Answered step by step

Verified Expert Solution

Question

1 Approved Answer

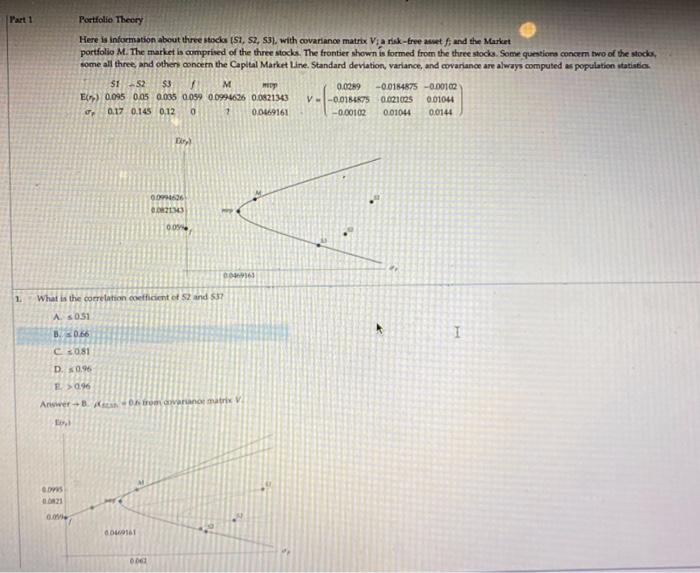

The answer is given, but how do you solve it? Part 1 Portfolio Theory Here is information about the stocks (S1, S2, S3, with covariance

The answer is given, but how do you solve it?

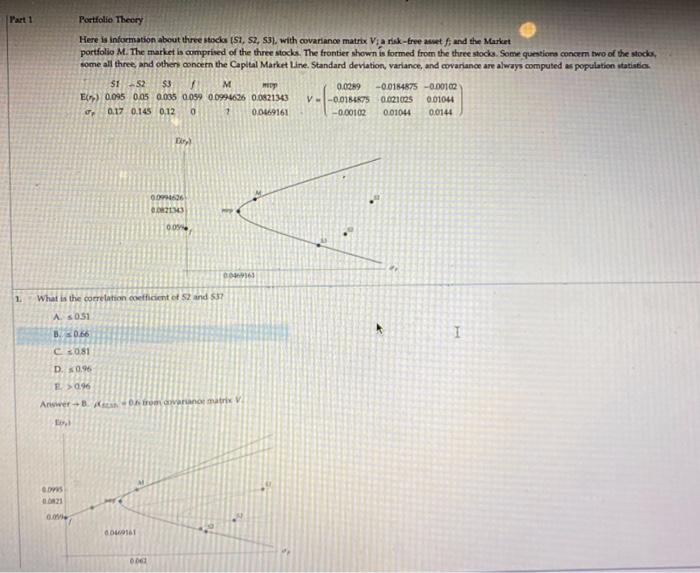

Part 1 Portfolio Theory Here is information about the stocks (S1, S2, S3, with covariance matrix Via risk-Eree asset; and the Market portfolio M. The market is omprised of the three stocks. The frontier shown is formed from the three stocks. Some questions concer two of the stodos, some all three and other concern the Capital Market Line Standard deviation, variance, and covariance are always computed as population statistics S1 -52 $3 M MEDY 0.0019 -0.0154875 -0.00102 E) 0.095 0.05 0.035 0.059 00994626 0.0821343 V-0.0184KTS 0.021025 0.01044 0.17 0.145 0.12 0 00469161 -0.00102 0.01044 0.0144 D 36 2003 007 1 What is the correlation coefficient et 2 and 537 A S 0.51 B120.66 1 C081 D. 0.96 E> Answer Arrangemar V 00121 011

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started