Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the answers ars highlighted. i just need someone to break down the concepts please . 11. undos A lessee signs a three-year operating lease with

the answers ars highlighted. i just need someone to break down the concepts please

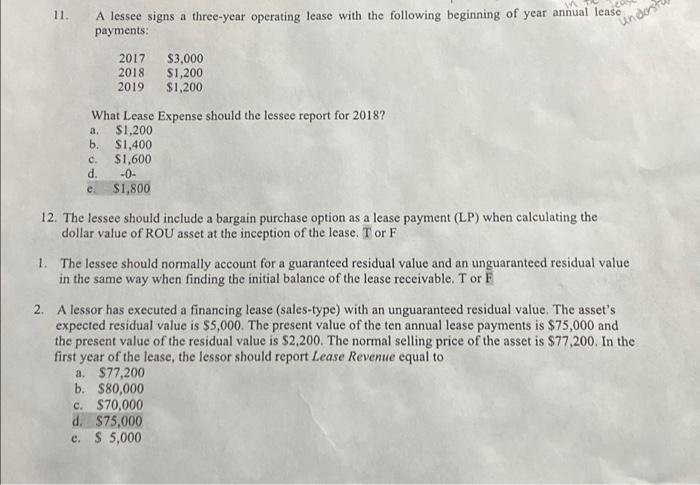

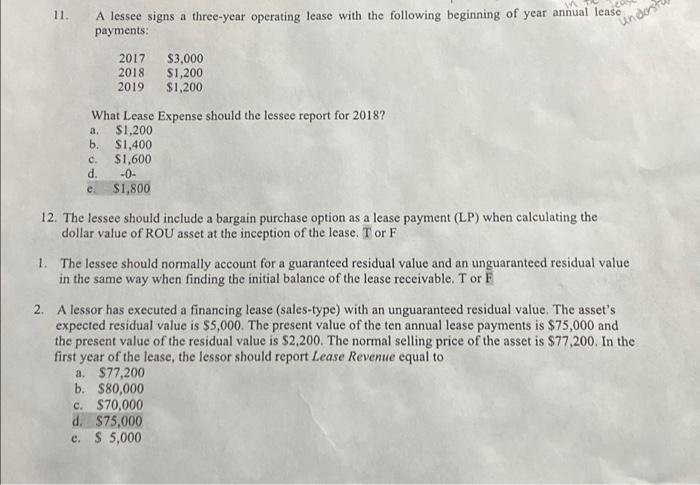

. 11. undos A lessee signs a three-year operating lease with the following beginning of year annual lease payments: 2017 $3,000 2018 $1,200 2019 $1,200 What Lease Expense should the lessee report for 2018? a $1,200 b. $1,400 c. $1,600 d. -0- $1,800 e 12. The lessee should include a bargain purchase option as a lease payment (LP) when calculating the dollar value of ROU asset at the inception of the lease. Tor F L. The lessee should normally account for a guaranteed residual value and an unguaranteed residual value in the same way when finding the initial balance of the lease receivable. Tor F 2. A lessor has executed a financing lease (sales-type) with an unguaranteed residual value. The asset's expected residual value is $5,000. The present value of the ten annual lease payments is $75,000 and the present value of the residual value is $2,200. The normal selling price of the asset is $77,200. In the first year of the lease, the lessor should report Lease Revenue equal to a. $77,200 b. $80,000 c. $70,000 d. $75,000 e. S 5,000 . 11. undos A lessee signs a three-year operating lease with the following beginning of year annual lease payments: 2017 $3,000 2018 $1,200 2019 $1,200 What Lease Expense should the lessee report for 2018? a $1,200 b. $1,400 c. $1,600 d. -0- $1,800 e 12. The lessee should include a bargain purchase option as a lease payment (LP) when calculating the dollar value of ROU asset at the inception of the lease. Tor F L. The lessee should normally account for a guaranteed residual value and an unguaranteed residual value in the same way when finding the initial balance of the lease receivable. Tor F 2. A lessor has executed a financing lease (sales-type) with an unguaranteed residual value. The asset's expected residual value is $5,000. The present value of the ten annual lease payments is $75,000 and the present value of the residual value is $2,200. The normal selling price of the asset is $77,200. In the first year of the lease, the lessor should report Lease Revenue equal to a. $77,200 b. $80,000 c. $70,000 d. $75,000 e. S 5,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started