Answered step by step

Verified Expert Solution

Question

1 Approved Answer

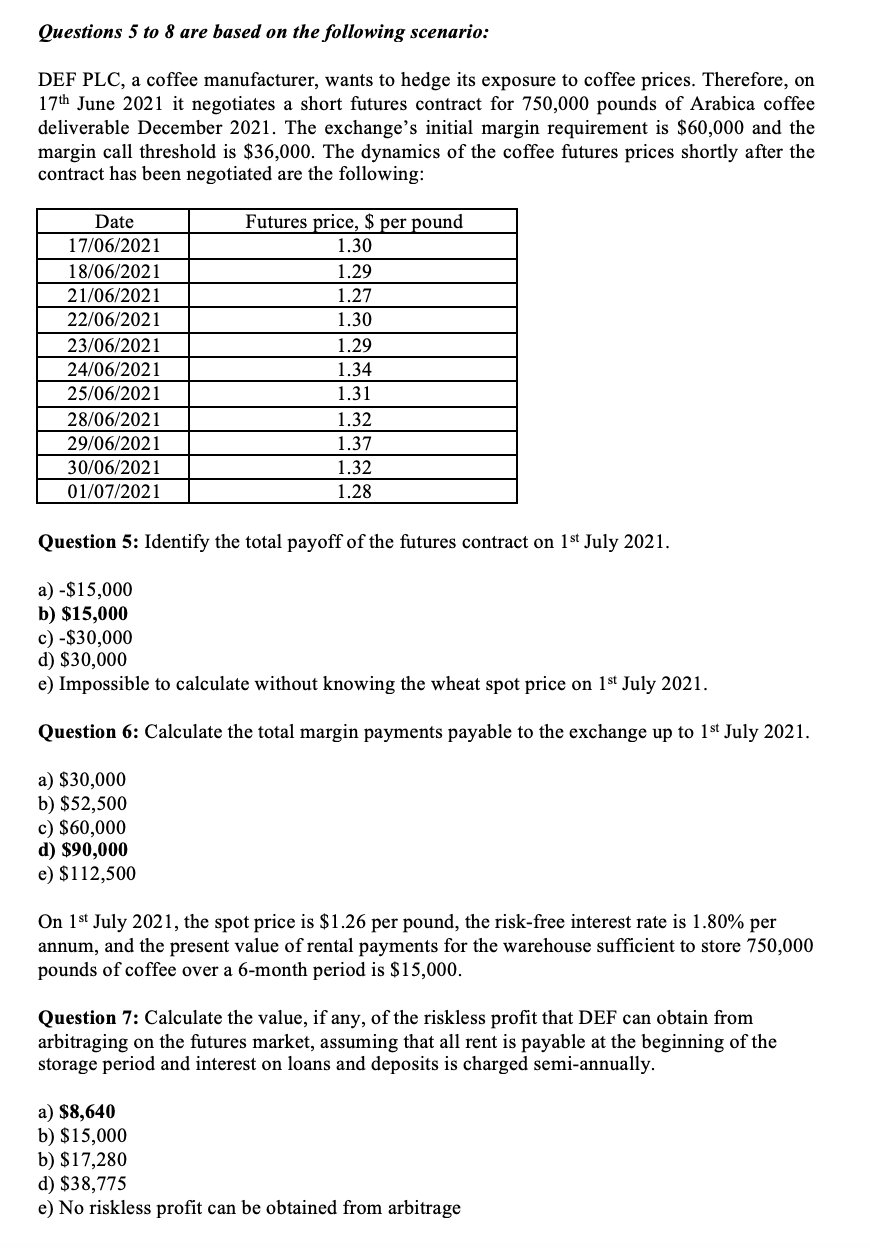

The answers are there I need to understand how they got Q 6,7,8 Questions 5 to 8 are based on the following scenario: DEF PLC,

The answers are there I need to understand how they got Q 6,7,8

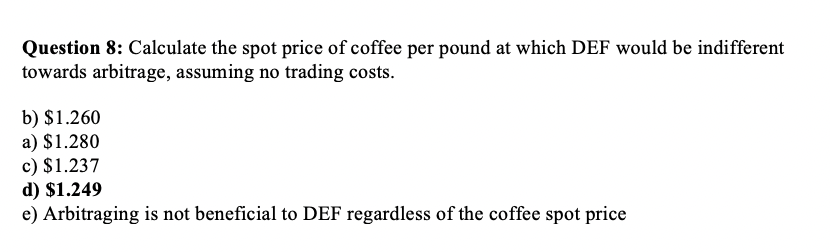

Questions 5 to 8 are based on the following scenario: DEF PLC, a coffee manufacturer, wants to hedge its exposure to coffee prices. Therefore, on 17th June 2021 it negotiates a short futures contract for 750,000 pounds of Arabica coffee deliverable December 2021. The exchange's initial margin requirement is $60,000 and the margin call threshold is $36,000. The dynamics of the coffee futures prices shortly after the contract has been negotiated are the following: Futures price, $ per pound 1.30 1.29 1.27 1.30 Date 17/06/2021 18/06/2021 21/06/2021 22/06/2021 23/06/2021 24/06/2021 25/06/2021 28/06/2021 29/06/2021 30/06/2021 01/07/2021 1.29 1.34 1.31 1.32 1.37 1.32 1.28 Question 5: Identify the total payoff of the futures contract on 1st July 2021. a) -$15,000 b) $15,000 c) -$30,000 d) $30,000 e) Impossible to calculate without knowing the wheat spot price on 1st July 2021. Question 6: Calculate the total margin payments payable to the exchange up to 1st July 2021. a) $30,000 b) $52,500 c) $60,000 d) $90,000 e) $112,500 On 1st July 2021, the spot price is $1.26 per pound, the risk-free interest rate is 1.80% per annum, and the present value of rental payments for the warehouse sufficient to store 750,000 pounds of coffee over a 6-month period is $15,000. Question 7: Calculate the value, if any, of the riskless profit that DEF can obtain from arbitraging on the futures market, assuming that all rent is payable at the beginning of the storage period and interest on loans and deposits is charged semi-annually. a $8,640 b) $15,000 b) $17,280 d) $38,775 e) No riskless profit can be obtained from arbitrage Question 8: Calculate the spot price of coffee per pound at which DEF would be indifferent towards arbitrage, assuming no trading costs. b) $1.260 a) $1.280 c) $1.237 d) $1.249 e) Arbitraging is not beneficial to DEF regardless of the coffee spot price Questions 5 to 8 are based on the following scenario: DEF PLC, a coffee manufacturer, wants to hedge its exposure to coffee prices. Therefore, on 17th June 2021 it negotiates a short futures contract for 750,000 pounds of Arabica coffee deliverable December 2021. The exchange's initial margin requirement is $60,000 and the margin call threshold is $36,000. The dynamics of the coffee futures prices shortly after the contract has been negotiated are the following: Futures price, $ per pound 1.30 1.29 1.27 1.30 Date 17/06/2021 18/06/2021 21/06/2021 22/06/2021 23/06/2021 24/06/2021 25/06/2021 28/06/2021 29/06/2021 30/06/2021 01/07/2021 1.29 1.34 1.31 1.32 1.37 1.32 1.28 Question 5: Identify the total payoff of the futures contract on 1st July 2021. a) -$15,000 b) $15,000 c) -$30,000 d) $30,000 e) Impossible to calculate without knowing the wheat spot price on 1st July 2021. Question 6: Calculate the total margin payments payable to the exchange up to 1st July 2021. a) $30,000 b) $52,500 c) $60,000 d) $90,000 e) $112,500 On 1st July 2021, the spot price is $1.26 per pound, the risk-free interest rate is 1.80% per annum, and the present value of rental payments for the warehouse sufficient to store 750,000 pounds of coffee over a 6-month period is $15,000. Question 7: Calculate the value, if any, of the riskless profit that DEF can obtain from arbitraging on the futures market, assuming that all rent is payable at the beginning of the storage period and interest on loans and deposits is charged semi-annually. a $8,640 b) $15,000 b) $17,280 d) $38,775 e) No riskless profit can be obtained from arbitrage Question 8: Calculate the spot price of coffee per pound at which DEF would be indifferent towards arbitrage, assuming no trading costs. b) $1.260 a) $1.280 c) $1.237 d) $1.249 e) Arbitraging is not beneficial to DEF regardless of the coffee spot priceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started