Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The answer to part (i) is Project 1 required rate of return = 10.8% & Project 2 required rate of return = 7.2% Dudley plc

The answer to part (i) is Project 1 required rate of return = 10.8% & Project 2 required rate of return = 7.2%

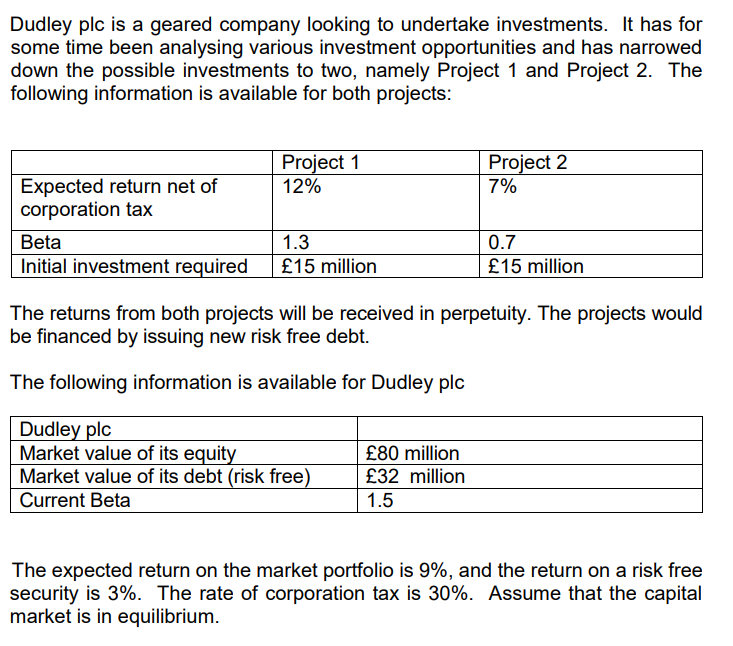

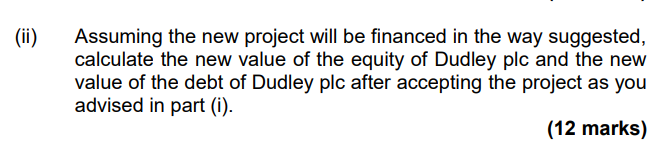

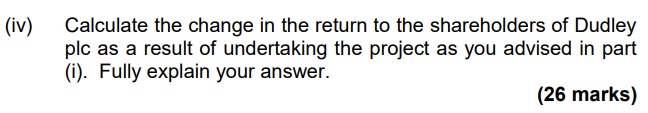

Dudley plc is a geared company looking to undertake investments. It has for some time been analysing various investment opportunities and has narrowed down the possible investments to two, namely Project 1 and Project 2. The following information is available for both projects: Project 1 Project 2 7% 12% Expected return net of corporation tax Beta 1.3 0.7 Initial investment required 15 million 15 million The returns from both projects will be received in perpetuity. The projects would be financed by issuing new risk free debt. The following information is available for Dudley plc Dudley plc Market value of its equity 80 million 32 million Market value of its debt (risk free) Current Beta 1.5 The expected return on the market portfolio is 9%, and the return on a risk free security is 3%. The rate of corporation tax is 30%. Assume that the capital market is in equilibrium. (ii) Assuming the new project will be financed in the way suggested, calculate the new value of the equity of Dudley plc and the new value of the debt of Dudley plc after accepting the project as you advised in part (i). (12 marks) (iv) Calculate the change in the return to the shareholders of Dudley plc as a result of undertaking the project as you advised in part (i). Fully explain your answer. (26 marks) Dudley plc is a geared company looking to undertake investments. It has for some time been analysing various investment opportunities and has narrowed down the possible investments to two, namely Project 1 and Project 2. The following information is available for both projects: Project 1 Project 2 7% 12% Expected return net of corporation tax Beta 1.3 0.7 Initial investment required 15 million 15 million The returns from both projects will be received in perpetuity. The projects would be financed by issuing new risk free debt. The following information is available for Dudley plc Dudley plc Market value of its equity 80 million 32 million Market value of its debt (risk free) Current Beta 1.5 The expected return on the market portfolio is 9%, and the return on a risk free security is 3%. The rate of corporation tax is 30%. Assume that the capital market is in equilibrium. (ii) Assuming the new project will be financed in the way suggested, calculate the new value of the equity of Dudley plc and the new value of the debt of Dudley plc after accepting the project as you advised in part (i). (12 marks) (iv) Calculate the change in the return to the shareholders of Dudley plc as a result of undertaking the project as you advised in part (i). Fully explain your answer. (26 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started