Question

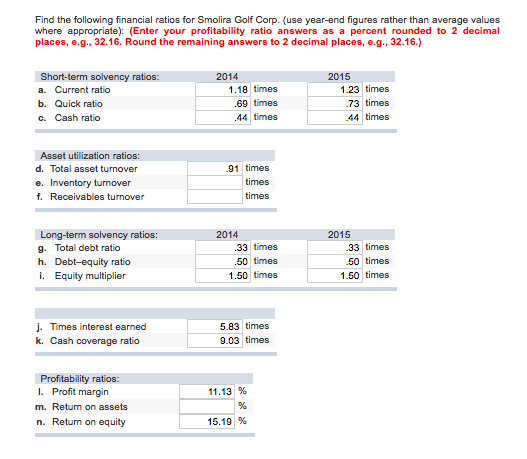

The answers I have are correct but I cannot figure out the missing ones Some recent financial statements for Smolira Golf Corp. follow. SMOLIRA GOLF

The answers I have are correct but I cannot figure out the missing ones

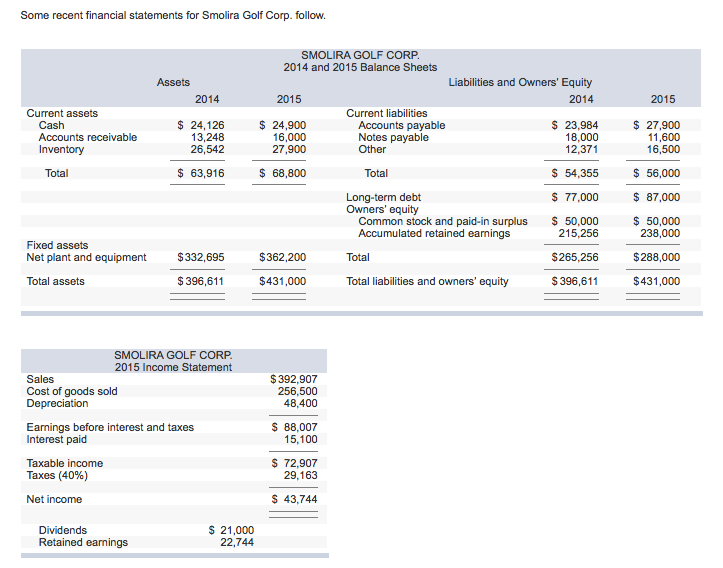

Some recent financial statements for Smolira Golf Corp. follow. SMOLIRA GOLF CORP. 2014 and 2015 Balance Sheets Assets Liabilities and Owners Equity 2014 2015 2014 2015 Current assets Current liabilities Cash $ 24,126 $ 24,900 Accounts payable $ 23,984 $ 27,900 Accounts receivable 13,248 16,000 Notes payable 18,000 11,600 Inventory 26,542 27,900 Other 12,371 16,500 Total $ 63,916 $ 68,800 Total $ 54,355 $ 56,000 Long-term debt $ 77,000 $ 87,000 Owners equity Common stock and paid-in surplus $ 50,000 $ 50,000 Accumulated retained earnings 215,256 238,000 Fixed assets Net plant and equipment $ 332,695 $ 362,200 Total $ 265,256 $ 288,000 Total assets $ 396,611 $ 431,000 Total liabilities and owners equity $ 396,611 $ 431,000

Some recent financial statements for Smolira Golf Corp. follow. SMOLIRA GOLF CORP. 2014 and 2015 Balance Sheets Assets Liabilities and Owners' Equity 2014 2015 2014 2015 Current assets Current liabilities 23,984 27,900 24,126 24,900 Cash Accounts payable Accounts receivable 13,248 6,000 Notes payable 18,000 1,600 27,900 Inventory 26,542 Other 12.37 16,500 63,916 68,800 54,355 56,000 Total Total 77,000 87,000 Long-term debt Owners' equity Common stock and paid-in surplus 50,000 50,000 238,000 Accumulated retained earnings 215,256 Fixed assets Net plant and equipment $332,695 $362,200 $265,256 $288,000 Total Total assets $396,611 $431,000 $396,611 $431,000 Total liabilities and owners' equity SMOLIRA GO CORP. 2015 Income Statement $392,907 Sales 256,500 Cost of goods sold 48,400 Depreciation Earnings before interest and taxes 88,007 Interest paid 15.100 Taxable income 72,907 Taxes (40%) 29,163 43,744 Net income 21,000 Dividends Retained earnings 22,744Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started