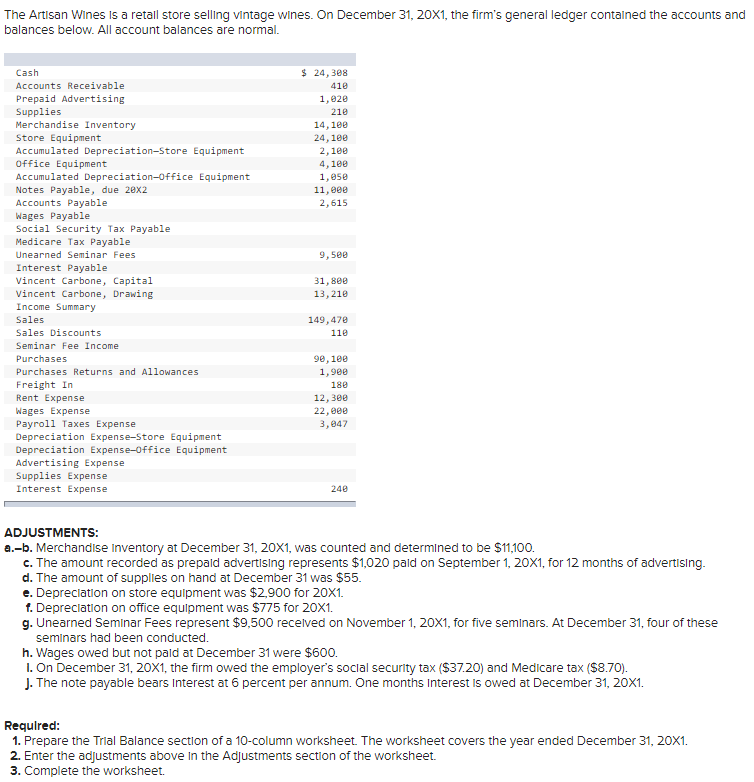

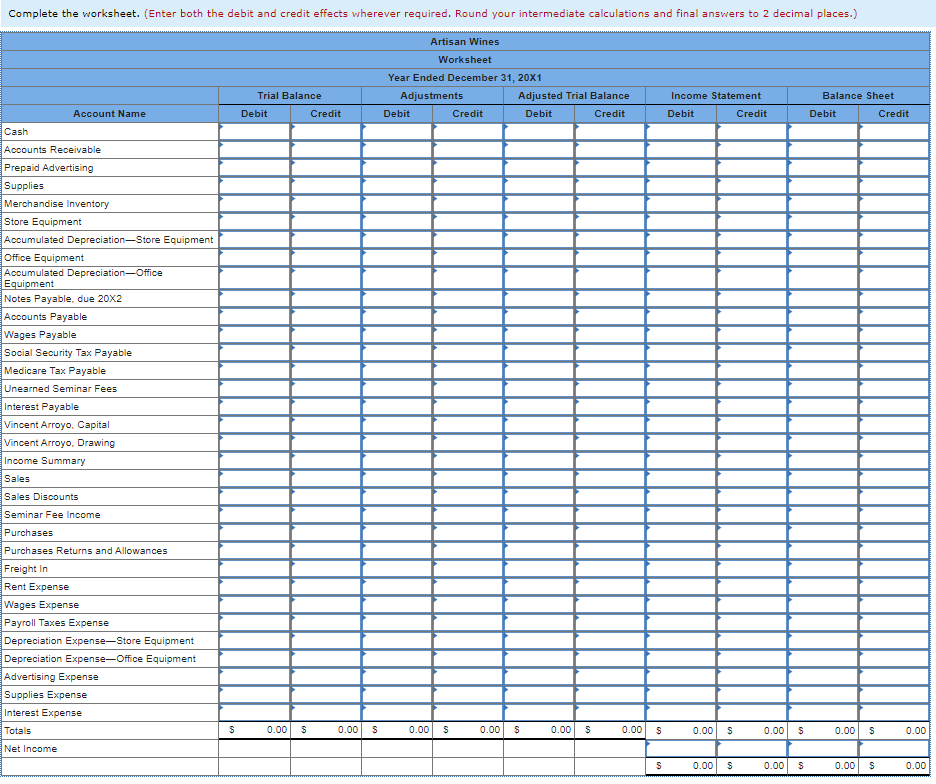

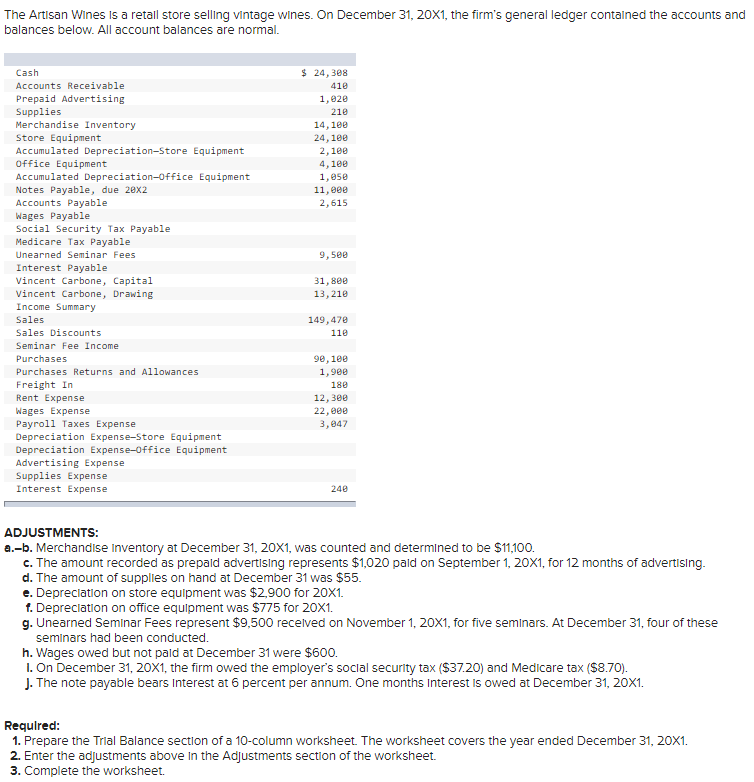

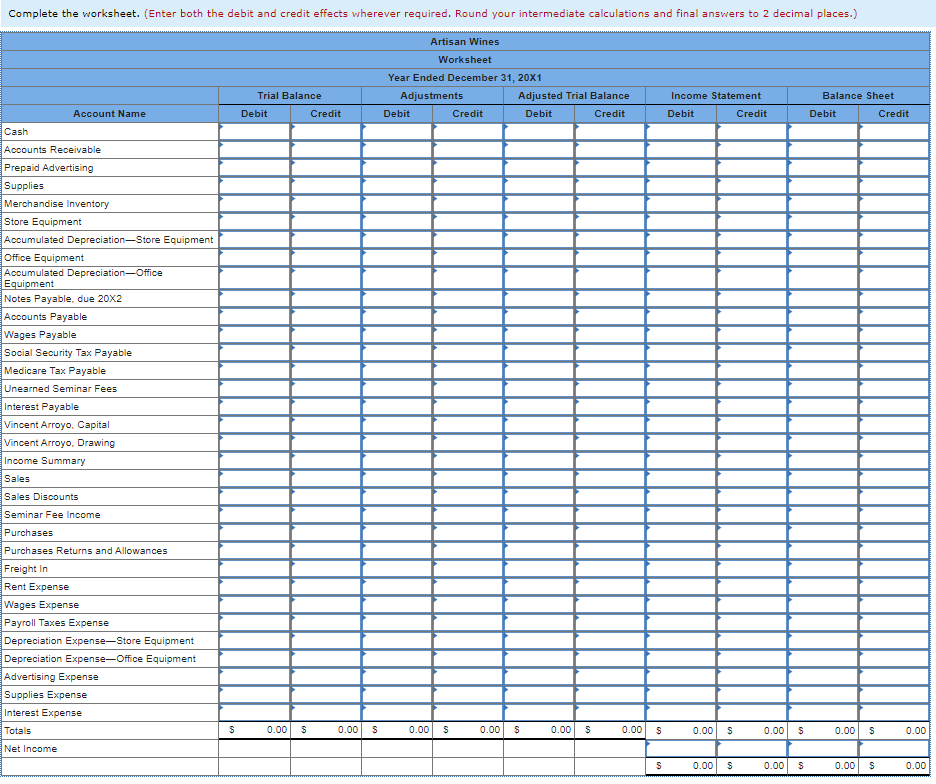

The Artisan Wines is a retail store selling vintage wines. On December 31, 20x1, the firm's general ledger contained the accounts and balances below. All account balances are normal. $ 24,308 410 1,20 210 14,100 24,100 2,100 4,100 1,050 11,000 2,615 9,5ee Cash Accounts Receivable Prepaid Advertising Supplies Merchandise Inventory Store Equipment Accumulated Depreciation-Store Equipment Office Equipment Accumulated Depreciation-office Equipment Notes Payable, due 20x2 Accounts Payable Wages Payable Social Security Tax Payable Medicare Tax Payable Unearned Seminar Fees Interest Payable Vincent Carbone, Capital Vincent Carbone, Drawing Income Summary Sales Sales Discounts Seminar Fee Income Purchases Purchases Returns and Allowances Freight In Rent Expense Wages Expense Payroll Taxes Expense Depreciation Expense-Store Eq ment Depreciation Expense-Office Equipment Advertising Expense Supplies Expense Interest Expense 31,800 13, 210 149,470 110 90, 100 1,9ee 180 12,300 22,000 3,047 240 ADJUSTMENTS: a.-b. Merchandise Inventory at December 31, 20X1, was counted and determined to be $11,100. c. The amount recorded as prepaid advertising represents $1,020 paid on September 1, 20x1, for 12 months of advertising. d. The amount of supplies on hand at December 31 was $55. e. Depreciation on store equipment was $2,900 for 20X1. f. Depreciation on office equipment was $775 for 20X1. g. Unearned Seminar Fees represent $9,500 received on November 1, 20x1, for five seminars. At December 31, four of these seminars had been conducted. h. Wages owed but not paid at December 31 were $600. I. On December 31, 20X1, the firm owed the employer's social security tax ($37.20) and Medicare tax ($8.70). J. The note payable bears Interest at 6 percent per annum. One months Interest is owed at December 31, 20X1. Required: 1. Prepare the Trial Balance section of a 10-column worksheet. The worksheet covers the year ended December 31, 20X1. 2. Enter the adjustments above in the Adjustments section of the worksheet. 3. Complete the worksheet. Complete the worksheet. (Enter both the debit and credit effects wherever required. Round your intermediate calculations and final answers to 2 decimal places.) Artisan Wines Worksheet Year Ended December 31, 20X1 Adjustments Adjusted Trial Balance Debit Credit Debit Credit Income Statement Balance Sheet Trial Balance Debit Credit Account Name Debit Credit Debit Credit Cash Accounts Receivable Prepaid Advertising Supplies Merchandise Inventory Store Equipment Accumulated Depreciation-Store Equipment Office Equipment Accumulated Depreciation Office Equipment Notes Payable, due 20X2 Accounts Payable Wages Payable Social Security Tax Payable Medicare Tax Payable Unearned Seminar Fees Interest Payable Vincent Arroyo, Capital Vincent Arroyo. Drawing Income Summary Sales Sales Discounts Seminar Fee Income Purchases Purchases Returns and Allowances Freight in Rent Expense Wages Expense Payroll Taxes Expense Depreciation Expense-Store Equipment Depreciation Expense-Office Equipment Advertising Expense Supplies Expense Interest Expense Totals 0.00 s 0.00 $ 0.00 s 0.00 $ 0.00 S 0.00 $ 0.00 $ 0.00 $ 0.00 $ 0.00 Net Income S 0.00 $ 0.00 S 0.00 $ 0.00 What was the amount of revenue earned by conducting seminars during the year ended December 31, 20X1? Revenue earned, Dec. 31, 20X1