Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The answer is given, what I'm wondering about is the calculation step by step. Please offer details if you can figure it out, otherwise just

The answer is given, what I'm wondering about is the calculation step by step.

Please offer details if you can figure it out, otherwise just skip it.

Thanks in advance

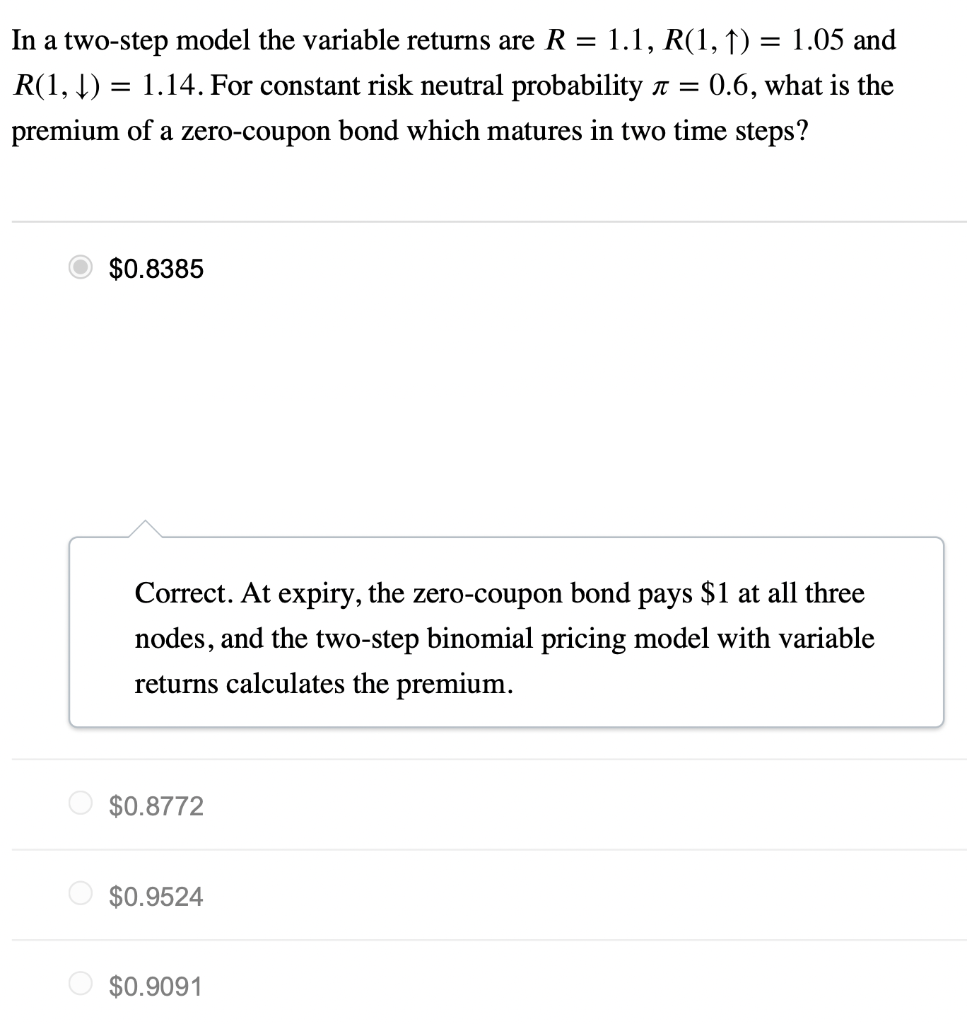

In a two-step model the variable returns are R=1.1,R(1,)=1.05 and R(1,)=1.14. For constant risk neutral probability =0.6, what is the premium of a zero-coupon bond which matures in two time steps? $0.8385 Correct. At expiry, the zero-coupon bond pays $1 at all three nodes, and the two-step binomial pricing model with variable returns calculates the premium. $0.8772 $0.9524 $0.9091 In a two-step model the variable returns are R=1.1,R(1,)=1.05 and R(1,)=1.14. For constant risk neutral probability =0.6, what is the premium of a zero-coupon bond which matures in two time steps? $0.8385 Correct. At expiry, the zero-coupon bond pays $1 at all three nodes, and the two-step binomial pricing model with variable returns calculates the premium. $0.8772 $0.9524 $0.9091Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started