Answered step by step

Verified Expert Solution

Question

1 Approved Answer

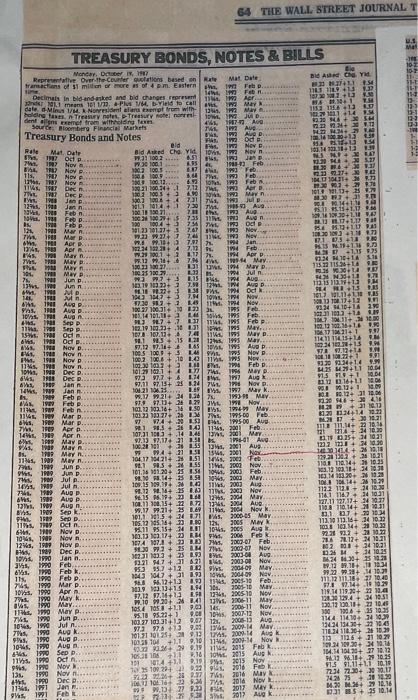

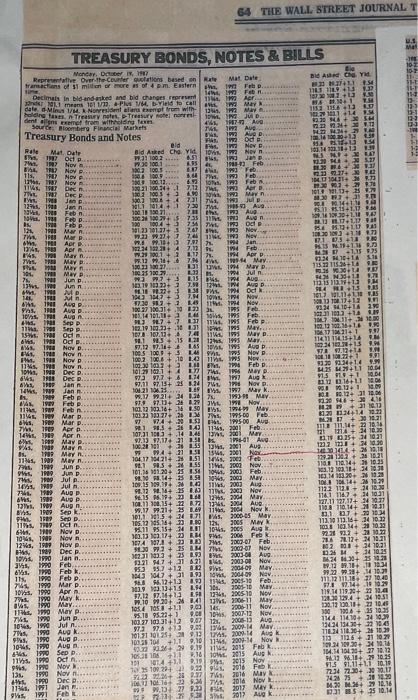

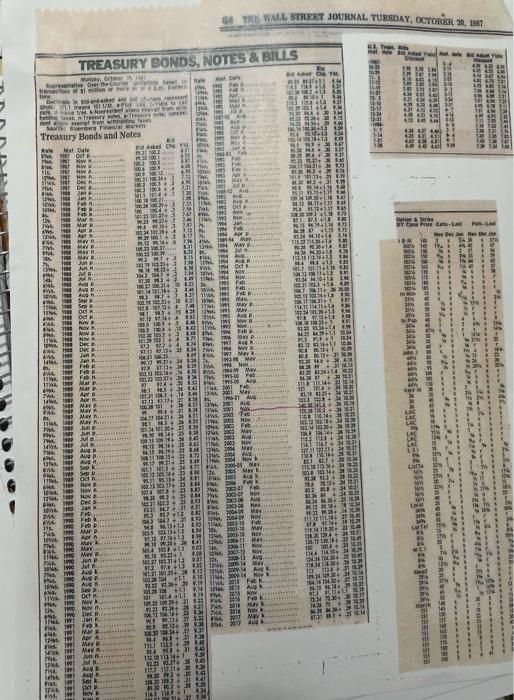

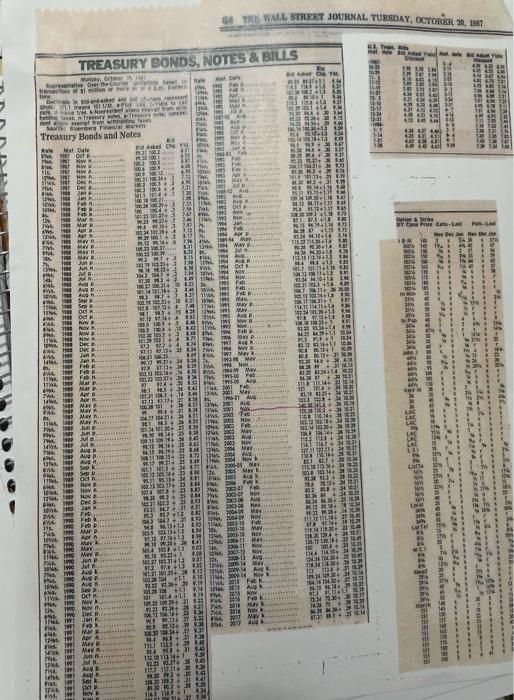

The answer is 1411.24, please explain and show steps how to get this answer. decimals in bid-and-asked and bid changes represent 32nds so for example

The answer is 1411.24, please explain and show steps how to get this answer.

decimals in bid-and-asked and bid changes represent 32nds so for example 101.1 means 101 1/32. the sheet of treasury bonds shows the bond rates bid etc for the years. in this case its asking how much the bond that matures in Nov 2001 would have cost per $1000 face value

*answer is 1411.25

The answer is 1411.25. Please show how this was found and the steps to how the written work could be done. The prices are in 32nds

1. Suppose that someone wanted to buy a $1,000 face value T-bond that matures in November 2001. How much would it have cost on Black Monday? 1. Suppose that someone wanted to buy a $1,000 face value T-bond that matures in November 2001. How much would it have cost on Black Monday? 1. Suppose that someone wanted to buy a $1,000 face value T-bond that matures in November 2001. How much would it have cost on Black Monday? 1. Suppose that someone wanted to buy a $1,000 face value T-bond that matures in November 2001. How much would it have cost on Black Monday

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started