Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The answer is on the image, but I don't understand how to get to the answer step-by-step. Please help me Janet is a physician with

The answer is on the image, but I don't understand how to get to the answer step-by-step. Please help me

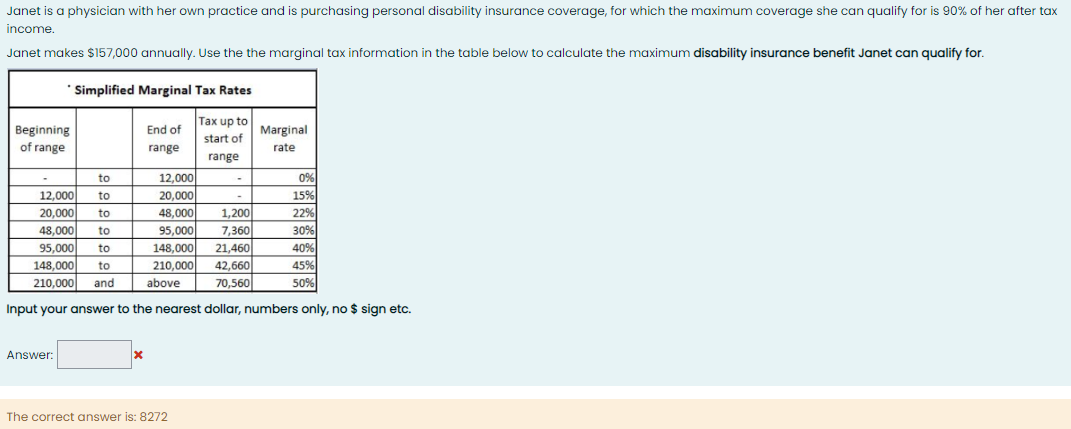

Janet is a physician with her own practice and is purchasing personal disability insurance coverage, for which the maximum coverage she can qualify for is 90% of her after tax income. Janet makes $157,000 annually. Use the the marginal tax information in the table below to calculate the maximum disability insurance benefit Janet can qualify for. *Simplified Marginal Tax Rates End of Tax up to start of Beginning of range Marginal range rate range to 12,000 0% 20,000 15% 48,000 1.200 22% 12,000 to 20,000 to 48,000 to 95,000 to 148,000 to 95,000 7,360 30% 40% 148,000 21,460 210,000 42,660 above 45% 210,000 and 70,560 50% Input your answer to the nearest dollar, numbers only, no $ sign etc. Answer: X The correct answer is: 8272Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started