Answered step by step

Verified Expert Solution

Question

1 Approved Answer

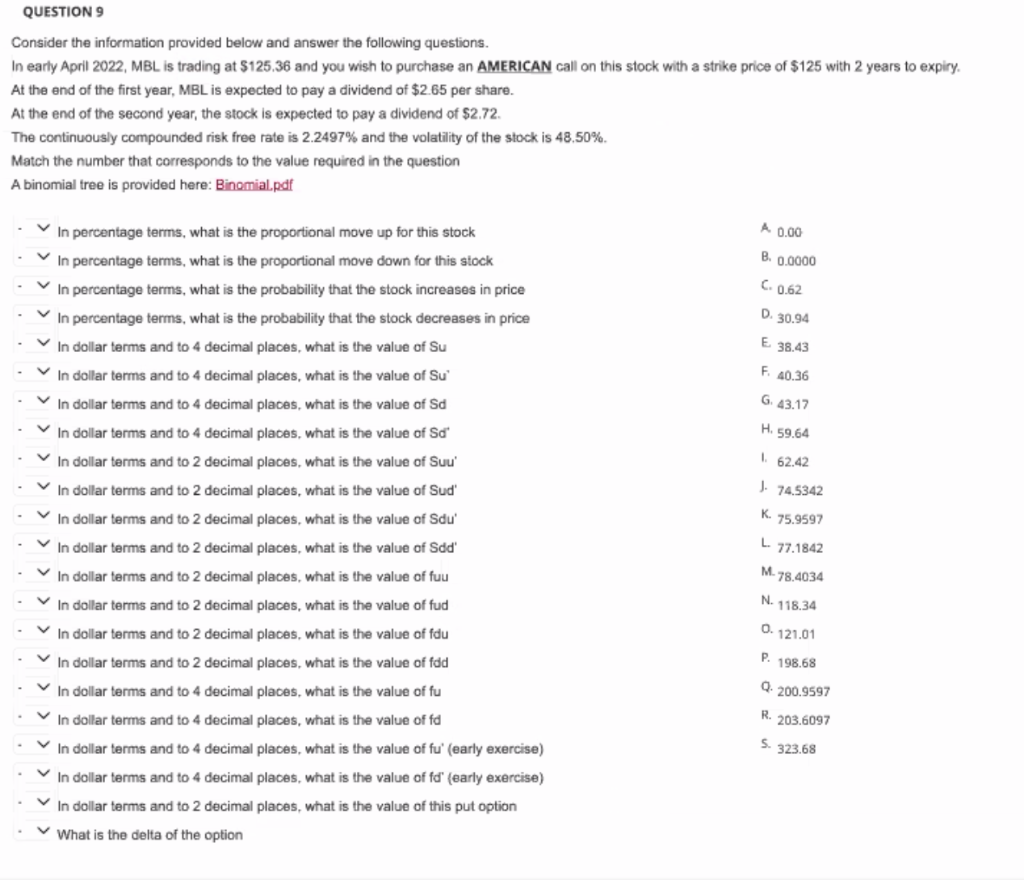

The arrows on the left are to pick which letter to go into. QUESTION 9 Consider the information provided below and answer the following questions.

The arrows on the left are to pick which letter to go into.

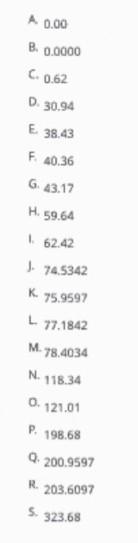

QUESTION 9 Consider the information provided below and answer the following questions. In early April 2022, MBL is trading at $125,36 and you wish to purchase an AMERICAN call on this stock with a strike price of $125 with 2 years to expiry. At the end of the first year, MBL is expected to pay a dividend of $2.65 per share. At the end of the second year, the stock is expected to pay a dividend of $2.72. The continuously compounded risk free rate is 2.2497% and the volatility of the stock is 48.50%. Match the number that corresponds to the value required in the question A binomial tree is provided here: Binomial.pdf A 0.00 B. 0.0000 C. 0.62 D. 30.94 E 38.43 F. 40.36 G.43.17 H. 59.64 162.42 J. 74.5342 In percentage terms, what is the proportional move up for this stock In percentage terms, what is the proportional move down for this stock In percentage terms, what is the probability that the stock increases in price In percentage terms, what is the probability that the stock decreases in price In dollar terms and to 4 decimal places, what is the value of Su In dollar terms and to 4 decimal places, what is the value of Su In dollar terms and to 4 decimal places, what is the value of Sd In dollar terms and to 4 decimal places, what is the value of Sd In dollar terms and to 2 decimal places, what is the value of Suu' In dollar terms and to 2 decimal places, what is the value of Sud' In dollar terms and to 2 decimal places, what is the value of Sdu' In dollar terms and to 2 decimal places, what is the value of Sdd' In dollar terms and to 2 decimal places, what is the value of fuu In dollar terms and to 2 decimal places, what is the value of fud In dollar terms and to 2 decimal places, what is the value of fdu In dollar terms and to 2 decimal places, what is the value of fdd In dollar terms and to 4 decimal places, what is the value of fu In dollar terms and to 4 decimal places, what is the value of fd In dollar terms and to 4 decimal places, what is the value of fu' (early exercise) In dollar terms and to 4 decimal places, what is the value of fd (early exercise) In dollar terms and to 2 decimal places, what is the value of this put option What is the delta of the option K. 75.9597 L. 77.1842 M-78.4034 N. 118.34 0. 121.01 P. 198.68 V Q. 200.9597 R. 203.6097 5. 323.68 A 0.00 B. 0.0000 C 0.62 D. 30.94 E 38.43 F 40.36 G 43.17 H. 59.64 62.42 J. 74,5342 K. 75.9597 77.1842 M 78.4034 N. 118.34 0.121.01 P. 198.68 Q 200.9597 R203,6097 323.68 A 0.00 B. 0.0000 C 0.62 D. 30.94 E 38.43 F 40.36 G 43.17 H. 59.64 62.42 J. 74,5342 K. 75.9597 77.1842 M 78.4034 N. 118.34 0.121.01 P. 198.68 Q 200.9597 R203,6097 323.68 A 0.00 B. 0.0000 C 0.62 D. 30.94 E 38.43 F 40.36 G 43.17 H. 59.64 62.42 J. 74,5342 K. 75.9597 77.1842 M 78.4034 N. 118.34 0.121.01 P. 198.68 Q 200.9597 R203,6097 323.68 QUESTION 9 Consider the information provided below and answer the following questions. In early April 2022, MBL is trading at $125,36 and you wish to purchase an AMERICAN call on this stock with a strike price of $125 with 2 years to expiry. At the end of the first year, MBL is expected to pay a dividend of $2.65 per share. At the end of the second year, the stock is expected to pay a dividend of $2.72. The continuously compounded risk free rate is 2.2497% and the volatility of the stock is 48.50%. Match the number that corresponds to the value required in the question A binomial tree is provided here: Binomial.pdf A 0.00 B. 0.0000 C. 0.62 D. 30.94 E 38.43 F. 40.36 G.43.17 H. 59.64 162.42 J. 74.5342 In percentage terms, what is the proportional move up for this stock In percentage terms, what is the proportional move down for this stock In percentage terms, what is the probability that the stock increases in price In percentage terms, what is the probability that the stock decreases in price In dollar terms and to 4 decimal places, what is the value of Su In dollar terms and to 4 decimal places, what is the value of Su In dollar terms and to 4 decimal places, what is the value of Sd In dollar terms and to 4 decimal places, what is the value of Sd In dollar terms and to 2 decimal places, what is the value of Suu' In dollar terms and to 2 decimal places, what is the value of Sud' In dollar terms and to 2 decimal places, what is the value of Sdu' In dollar terms and to 2 decimal places, what is the value of Sdd' In dollar terms and to 2 decimal places, what is the value of fuu In dollar terms and to 2 decimal places, what is the value of fud In dollar terms and to 2 decimal places, what is the value of fdu In dollar terms and to 2 decimal places, what is the value of fdd In dollar terms and to 4 decimal places, what is the value of fu In dollar terms and to 4 decimal places, what is the value of fd In dollar terms and to 4 decimal places, what is the value of fu' (early exercise) In dollar terms and to 4 decimal places, what is the value of fd (early exercise) In dollar terms and to 2 decimal places, what is the value of this put option What is the delta of the option K. 75.9597 L. 77.1842 M-78.4034 N. 118.34 0. 121.01 P. 198.68 V Q. 200.9597 R. 203.6097 5. 323.68 A 0.00 B. 0.0000 C 0.62 D. 30.94 E 38.43 F 40.36 G 43.17 H. 59.64 62.42 J. 74,5342 K. 75.9597 77.1842 M 78.4034 N. 118.34 0.121.01 P. 198.68 Q 200.9597 R203,6097 323.68 A 0.00 B. 0.0000 C 0.62 D. 30.94 E 38.43 F 40.36 G 43.17 H. 59.64 62.42 J. 74,5342 K. 75.9597 77.1842 M 78.4034 N. 118.34 0.121.01 P. 198.68 Q 200.9597 R203,6097 323.68 A 0.00 B. 0.0000 C 0.62 D. 30.94 E 38.43 F 40.36 G 43.17 H. 59.64 62.42 J. 74,5342 K. 75.9597 77.1842 M 78.4034 N. 118.34 0.121.01 P. 198.68 Q 200.9597 R203,6097 323.68

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started