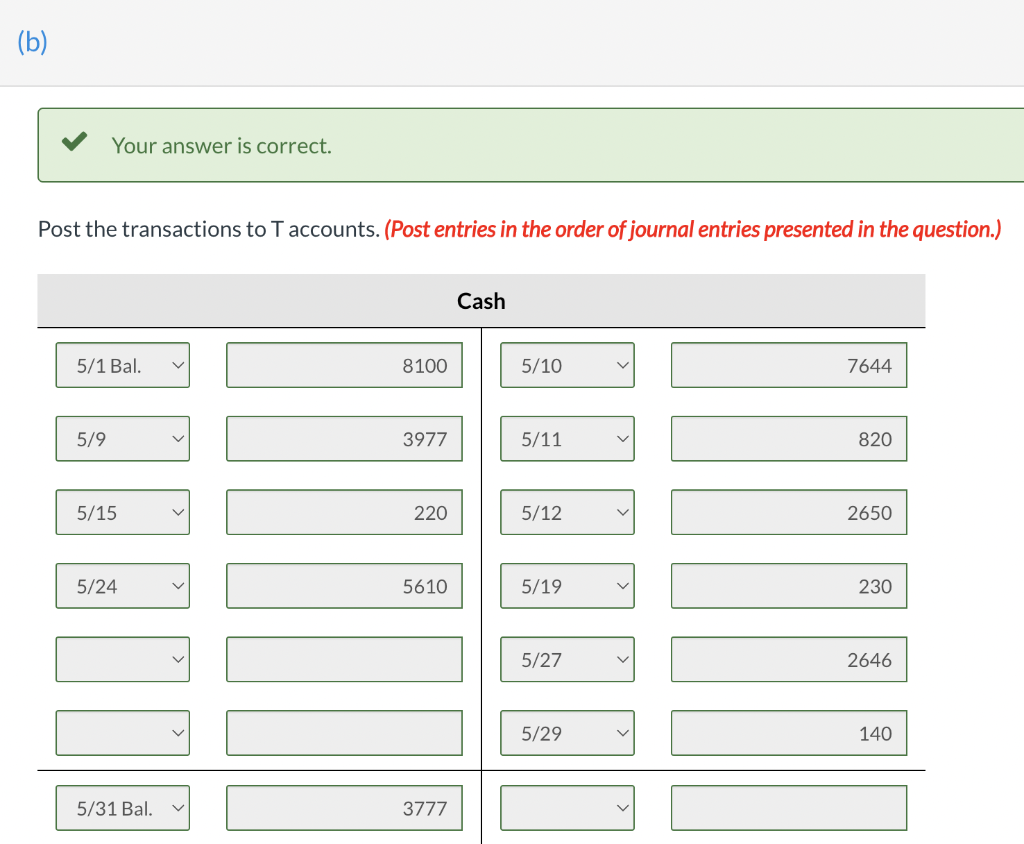

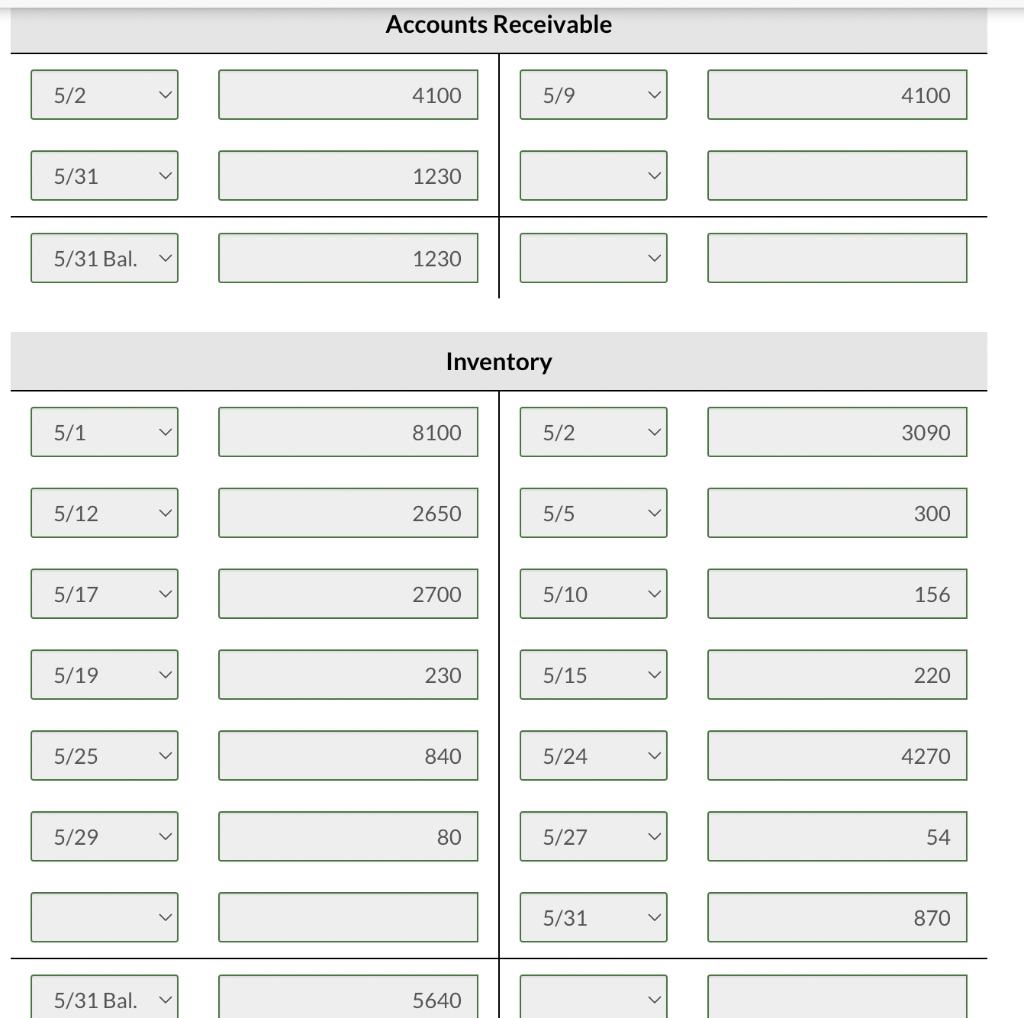

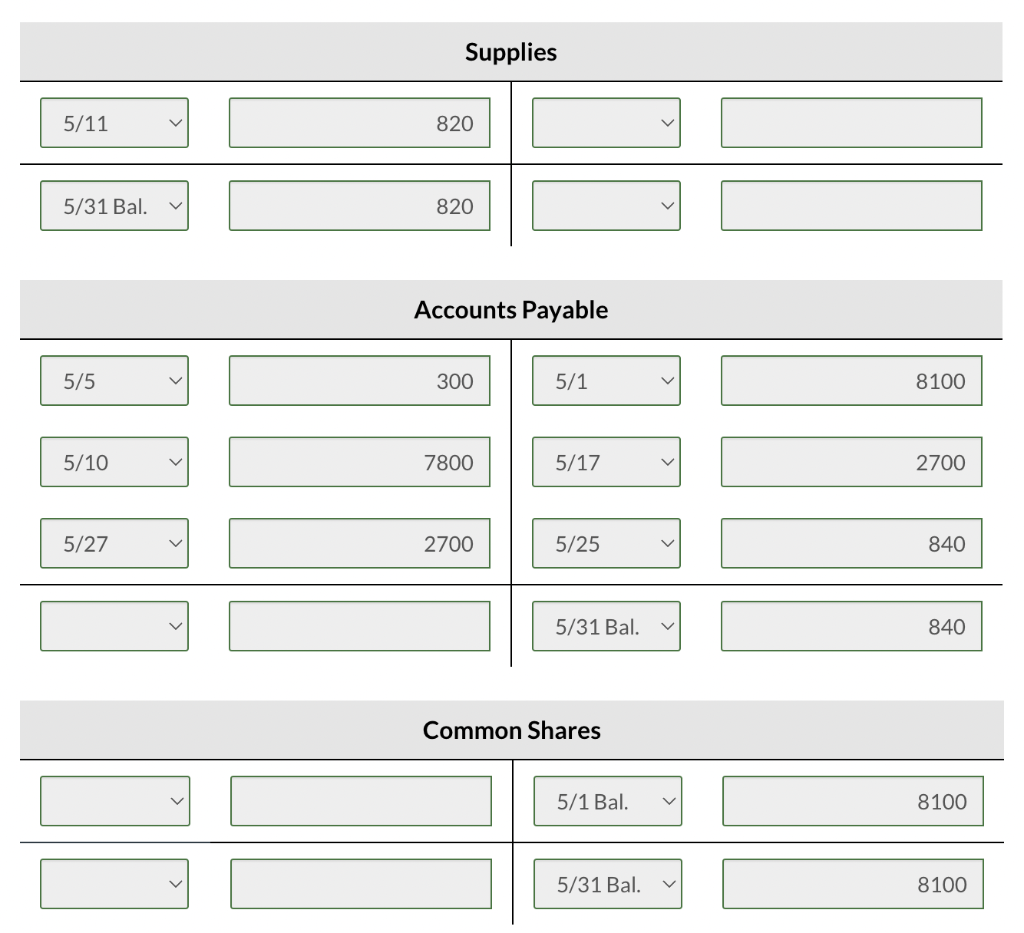

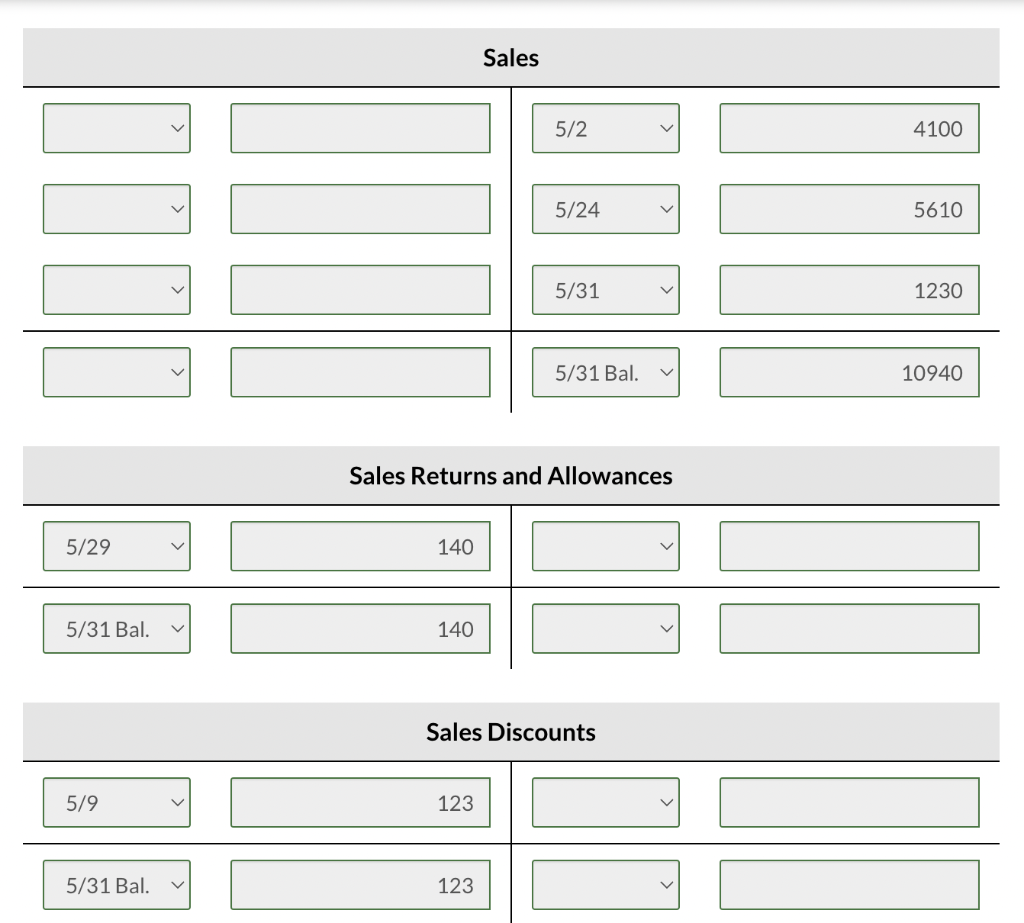

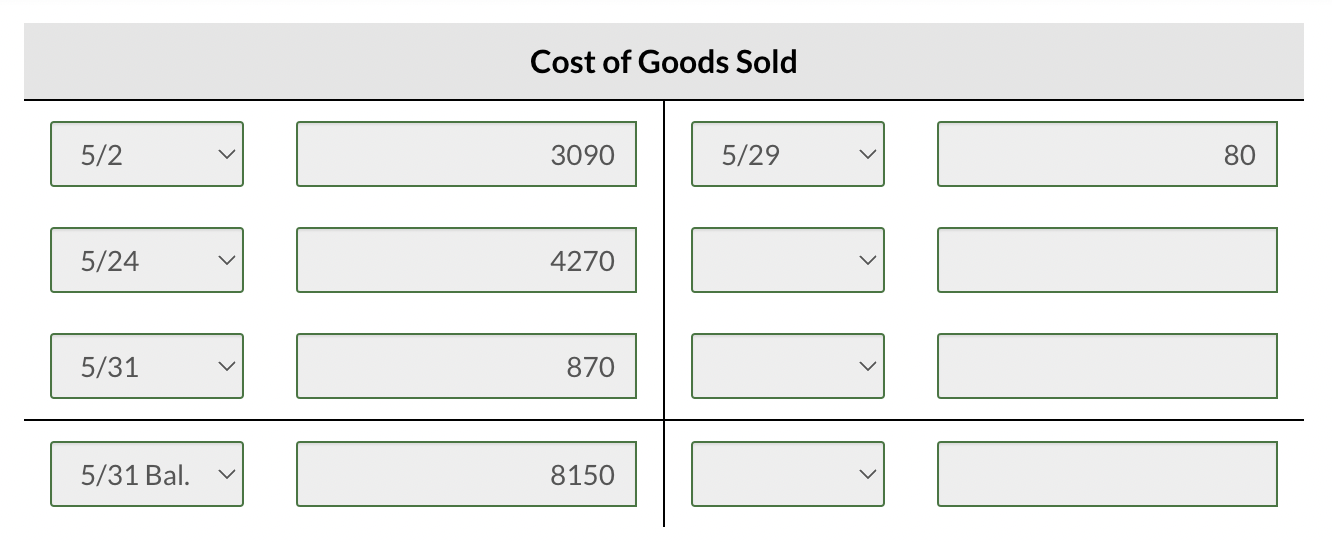

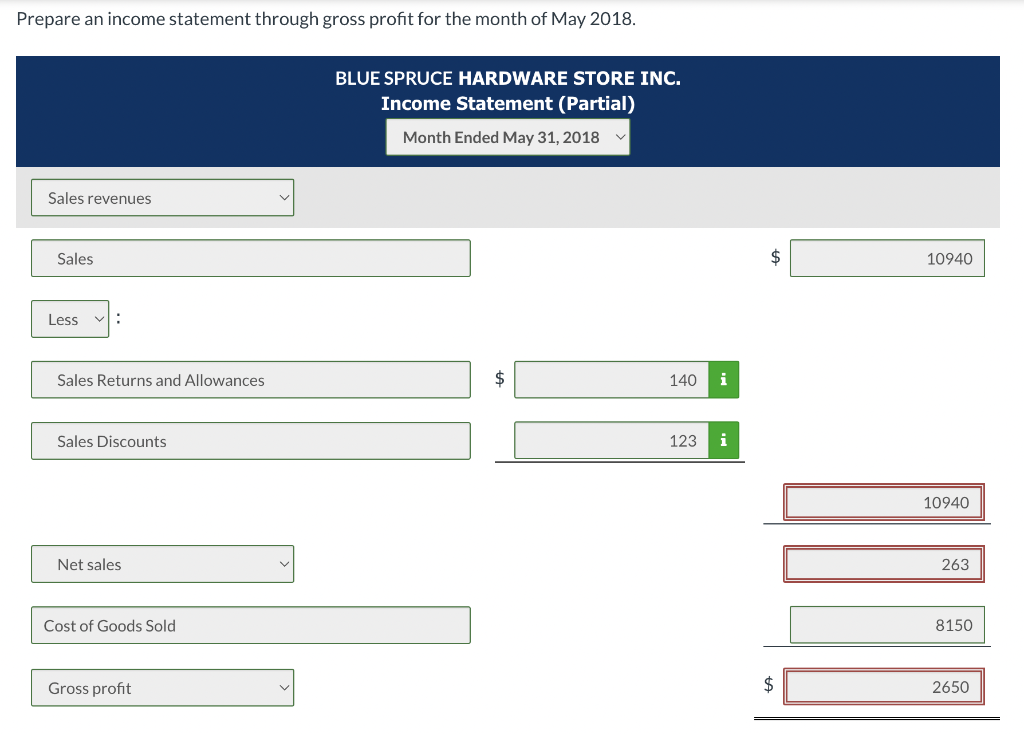

Blue Spruce Hardware Store Inc. completed the following merchandising transactions in the month of May 2018. At the beginning of May, Blue Spruce's ledger showed Cash of $8,100 and Common Shares of $8,100. May 1 Purchased merchandise on account from Hilton Wholesale Supply for $8,100, terms 2/10, n/30. 2 Sold merchandise on account for $4,100, terms 3/10, n/30. The cost of the merchandise sold was $3,090. 5 Received credit from Hilton Wholesale Supply for merchandise returned $300. 9 Received collections in full, less discounts, from customers billed on May 2. 10 Paid Hilton Wholesale Supply in full, less discount. 11 Purchased supplies for cash $820. 12 Purchased merchandise for cash $2,650. 15 Received $220 refund for return of poor-quality merchandise from supplier on cash purchase. 17 Purchased merchandise from Northern Distributors for $2,700, terms 2/10, n/30. 19 Paid freight on May 17 purchase $230. 24 Sold merchandise for cash $5,610. The cost of the merchandise sold was $4,270. 25 Purchased merchandise from Toolware Inc. for $840, terms 3/10, n/30. 27 Paid Northern Distributors in full, less discount. 29 Made refunds to cash customers for returned merchandise $140. The returned merchandise was returned to inventory and had cost $80. 31 Sold merchandise on account for $1,230, terms n/30. The cost of the merchandise sold was $870. (a) Your answer is partially correct. Record the above transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round answers to the nearest whole dollar, e.g. 5,775.) Date Account Titles and Explanation Debit Credit May 1 Inventory 8100 Accounts Payable Accounts Receivable 4100 Sales (Sale of merchandise on account) Cost of Goods Sold 3090 Inventory (Cost of goods sold recorded) 2 2 8100 4100 3090 5 9 10 11 12 Accounts Payable Inventory Cash Sales Discounts Accounts Receivable Accounts Payable Cash Sales Discounts Supplies Cash Inventory Cash 300 3977 123 7800 820 2650 300 4100 7644 156 820 2650 15 17 19 Inventory Cash 24 24 25 Cash Inventory Inventory Accounts Payable Cash Sales (Sale of merchandise) Cost of Goods Sold Inventory (Cost of goods sold recorded) Inventory 220 2700 230 5610 4270 840 220 2700 230 5610 4270 27 Accounts Payable Cash Sales Discounts Sales Returns and Allowances Cash (Return of merchandise) Inventory Cost of Goods Sold (Return of merchandise, assuming goods are resaleable and returned to inventory) 31 Accounts Receivable Sales (Sale of merchandise) 29 Accounts Payable 29 2700 140 80 1230 840 2646 54 140 80 1230 31 Cost of Goods Sold Inventory (Cost of goods sold recorded) 870 870 (b) Your answer is correct. Post the transactions to T accounts. (Post entries in the order of journal entries presented in the question.) Cash 5/1 Bal. 7644 5/9 820 5/15 2650 5/24 230 2646 140 5/31 Bal. 8100 3977 220 5610 3777 5/10 5/11 5/12 5/19 5/27 5/29 5/2 5/31 5/31 Bal. 5/1 5/12 5/17 5/19 5/25 5/29 5/31 Bal. Accounts Receivable 4100 5/9 1230 1230 Inventory 8100 2650 2700 230 840 80 5640 5/2 5/5 5/10 5/15 5/24 5/27 5/31 4100 3090 300 156 220 4270 54 870 5/11 5/31 Bal. 5/5 5/10 5/27 Supplies 820 820 Accounts Payable 300 5/1 7800 5/17 2700 5/25 5/31 Bal. Common Shares 5/1 Bal. 5/31 Bal. 8100 700 840 840 8100 8100 5/29 5/31 Bal. 5/9 5/31 Bal. Sales 5/2 5/24 5/31 5/31 Bal. Sales Returns and Allowances 140 140 Sales Discounts 123 123 4100 5610 1230 10940 101 5/2 5/24 5/31 5/31 Bal. Cost of Goods Sold 3090 5/29 4270 870 8150 80 Prepare an income statement through gross profit for the month of May 2018. BLUE SPRUCE HARDWARE STORE INC. Income Statement (Partial) Month Ended May 31, 2018 Sales revenues Sales Less V: Sales Returns and Allowances Sales Discounts Net sales Cost of Goods Sold Gross profit 140 i 123 $ $ 10940 10940 263 8150 2650 Calculate the profit margin and the gross profit margin. (Assume operating expenses were $1,470. and income tax expense was $260.) (Round answers to 1 decimal place, e.g. 17.5%.) % Profit margin Gross profit margin %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started