The answer is not 39563 or 39564

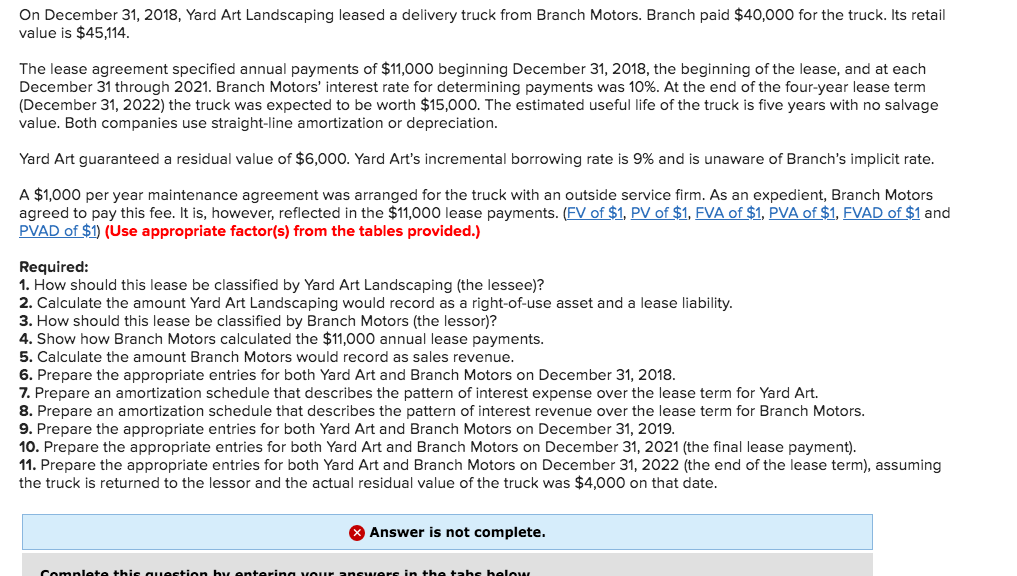

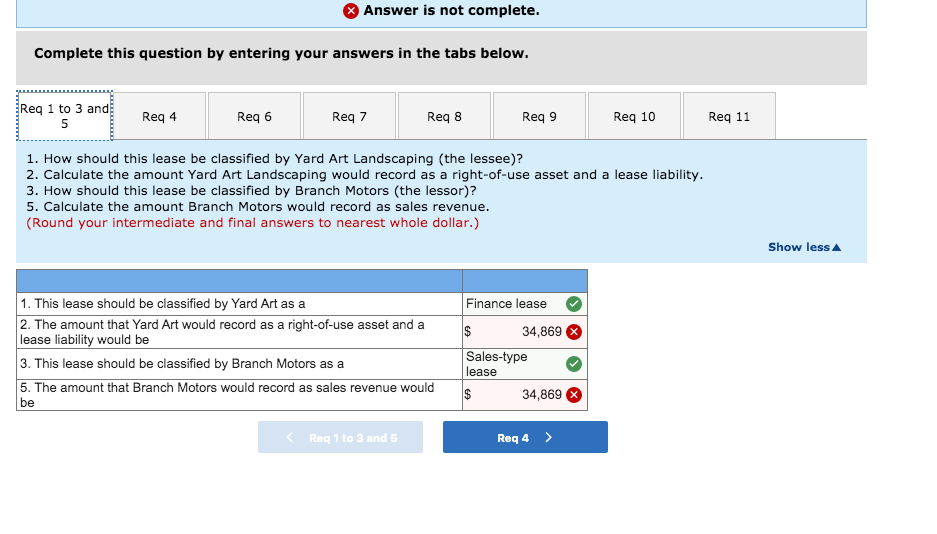

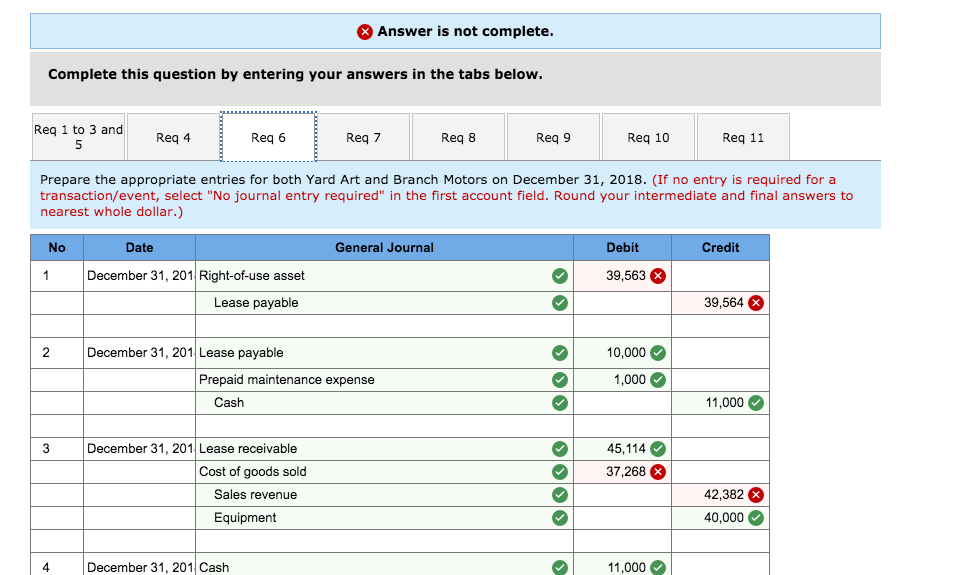

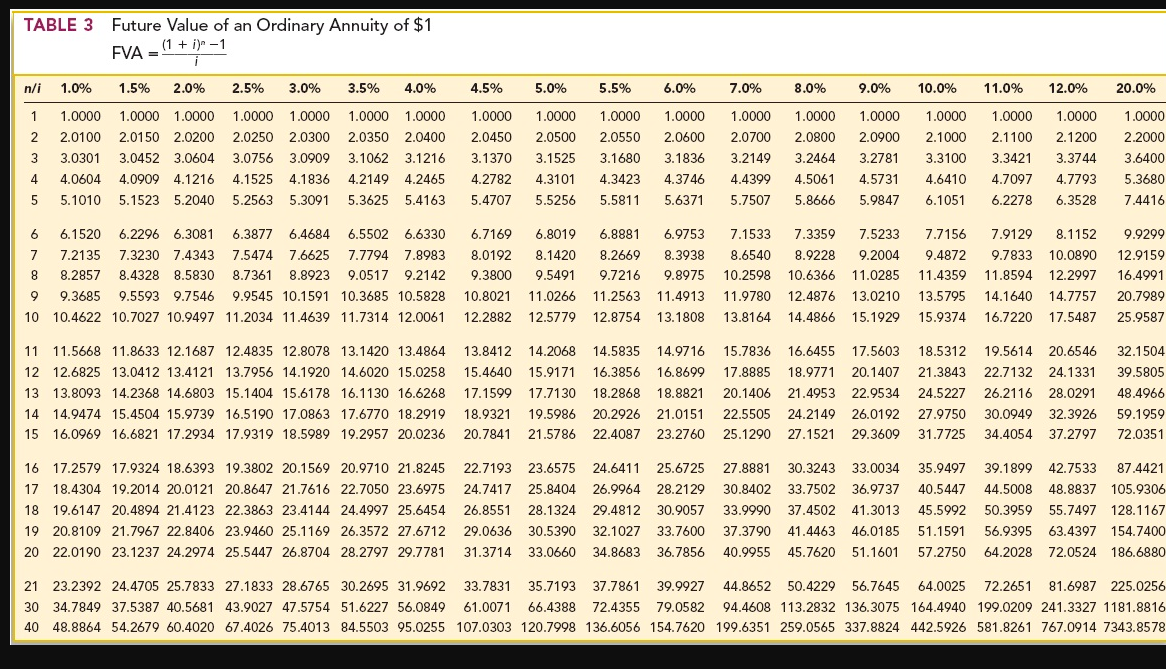

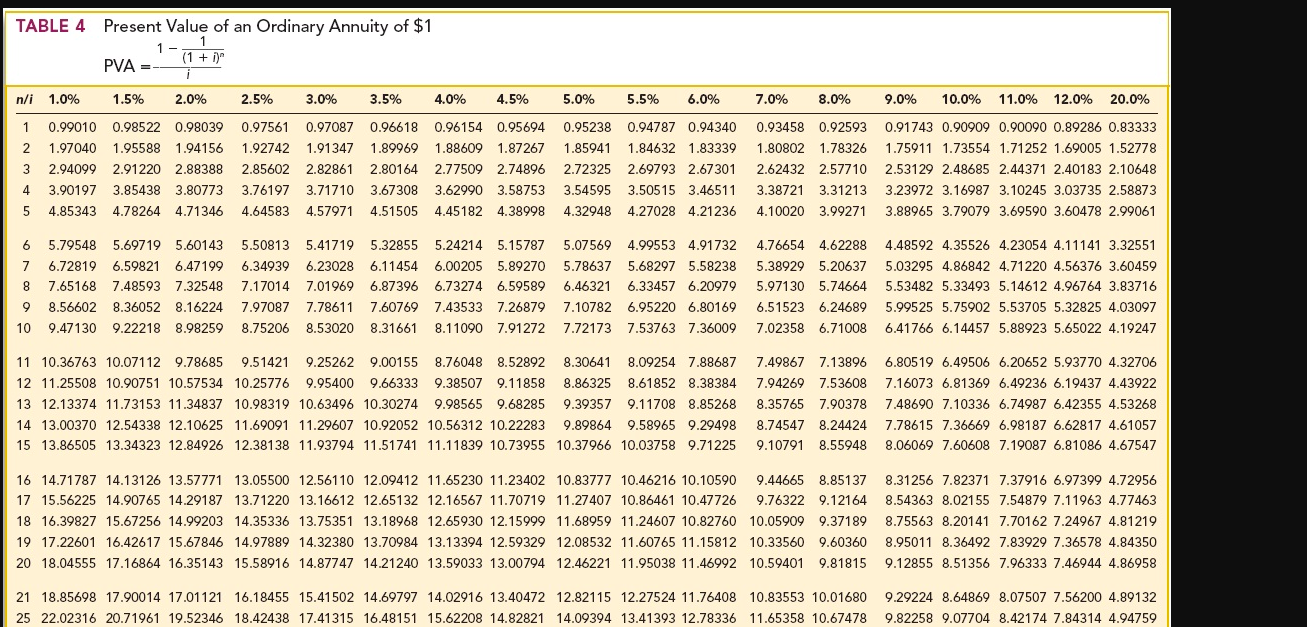

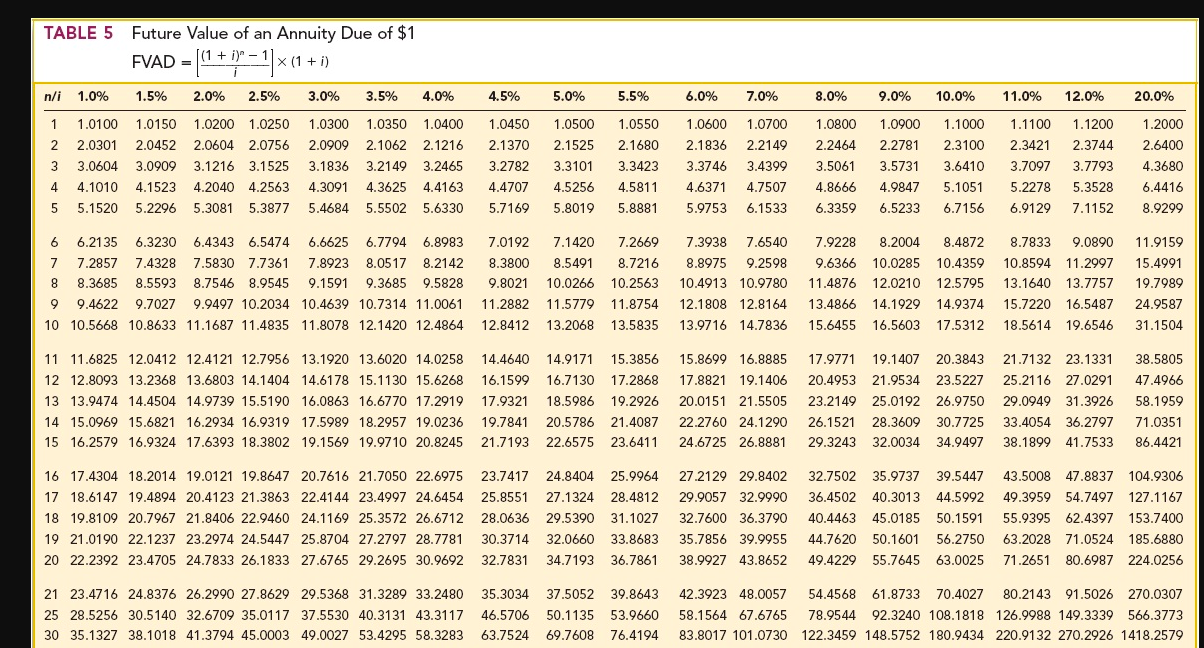

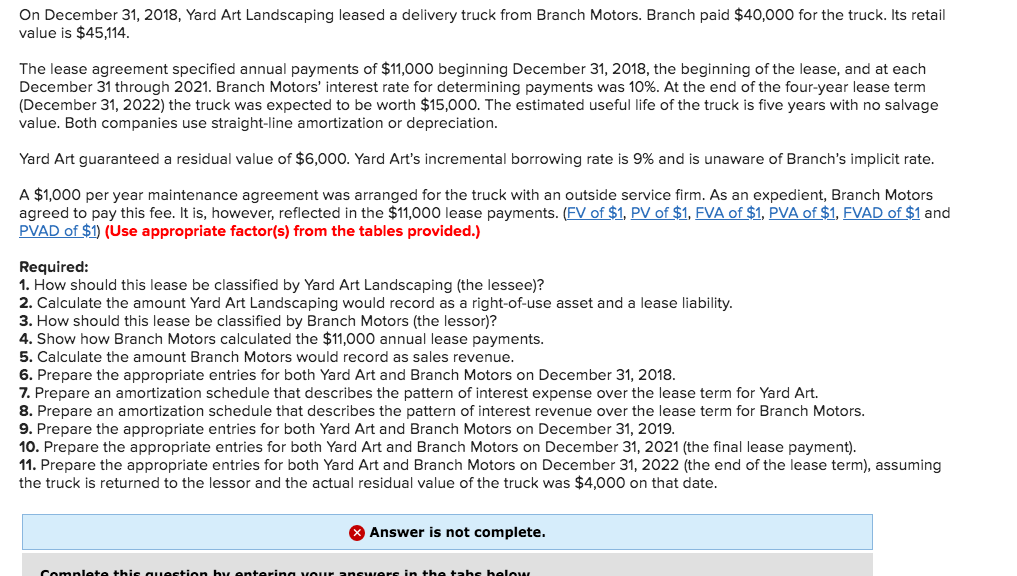

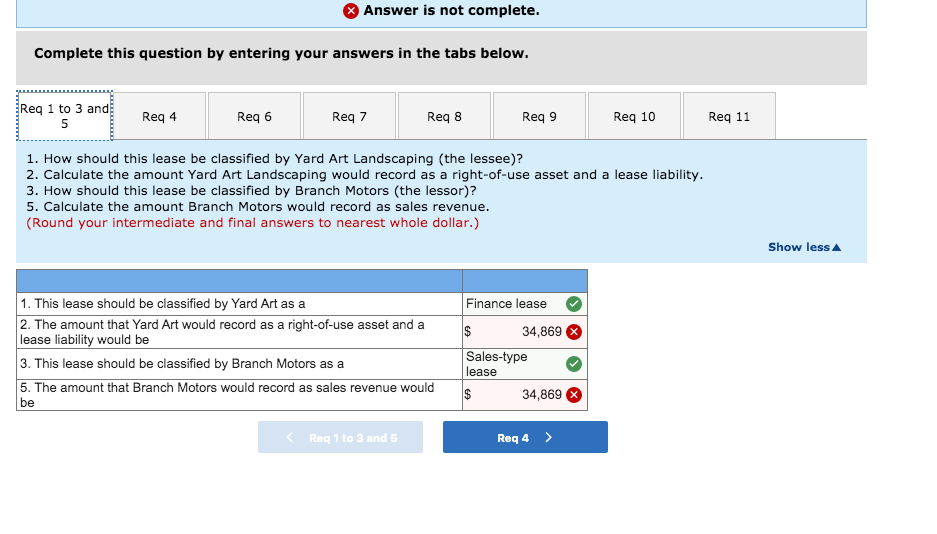

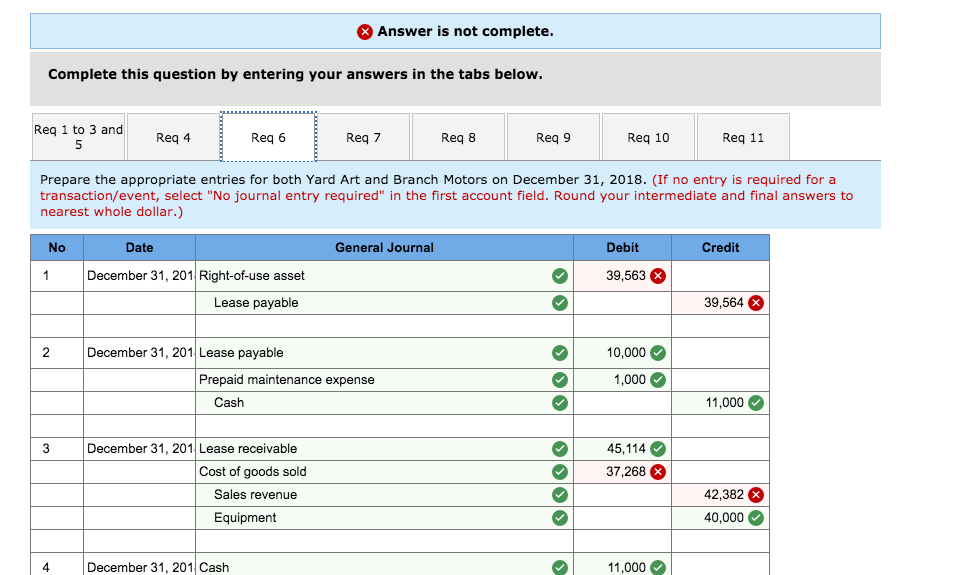

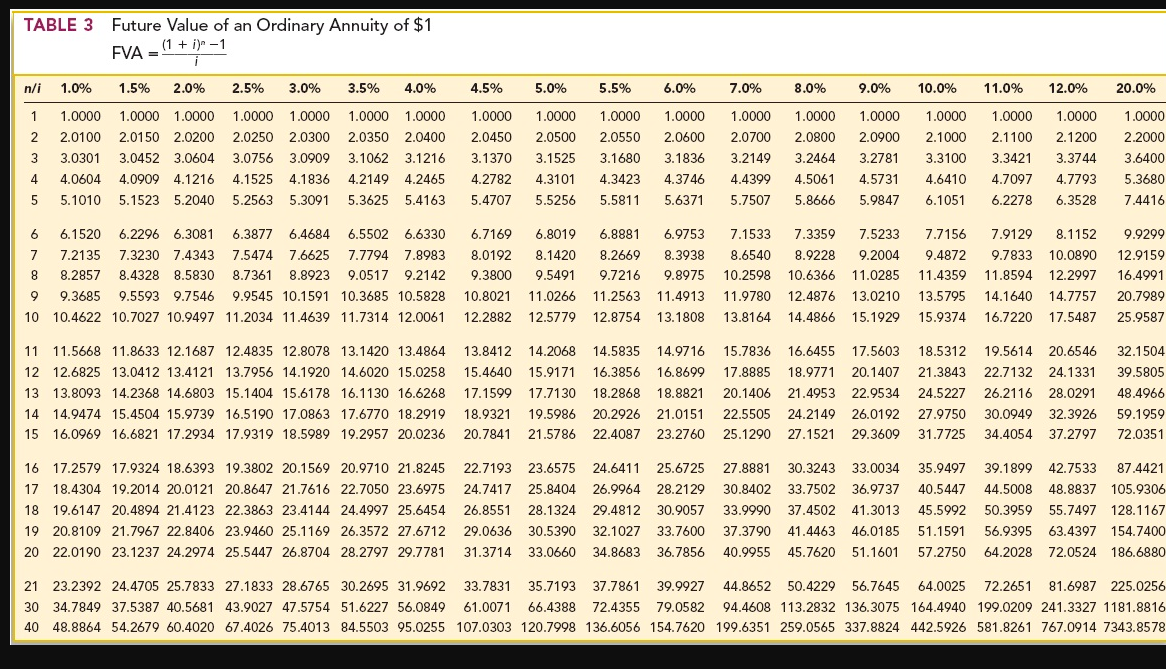

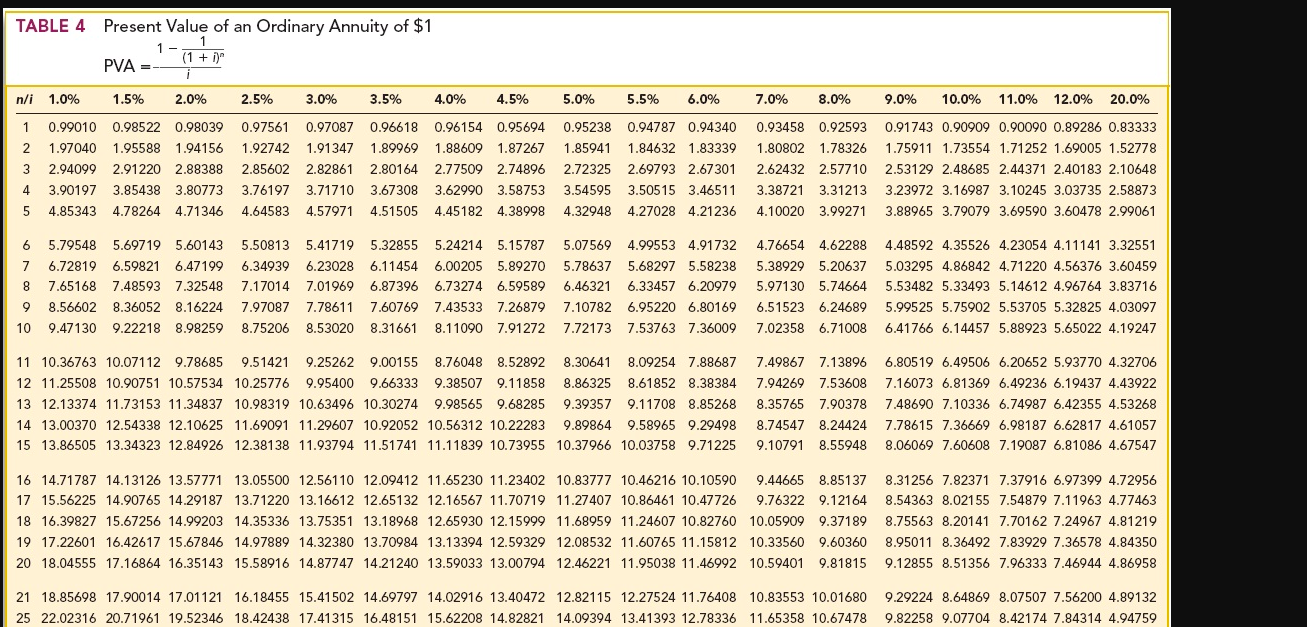

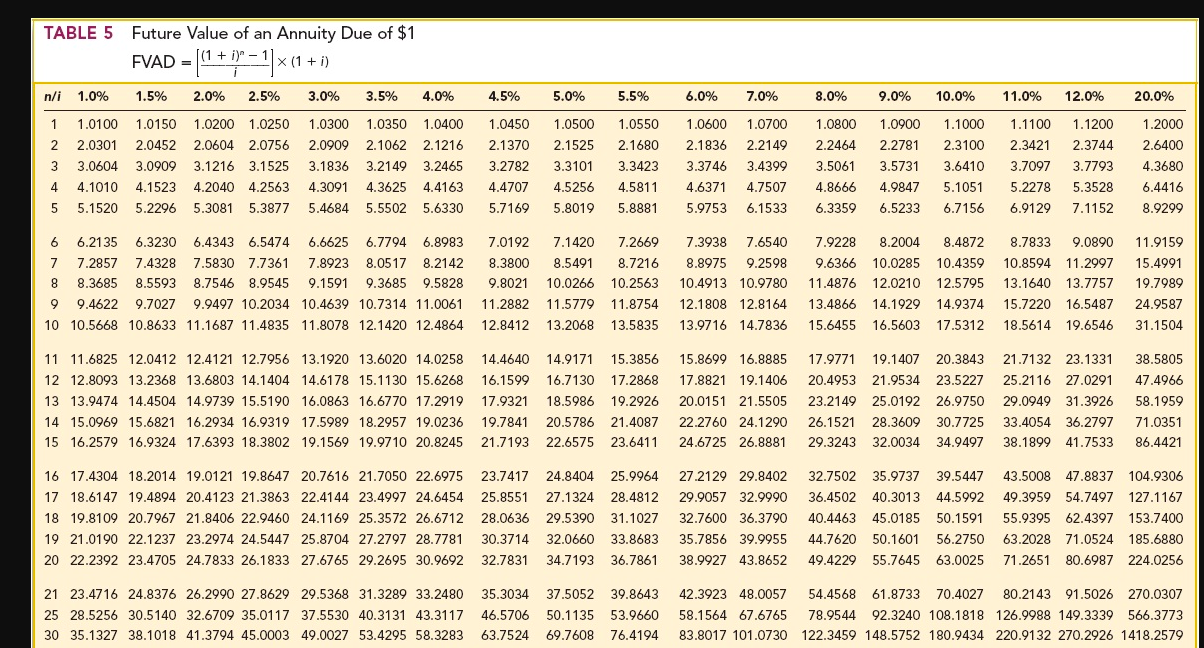

On December 31, 2018, Yard Art Landscaping leased a delivery truck from Branch Motors. Branch paid $40,000 for the truck. Its retail value is $45,114. The lease agreement specified annual payments of $11,000 beginning December 31, 2018, the beginning of the lease, and at each December 31 through 2021. Branch Motors' interest rate for determining payments was 10%. At the end of the four-year lease term (December 31, 2022) the truck was expected to be worth $15,000. The estimated useful life of the truck is five years with no salvage value. Both companies use straight-line amortization or depreciation. Yard Art guaranteed a residual value of $6,000. Yard Art's incremental borrowing rate is 9% and is unaware of Branch's implicit rate. A $1,000 per year maintenance agreement was arranged for the truck with an outside service firm. As an expedient, Branch Motors agreed to pay this fee. It is, however, reflected in the $11,000 lease payments. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. How should this lease be classified by Yard Art Landscaping (the lessee)? 2. Calculate the amount Yard Art Landscaping would record as a right-of-use asset and a lease liability. 3. How should this lease be classified by Branch Motors (the lessor)? 4. Show how Branch Motors calculated the $11,000 annual lease payments. 5. Calculate the amount Branch Motors would record as sales revenue. 6. Prepare the appropriate entries for both Yard Art and Branch Motors on December 31, 2018. 7. Prepare an amortization schedule that describes the pattern of interest expense over the lease term for Yard Art. 8. Prepare an amortization schedule that describes the pattern of interest revenue over the lease term for Branch Motors. 9. Prepare the appropriate entries for both Yard Art and Branch Motors on December 31, 2019 10. Prepare the appropriate entries for both Yard Art and Branch Motors on December 31, 2021 (the final lease payment). 11. Prepare the appropriate entries for both Yard Art and Branch Motors on December 31, 2022 (the end of the lease term), assuming the truck is returned to the lessor and the actual residual value of the truck was $4,000 on that date. Answer is not complete. Comnlete this question by entering your answers in the the below Answer is not complete. Complete this question by entering your answers in the tabs below. Req 1 to 3 and Reg 4 Reg 6 Req 7 Req 8 Req 9 Req 10 Req 11 1. How should this lease be classified by Yard Art Landscaping the lessee)? 2. Calculate the amount Yard Art Landscaping would record as a right-of-use asset and a lease liability. 3. How should this lease be classified by Branch Motors (the lessor)? 5. Calculate the amount Branch Motors would record as sales revenue. (Round your intermediate and final answers to nearest whole dollar.) Show less 1. This lease should be classified by Yard Art as a 2. The amount that Yard Art would record as a right-of-use asset and a lease liability would be 3. This lease should be classified by Branch Motors as a Finance lease 34,869 Sales-type lease 34,869 5. The amount that Branch Motors would record as sales revenue would be Answer is not complete. Complete this question by entering your answers in the tabs below. Req 1 to 3 and Req 4 Req 6 Req 7 Req 8 Req 9 Req 10 Req 11 Prepare the appropriate entries for both Yard Art and Branch Motors on December 31, 2018. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your intermediate and final answers to nearest whole dollar.) General Journal Credit No 1 Date December 31, 201 Right-of-use asset Lease payable Debit 39,563 39,564 2 December 31, 201 Lease payable 10,000 1,000 Prepaid maintenance expense Cash 11,000 3 Decemb 45,114 37,268 December 31, 201 Lease receivable Cost of goods sold Sales revenue Equipment 42,382 40,000 December 31, 201 Cash 11,000 TABLE 2 Present Value of $1 PV = n n/i 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% 7.0% 1 0.99010 0.98522 0.98039 0.97561 0.97087 0.96618 0.96154 0.95694 0.95238 0.94787 0.94340 0.93458 2 0.98030 0.97066 0.96117 0.95181 0.94260 0.93351 0.92456 0.91573 0.90703 0.89845 0.89000 0.87344 3 0.97059 0.95632 0.94232 0.92860 0.91514 0.90194 0.88900 0.87630 0.86384 0.85161 0.83962 0.81630 4 0.96098 0.94218 0.92385 0.90595 0.88849 0.87144 0.85480 0.83856 0.82270 0.80722 0.79209 0.76290 5 0.95147 0.92826 0.90573 0.88385 0.86261 0.84197 0.82193 0.80245 0.78353 0.76513 0.74726 0.71299 8.0% 9.0% 0.0% 0.92593 0.91743 0.90909 0.85734 0.84168 0.82645 0.79383 0.77218 0.75131 0.73503 0.70843 0.68301 0.68058 0.64993 0.62092 11.0% 12.0% 0.90090 0.89286 0.81162 0.79719 0.73119 0.71178 0.65873 0.63552 0.59345 0.56743 20.0% 0.83333 0.69444 0.57870 0.48225 0.40188 6 0.94205 0.91454 0.88797 0.86230 0.83748 0.81350 0.79031 0.76790 0.74622 0.72525 0.70496 0.66634 0.63017 7 0.93272 0.90103 0.87056 0.84127 0.81309 0.78599 0.75992 0.73483 0.71068 0.68744 0.66506 0.62275 0.58349 8 0.92348 0.88771 0.85349 0.82075 0.78941 0.75941 0.73069 0.70319 0.67684 0.65160 0.62741 0.58201 0.54027 9 0.91434 0.87459 0.83676 0.80073 0.76642 0.73373 0.70259 0.67290 0.64461 0.61763 0.59190 0.54393 0.50025 10 0.90529 0.86167 0.82035 0.78120 0.74409 0.70892 0.67556 0.64393 0.61391 0.58543 0.55839 0.50835 0.46319 0.59627 0.56447 0.54703 0.51316 0.50187 0.46651 0.46043 0.42410 0.42241 0.38554 0.53464 0.50663 0.48166 0.45235 0.43393 0.40388 0.39092 0.36061 0.35218 0.32197 0.33490 0.27908 0.23257 0.19381 0.16151 11 0.89632 0.84893 0.80426 0.76214 0.72242 0.68495 0.64958 0.61620 0.58468 0.55491 0.52679 12 0.88745 0.83639 0.78849 0.74356 0.70138 0.66178 0.62460 0.58966 0.55684 0.52598 0.49697 13 0.87866 0.82403 0.77303 0.72542 0.68095 0.63940 0.60057 0.56427 0.53032 0.49856 0.46884 14 0.86996 0.81185 0.75788 0.70773 0.66112 0.61778 0.57748 0.53997 0.50507 0.47257 0.44230 15 0.86135 0.79985 0.74301 0.69047 0.64186 0.59689 0.55526 0.51672 0.48102 0.44793 0.41727 0.47509 0.44401 0.41496 0.38782 0.36245 0.42888 0.39711 0.36770 0.34046 0.31524 0.38753 0.35049 0.35553 0.31863 0.32618 0.28966 0.29925 0.26333 0.27454 0.23939 0.31728 0.28748 0.28584 0.25668 0.25751 0.22917 0.23199 0.20462 0.20900 0.18270 0.13459 0.11216 0.09346 0.07789 0.06491 16 0.85282 0.78803 0.72845 0.67362 0.62317 0.57671 0.53391 0.49447 0.45811 0.42458 17 0.84438 0.77639 0.71416 0.65720 0.60502 0.55720 0.51337 0.47318 0.43630 0.40245 18 0.83602 0.76491 0.70016 0.64117 0.58739 0.53836 0.49363 0.45280 0.41552 0.38147 19 0.82774 0.75361 0.68643 0.62553 0.57029 0.52016 0.47464 0.43330 0.39573 0.36158 20 0.81954 0.74247 0.67297 0.61027 0.55368 0.50257 0.45639 0.41464 0.37689 0.34273 0.39365 0.33873 0.37136 0.31657 0.35034 0.29586 0.33051 0.27651 0.31180 0.25842 0.29189 0.27027 0.25025 0.23171 0.21455 0.25187 0.21763 0.23107 0.19784 0.21199 0.17986 0.19449 0.16351 0.17843 0.14864 0.18829 0.16312 0.16963 0.14564 0.15282 0.13004 0.13768 0.11611 0.12403 0.10367 0.05409 0.04507 0.03756 0.03130 0.02608 21 0.81143 0.73150 0.65978 0.59539 0.53755 0.48557 0.43883 0.39679 0.35894 0.32486 0.29416 0.24151 24 0.78757 0.69954 0.62172 0.55288 0.49193 0.43796 0.39012 0.34770 0.31007 0.27666 0.24698 0.19715 25 0.77977 0.68921 0.60953 0.53939 0.47761 0.42315 0.37512 0.33273 0.29530 0.26223 0.23300 0.18425 28 0.75684 0.65910 0.57437 0.50088 0.43708 0.38165 0.33348 0.29157 0.25509 0.22332 0.19563 0.15040 29 0.74934 0.64936 0.56311 0.48866 0.42435 0.36875 0.32065 0.27902 0.24295 0.21168 0.18456 0.14056 0.19866 0.15770 0.14602 0.11591 0.10733 0.16370 0.13513 0.126400.10153 0.11597 0.09230 0.08955 0.06934 0.08215 0.06304 0.11174 0.09256 0.08170 0.06588 0.07361 0.05882 0.05382 0.04187 0.04849 0.03738 0.02174 0.01258 0.01048 0.00607 0.00506 30 0.74192 0.63976 0.55207 0.47674 0.41199 0.35628 0.30832 0.26700 0.23138 0.20064 0.17411 0.13137 0.09938 0.07537 0.05731 0.04368 0.03338 0.00421 TABLE 3 Future Value of an Ordinary Annuity of $1 FVA - (1 + i) - 1 n/i 1 2 3 4 5 1.0% 1.0000 2.0100 3.0301 4.0604 5.1010 1.5% 2.0% 1.0000 1.0000 2.0150 2.0200 3.0452 3.0604 4.0909 4.1216 5.1523 5.2040 2.5% 3.0% 1.0000 1.0000 2.0250 2.0300 3.0756 3.0909 4.1525 4.1836 5.2563 5.3091 3.5% 1.0000 2.0350 3.1062 4.2149 5.3625 4.0% 1.0000 2.0400 3.1216 4.2465 5.4163 4.5% 1.0000 2.0450 3.1370 4.2782 5.4707 5.0% 1.0000 2.0500 3.1525 4.3101 5.5256 5.5% 1.0000 2.0550 3.1680 4.3423 5.5811 6.0% 1.0000 2.0600 3.1836 4.3746 5.6371 7.0% 8.0% 1.0000 1.0000 2.0700 2.0800 3.21493.2464 4.4399 4.5061 5.7507 5.8666 9.0% 1.0000 2.0900 3.2781 4.5731 5.9847 10.0% 1.0000 2.1000 3.3100 4.6410 6.1051 11.0% 1.0000 2.1100 3.3421 4.7097 6.2278 12.0% 1.0000 2.1200 3.3744 4.7793 6.3528 20.0% 1.0000 2.2000 3.6400 5.3680 7.4416 6 7 8 9 10 6.1520 6.2296 6.3081 6.3877 6.4684 6.5502 6.6330 7.2135 7.3230 7.4343 7.5474 7.6625 7.7794 7.8983 8.2857 8.4328 8.5830 8.7361 8.8923 9.0517 9.2142 9.3685 9.5593 9.7546 9.9545 10.1591 10.3685 10.5828 10.4622 10.7027 10.9497 11.2034 11.4639 11.7314 12.0061 6.7169 8.0192 9.3800 10.8021 12.2882 6.80196.8881 6.9753 8.1420 8.26698.3938 9.5491 9.7216 9.8975 11.0266 11.2563 11.4913 12.5779 12.8754 13.1808 7.1533 8.6540 10.2598 11.9780 13.8164 7.33597.5233 8.9228 9.2004 10.6366 11.0285 12.4876 13.0210 14.4866 15.1929 7.7156 9.4872 11.4359 13.5795 15.9374 7.9129 9.7833 11.8594 14.1640 16.7220 8.11529.9299 10.0890 12.9159 12.2997 16.4991 14.7757 20.7989 17.5487 25.9587 11 11.5668 11.8633 12.1687 12.4835 12.8078 13.1420 13.4864 12 12.6825 13.0412 13.4121 13.7956 14.1920 14.6020 15.0258 13 13.8093 14.2368 14.6803 15.1404 15.6178 16.1130 16.6268 14 14.9474 15.4504 15.9739 16.5190 17.0863 17.6770 18.2919 15 16.0969 16.6821 17.2934 17.9319 18.5989 19.2957 20.0236 13.8412 14.2068 15.4640 15.9171 17.1599 17.7130 18.9321 19.5986 20.7841 21.5786 14.5835 14.9716 16.3856 16.8699 18.2868 18.8821 20.2926 21.0151 22.4087 23.2760 15.7836 17.8885 20.1406 22.5505 25.1290 16.6455 17.5603 18.5312 18.9771 20.1407 21.3843 21.4953 22.9534 24.5227 24.2149 26.0192 27.9750 27.1521 29.3609 31.7725 19.5614 22.7132 26.2116 30.0949 34.4054 20.6546 32.1504 24.1331 39.5805 28.029148.4966 32.3926 59.1959 37.2797 72.0351 16 17.2579 17.9324 18.6393 19.3802 20.1569 20.9710 21.8245 17 18.4304 19.2014 20.0121 20.8647 21.7616 22.7050 23.6975 18 19.6147 20.4894 21.4123 22.3863 23.4144 24.4997 25.6454 19 20.8109 21.7967 22.8406 23.9460 25.1169 26.3572 27.6712 20 22.0190 23.1237 24.2974 25.5447 26.8704 28.2797 29.7781 22.7193 24.7417 26.8551 29.0636 31.3714 23.6575 25.8404 28.1324 30.5390 33.0660 24.6411 25.6725 26.9964 28.2129 29.4812 30.9057 32.1027 33.7600 34.8683 36.7856 27.8881 30.3243 33.0034 35.9497 30.8402 33.7502 36.9737 40.5447 33.9990 37.4502 41.3013 45.5992 37.3790 41.4463 46.0185 51.1591 40.9955 45.7620 51.1601 57.2750 39.1899 42.7533 87.4421 44.5008 48.8837 105.9306 50.3959 55.7497 128.1167 56.9395 63.4397 154.7400 64.2028 72.0524 186.6880 21 23.2392 24.4705 25.7833 27.1833 28.6765 30.2695 31.9692 33.7831 35.7193 37.7861 39.9927 44.8652 50.4229 56.7645 64.0025 72.2651 81.6987 225.0256 30 34.7849 37.5387 40.5681 43.9027 47.5754 51.6227 56.084961.0071 66.4388 72.4355 79.0582 94.4608 113.2832 136.3075 164.4940 199.0209 241.3327 1181.8816 40 48.8864 54.2679 60.4020 67.4026 75.4013 84.5503 95.0255 107.0303 120.7998 136.6056 154.7620 199.6351 259.0565 337.8824 442.5926 581.8261 767.0914 7343.8578 TABLE4 Present Value of an Ordinary Annuity of $1 1 (1 + i) PVA =-- n/i 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 1 0.99010 0.98522 0.98039 0.97561 0.97087 0.96618 0.96154 0.95694 2 1.97040 1.95588 1.94156 1.92742 1.91347 1.899691.88609 1.87267 3 2.94099 2.91220 2.88388 2.85602 2.82861 2.80164 2.77509 2.74896 4 3.90197 3.85438 3.80773 3.76197 3.71710 3.67308 3.62990 3.58753 5 4.853434.78264 4.71346 4.64583 4.57971 4.51505 4.45182 4.38998 5.0% 0.95238 1.85941 2.72325 3.54595 4.32948 5.5% 6.0% 0.94787 0.94340 1.84632 1.83339 2.69793 2.67301 3.50515 3.46511 4.27028 4.21236 7.0% 8.0% 0.93458 0.92593 1.80802 1.78326 2.62432 2.57710 3.38721 3.31213 4.10020 3.99271 0.0% 0.0% 11.0% 12.0% 20.0% 0.91743 0.90909 0.90090 0.89286 0.83333 1.75911 1.73554 1.71252 1.69005 1.52778 2.53129 2.48685 2.44371 2.40183 2.10648 3.23972 3.16987 3.10245 3.03735 2.58873 3.88965 3.79079 3.69590 3.60478 2.99061 6 7 8 9 10 5.79548 6.72819 7.65168 8.56602 9.47130 5.69719 5.60143 6.59821 6.47199 7.48593 7.32548 8.36052 8.16224 9.22218 8.98259 5.50813 6.34939 7.17014 7.97087 8.75206 5.41719 6.23028 7.01969 7.78611 8.53020 5.32855 5.24214 5.15787 6.11454 6.00205 5.89270 6.87396 6.73274 6.59589 7.60769 7.435337 .26879 8.31661 8.11090 7.91272 5.07569 4.99553 4.91732 5.78637 5.68297 5.58238 6.46321 6.33457 6.20979 7.10782 6.95220 6.80169 7.72173 7.53763 7.36009 4.76654 4.62288 5.38929 5.20637 5.97130 5.74664 6.51523 6.24689 7.02358 6.71008 4.48592 4.35526 4.23054 4.11141 3.32551 5.03295 4.86842 4.71220 4.56376 3.60459 5.53482 5.33493 5.14612 4.96764 3.83716 5.99525 5.75902 5.53705 5.32825 4.03097 6.41766 6.14457 5.88923 5.65022 4.19247 11 10.36763 10.07112 9.78685 9.51421 9.25262 9.00155 8.76048 8.52892 8.30641 8.09254 7.88687 12 11.25508 10.90751 10.57534 10.25776 9.95400 9.66333 9.38507 9.11858 8.86325 8.61852 8.38384 13 12.13374 11.73153 11.34837 10.98319 10.63496 10.30274 9.98565 9.68285 9.39357 9.11708 8.85268 14 13.00370 12.54338 12.10625 11.69091 11.29607 10.92052 10.56312 10.22283 9.89864 9.589659.29498 15 13.86505 13.34323 12.84926 12.38138 11.93794 11.51741 11.11839 10.73955 10.37966 10.03758 9.71225 7.49867 7.13896 7.94269 7.53608 8.35765 7.90378 8.74547 8.24424 9.10791 8.55948 6.80519 6.49506 6.20652 5.93770 4.32706 7.16073 6.81369 6.49236 6.19437 4.43922 7.48690 7.10336 6.74987 6.42355 4.53268 7.78615 7.36669 6.98187 6.62817 4.61057 8.06069 7.60608 7.19087 6.81086 4.67547 16 14.71787 14.13126 13.57771 13.05500 12.56110 12.09412 11.65230 11.23402 10.83777 10.46216 10.10590 9.44665 17 15.56225 14.90765 14.29187 13.71220 13.16612 12.65132 12.16567 11.70719 11.27407 10.86461 10.47726 9.76322 18 16.39827 15.67256 14.99203 14.35336 13.75351 13.18968 12.65930 12.15999 11.68959 11.24607 10.82760 10.05909 19 17.22601 16.42617 15.67846 14.97889 14.32380 13.70984 13.13394 12.59329 12.08532 11.60765 11.15812 10.33560 20 18.04555 17.16864 16.35143 15.58916 14.87747 14.21240 13.59033 13.00794 12.46221 11.95038 11.46992 10.59401 8.85137 9.12164 9.37189 9.60360 9.81815 8.31256 7.82371 7.37916 6.97399 4.72956 8.54363 8.02155 7.54879 7.11963 4.77463 8.75563 8.20141 7.70162 7.24967 4.81219 8.95011 8.36492 7.83929 7.36578 4.84350 9.12855 8.51356 7.96333 7.46944 4.86958 21 18.85698 17.90014 17.01121 16.18455 15.41502 14.69797 14.02916 13.40472 12.82115 12.27524 11.76408 10.83553 10.01680 25 22.02316 20.71961 19.52346 18.42438 17.41315 16.48151 15.62208 14.82821 14.09394 13.41393 12.78336 11.65358 10.67478 9.29224 8.64869 8.07507 7.56200 4.89132 9.82258 9.07704 8.42174 7.84314 4.94759 TABLE 5 Future Value of an Annuity Due of $1 FVAD = (1 + i)" 1 x (1 + i) n/i 1 2 3 4 5 1.0% 1.0100 2.0301 3.0604 4.1010 5.1520 1.5% 1.0150 2.0452 3.0909 4.1523 5.2296 2.0% 2.5% 1.0200 1.0250 2.0604 2.0756 3.1216 3.1525 4.2040 4.2563 5.3081 5.3877 3.0% 3.5% 1.0300 1.0350 2.0909 2.1062 3.1836 3.2149 4.30914.3625 5.4684 5.5502 4.0% 4.5% 1.04001.0450 2.1216 2.1370 3.2465 3.2782 4.4163 4.4707 5.63305.7169 5.0% 1.0500 2.1525 3.3101 4.5256 5.8019 5.5% 1.0550 2.1680 3.3423 4.5811 5.8881 6.0% 1.0600 2.1836 3.3746 4.6371 5.9753 7.0% 8.0% 0.0% 10700 1.0800 1.0900 2.2149 2.2464 2.2781 3.4399 3.5061 3.5731 4.7507 4.8666 4.9847 6.15336.33596.5233 0.0% 1.1000 2.3100 3.6410 5.1051 6.7156 11.0% 1.1100 2.3421 3.7097 5.2278 6.9129 12.0% 1.1200 2.3744 3.7793 5.3528 7.1152 20.0% 1.2000 2.6400 4.3680 6.4416 8.9299 6 6.2135 6.3230 6.4343 6.5474 6.6625 6.7794 6.89837.0192 7 7.2857 7.4328 7.5830 7.7361 7.8923 8.0517 8.2142 8.3800 8 8.3685 8.5593 8.7546 8.9545 9.1591 9.3685 9.5828 9.8021 9 9.4622 9.7027 9.9497 10.2034 10.4639 10.7314 11.0061 11.2882 10 10.5668 10.8633 11.1687 11.4835 11.8078 12. 1420 12.4864 12.8412 7.1420 7.26697.3938 7.65407.9228 8.5491 8.7216 8.8975 9.2598 9.6366 10.0266 10.2563 10.4913 10.9780 11.4876 11.5779 11.8754 12.1808 12.8164 13.4866 13.2068 13.5835 13.9716 14.7836 15.6455 8.2004 8.4872 10.0285 10.4359 12.0210 12.5795 14.1929 14.9374 16.5603 17.5312 8.7833 9.0890 10.8594 11.2997 13.1640 13.7757 15.7220 16.5487 18.5614 19.6546 11.9159 15.4991 19.7989 24.9587 31.1504 11 11.6825 12.0412 12.4121 12.7956 13.1920 13.6020 14.0258 12 12.8093 13.2368 13.6803 14.1404 14.6178 15.1130 15.6268 13 13.9474 14.4504 14.9739 15.5190 16.0863 16.6770 17.2919 14 15.0969 15.6821 16.2934 16.9319 17.5989 18.2957 19.0236 15 16.2579 16.9324 17.6393 18.3802 19.1569 19.9710 20.8245 14.4640 14.9171 15.3856 16.1599 16.7130 17.2868 17.9321 18.5986 19.2926 19.7841 20.5786 21.4087 21.7193 22.6575 23.6411 15.8699 16.8885 17.8821 19.1406 20.0151 21.5505 22.2760 24.1290 24.6725 26.8881 17.9771 19.1407 20.4953 21.9534 23.2149 25.0192 26.1521 28.3609 29.3243 32.0034 20.3843 23.5227 26.9750 30.7725 34.9497 21.7132 23.1331 25.2116 27.0291 29.0949 31.3926 33.4054 36.2797 38.1899 41.7533 38.5805 47.4966 58.1959 71.0351 86.4421 16 17.4304 18.2014 19.0121 19.8647 20.7616 21.7050 22.6975 17 18.6147 19.4894 20.4123 21.3863 22.4144 23.4997 24.6454 18 19.8109 20.7967 21.8406 22.9460 24.1169 25.3572 26.6712 19 21.0190 22.1237 23.2974 24.5447 25.8704 27.2797 28.7781 20 22.2392 23.4705 24.7833 26.1833 27.6765 29.2695 30.9692 23.7417 24.8404 25.9964 27.2129 29.8402 25.8551 27.1324 28.481229.9057 32.9990 28.0636 29.5390 31.1027 32.7600 36.3790 30.3714 32.0660 33.8683 35.7856 39.9955 32.7831 34.7193 36.7861 38.9927 43.8652 32.7502 35.9737 39.5447 43.5008 47.8837 104.9306 36.4502 40.3013 44.5992 49.3959 54.7497 127.1167 40.4463 45.0185 50.1591 55.9395 62.4397 153.7400 44.7620 50.1601 56.2750 63.2028 71.0524 185.6880 49.4229 55.7645 63.0025 71.2651 80.6987 224.0256 21 23.4716 24.8376 26.2990 27.8629 29.5368 31.3289 33.2480 25 28.5256 30.5140 32.6709 35.0117 37.5530 40.3131 43.3117 30 35.1327 38.1018 41.3794 45.0003 49.0027 53.4295 58.3283 35.3034 46.5706 63.7524 37.5052 39.8643 50.1135 53.9660 69.7608 76.4194 42.3923 48.0057 54.4568 61.8733 70.4027 80.2143 91.5026 270.0307 58.1564 67.6765 78.9544 92.3240 108.1818 126.9988 149.3339 566.3773 83.8017 101.0730 122.3459 148.5752 180.9434 220.9132 270.2926 1418.2579