Answered step by step

Verified Expert Solution

Question

1 Approved Answer

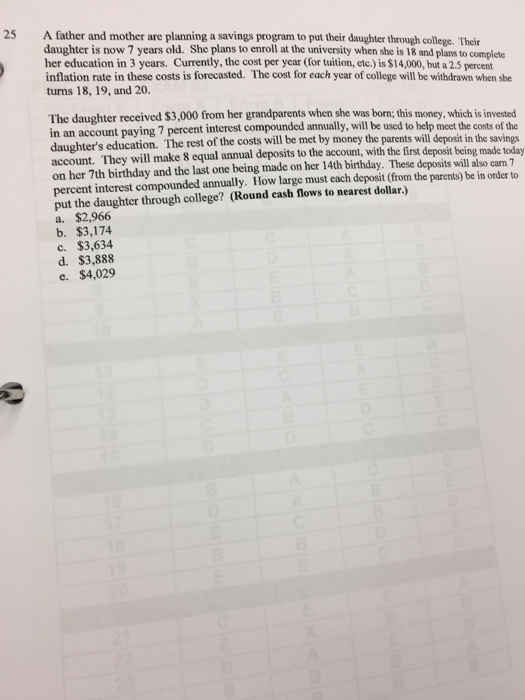

the answer is B but how did they got that answer??? 25 A father and mother are planning a savings program to put their daughter

the answer is B but how did they got that answer???

25 A father and mother are planning a savings program to put their daughter through college. Their daughter is now 7 years old. She plans to enroll at the university when she is 18 and plans to complete her education in 3 years. Currently, the cost per year (for tuition, etc.) is $14,000, but a 2.5 percent inflation rate in these costs is forecasted. The cost for each year of college will be withdrawn when she turns 18, 19, and 20. The daughter received $3,000 from her grandparents when she was born; this money, which is invested in an account paying 7 percent interest compounded annually, will be used to help meet the costs of the daughter's education. The rest of the costs will be met by money the parents will deposit in the savings account. They will make 8 equal annual deposits to the account, with the first deposit being made today on her 7th birthday and the last one being made on her 14th birthday. These deposits will also cam 7 percent interest compounded annually. How large must each deposit (from the parents) be in order to put the daughter through college? (Round cash flows to nearest dollar.) a. $2,966 b. $3,174 c. $3,634 d. $3,888 e. $4,029 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started