Answered step by step

Verified Expert Solution

Question

1 Approved Answer

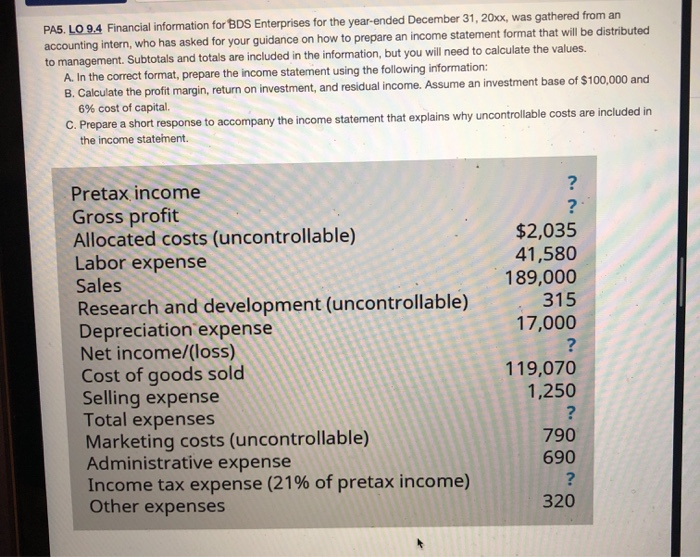

the answer is supposed to be in schedule format PAS. LO 9.4 Financial information for BDS Enterprises for the year-ended December 31, 20xx, was gathered

the answer is supposed to be in schedule format

PAS. LO 9.4 Financial information for BDS Enterprises for the year-ended December 31, 20xx, was gathered from an accounting intern, who has asked for your guidance on how to prepare an income statement format that will be distributed to management. Subtotals and totals are included in the information, but you will need to calculate the values. A. In the correct format, prepare the income statement using the following information: B. Calculate the profit margin, return on investment, and residual income. Assume an investment base of $100,000 and 6% cost of capital. C. Prepare a short response to accompany the income statement that explains why uncontrollable costs are included in the income statement $2,035 41,580 189,000 315 17,000 Pretax income Gross profit Allocated costs (uncontrollable) Labor expense Sales Research and development (uncontrollable) Depreciation expense Net income/(loss) Cost of goods sold Selling expense Total expenses Marketing costs (uncontrollable) Administrative expense Income tax expense (21% of pretax income) Other expenses 119,070 1,250 ? 790 690 320 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started