Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the answer is not 8,400,000 340,000 80,000 3,410,000 please provide a valid answer Hominy, Inc., has debt outstanding with a face value of $6 million.

the answer is not

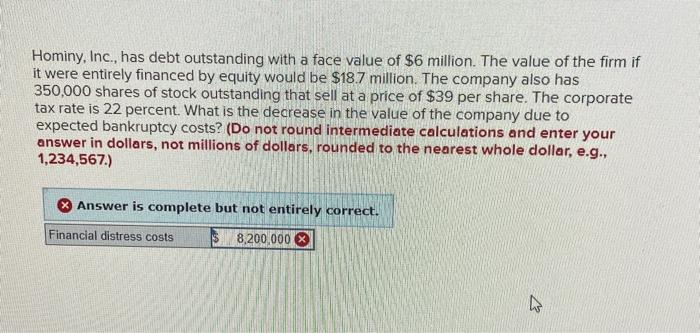

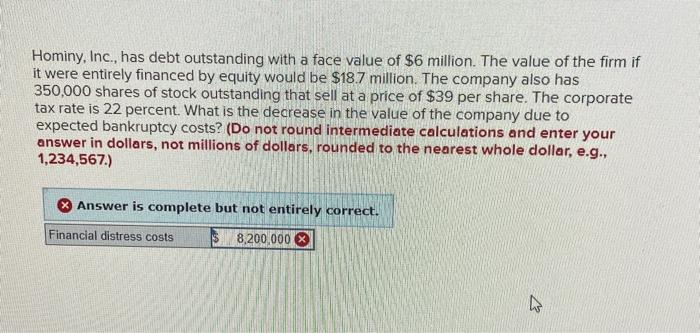

Hominy, Inc., has debt outstanding with a face value of $6 million. The value of the firm if it were entirely financed by equity would be $18.7 million. The company also has 350,000 shares of stock outstanding that sell at a price of $39 per share. The corporate tax rate is 22 percent. What is the decrease in the value of the company due to expected bankruptcy costs? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole dollar, e.g., 1,234,567. Answer is complete but not entirely correct. Hominy, Inc., has debt outstanding with a face value of $6 million. The value of the firm if it were entirely financed by equity would be $18.7 million. The company also has 350,000 shares of stock outstanding that sell at a price of $39 per share. The corporate tax rate is 22 percent. What is the decrease in the value of the company due to expected bankruptcy costs? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole dollar, e.g., 1,234,567. Answer is complete but not entirely correct 8,400,000

340,000

80,000

3,410,000

please provide a valid answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started