Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the answer is in the second page Prepare a 2018 individual federal income tax return. Use the 2018 forms all entries and calculates must be

the answer is in the second page

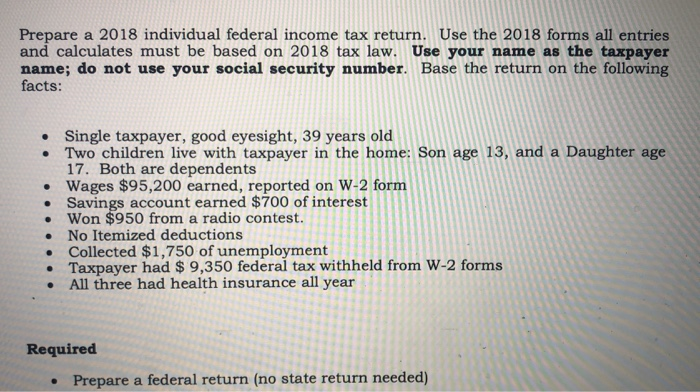

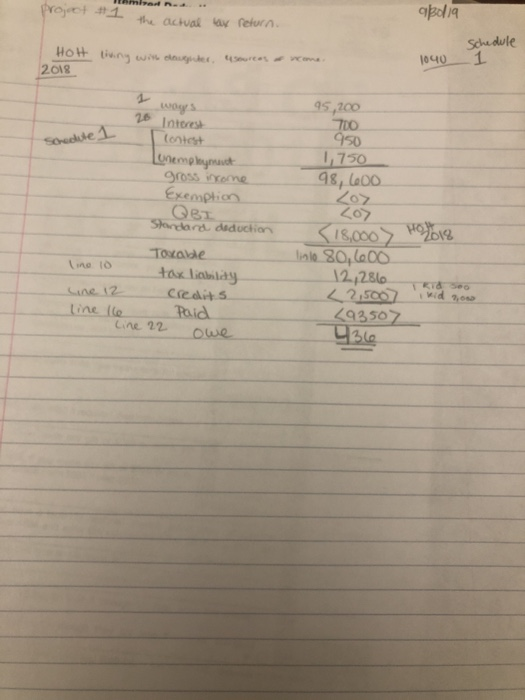

Prepare a 2018 individual federal income tax return. Use the 2018 forms all entries and calculates must be based on 2018 tax law. Use your name as the taxpayer name; do not use your social security number. Base the return on the following facts: Single taxpayer, good eyesight, 39 years old Two children live with taxpayer in the home: Son age 13, and a Daughter age 17. Both are dependents Wages $95,200 earned, reported on W-2 form Savings account earned $700 of interest Won $950 from a radio contest. No Itemized deductions Collected $1,750 of unemployment Taxpayer had $ 9,350 federal tax withheld from W-2 forms All three had health insurance all year Required Prepare a federal return (no state re turn needed) project #1 93019 the actual tax return. Schedule 1 Hol tiny wingerces 1040 2018 ws 16 Interest Schedule 1 95,200 TOO 950 1,750 98,600 Contest Lunemployment gross iyong Exemption QBL Standard deduction Toxade line 10 taxlillay line 12 credits line 16 Paid line 22 owe Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started