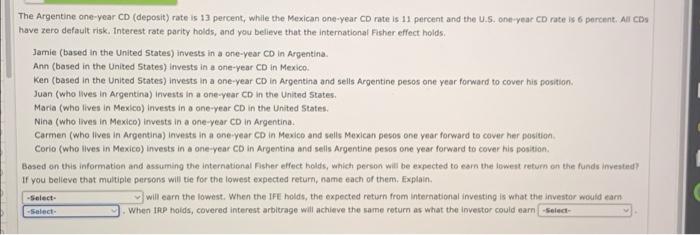

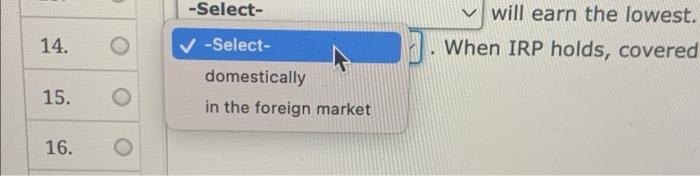

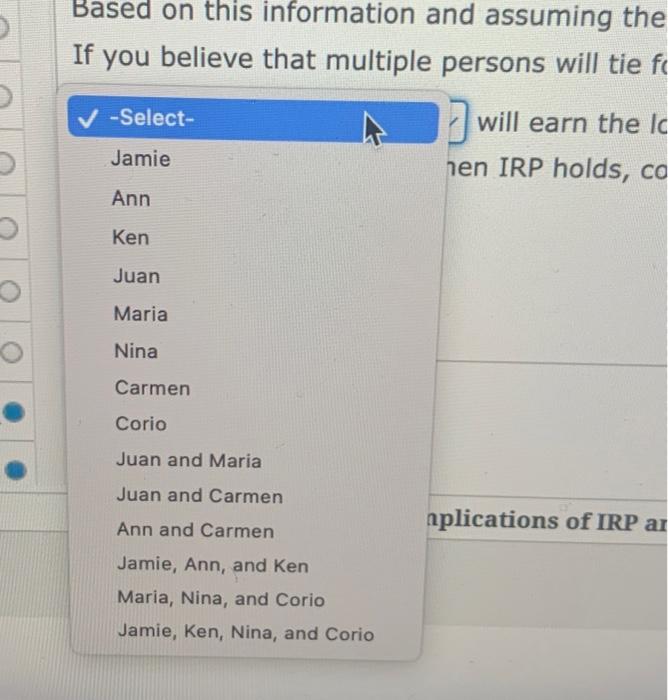

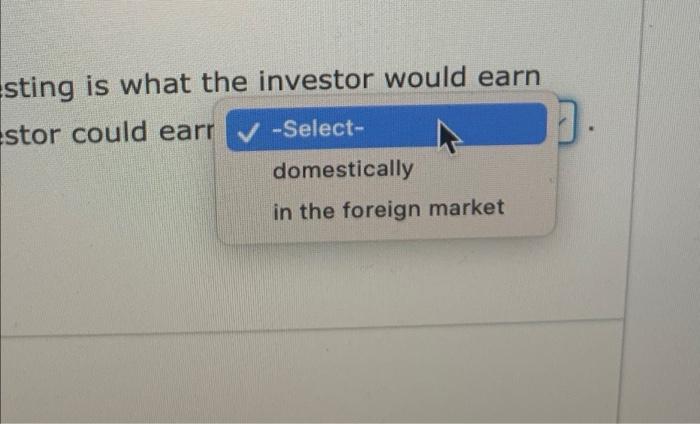

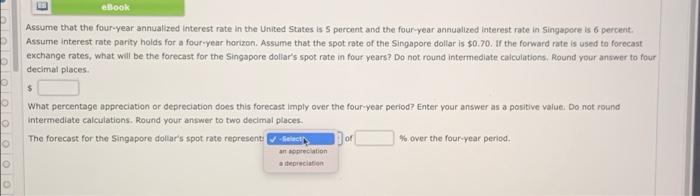

The Argentine one-year CD (deposit) rate is 13 percent, while the Mexican one-year CD rate is 11 percent and the U.S. one-year Crate 6 percent All CDs have zero default risk. Interest rate parity holds, and you believe that the international Fisher effect holds Jamie (tased in the United States) invests in a one-year CD in Argentina, Ann (based in the United States) Invests in a one-year CD in Mexico Ken (based in the United States) invests in a one-year CD in Argentina and sells Argentine pesos one year forward to cover his position Juan (who lives in Argentina) Invests in a one-year CD in the United States. Maria (who lives in Mexico) invests in a one-year CD in the United States. Nina (who lives in Mexico) invests in a one-year CD in Argentina. Carmen (who lives in Argentina) Invests in a one-year CD in Mexico and wells Mexican pesos one year forward to cover her position Corio (who lives in Mexico) Invests in a one-year Coin Argentina and sells Argentine pesos one year forward to cover his position Based on this information and assuming the international Fisher effect holds, which person will be expected to earn the lowest return on the funds invested? If you believe that multiple persons will tie for the lowest expected return, name each of them. Explain will earn the lowest. When the Ife holds, the expected return from international Investing is what the investor would earn when IP hoids, covered interest arbitrage will achieve the same return as what the investor could earnSelect- -Select- -Select -Select- v will earn the lowest. When IRP holds, covered 14. -Select- domestically in the foreign market 15. 16. O Based on this information and assuming the If you believe that multiple persons will tie fc -Select- will earn the Ic Jamie hen IRP holds, co Ann Ken Juan Maria Nina Carmen Corio nplications of IRP a Juan and Maria Juan and Carmen Ann and Carmen Jamie, Ann, and Ken Maria, Nina, and Corio Jamie, Ken, Nina, and Corio sting is what the investor would earn stor could earr -Select- domestically in the foreign market ebook Assume that the four-year annualized interest rate in the United States is 5 percent and the four year annualized interest rate in Singapore is 6 percent. Assume interest rate parity holds for a four-year horizon. Assume that the spot rate of the Singapore dollar is $0.70. If the forward rate is used to forecast exchange rates, what will be the forecast for the Singapore dollar's spot rate in four years? Do not round intermediate calculations, Round your answer to four decimal places $ What percentage appreciation or depreciation does this forecast imply over the four-year period? Enter your answer as a positive value. Do not round Intermediate calculations. Round your answer to two decimal places The forecast for the Singapore dollar's spot rate represente * over the four-year period an appreciation Depreciation 0 0 The Argentine one-year CD (deposit) rate is 13 percent, while the Mexican one-year CD rate is 11 percent and the U.S. one-year Crate 6 percent All CDs have zero default risk. Interest rate parity holds, and you believe that the international Fisher effect holds Jamie (tased in the United States) invests in a one-year CD in Argentina, Ann (based in the United States) Invests in a one-year CD in Mexico Ken (based in the United States) invests in a one-year CD in Argentina and sells Argentine pesos one year forward to cover his position Juan (who lives in Argentina) Invests in a one-year CD in the United States. Maria (who lives in Mexico) invests in a one-year CD in the United States. Nina (who lives in Mexico) invests in a one-year CD in Argentina. Carmen (who lives in Argentina) Invests in a one-year CD in Mexico and wells Mexican pesos one year forward to cover her position Corio (who lives in Mexico) Invests in a one-year Coin Argentina and sells Argentine pesos one year forward to cover his position Based on this information and assuming the international Fisher effect holds, which person will be expected to earn the lowest return on the funds invested? If you believe that multiple persons will tie for the lowest expected return, name each of them. Explain will earn the lowest. When the Ife holds, the expected return from international Investing is what the investor would earn when IP hoids, covered interest arbitrage will achieve the same return as what the investor could earnSelect- -Select- -Select -Select- v will earn the lowest. When IRP holds, covered 14. -Select- domestically in the foreign market 15. 16. O Based on this information and assuming the If you believe that multiple persons will tie fc -Select- will earn the Ic Jamie hen IRP holds, co Ann Ken Juan Maria Nina Carmen Corio nplications of IRP a Juan and Maria Juan and Carmen Ann and Carmen Jamie, Ann, and Ken Maria, Nina, and Corio Jamie, Ken, Nina, and Corio sting is what the investor would earn stor could earr -Select- domestically in the foreign market ebook Assume that the four-year annualized interest rate in the United States is 5 percent and the four year annualized interest rate in Singapore is 6 percent. Assume interest rate parity holds for a four-year horizon. Assume that the spot rate of the Singapore dollar is $0.70. If the forward rate is used to forecast exchange rates, what will be the forecast for the Singapore dollar's spot rate in four years? Do not round intermediate calculations, Round your answer to four decimal places $ What percentage appreciation or depreciation does this forecast imply over the four-year period? Enter your answer as a positive value. Do not round Intermediate calculations. Round your answer to two decimal places The forecast for the Singapore dollar's spot rate represente * over the four-year period an appreciation Depreciation 0 0