Answered step by step

Verified Expert Solution

Question

1 Approved Answer

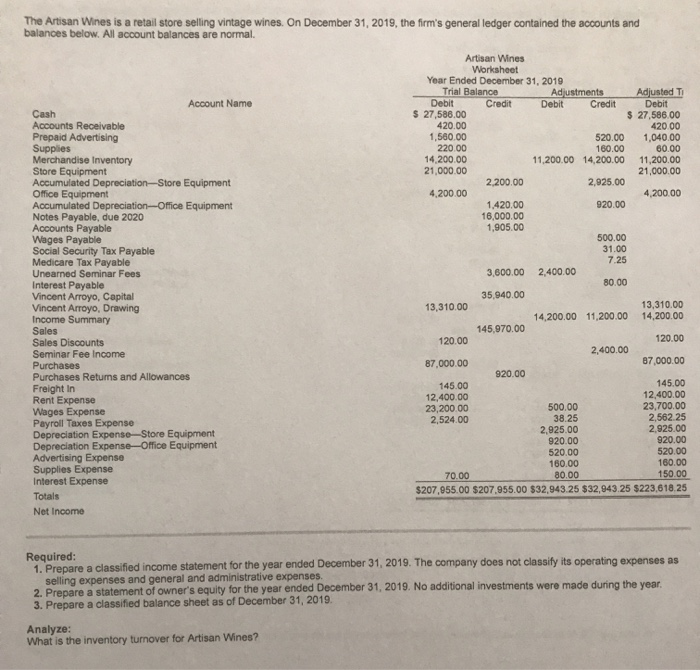

The artisan wines is a retail store selling vintage wines on December 31, 2019 the firms general ledger contain the account and balance is below.

The artisan wines is a retail store selling vintage wines on December 31, 2019 the firms general ledger contain the account and balance is below. all account balances are normal.

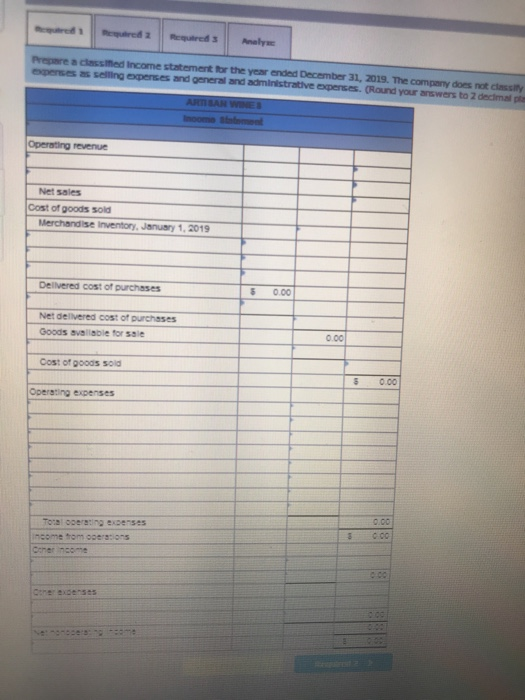

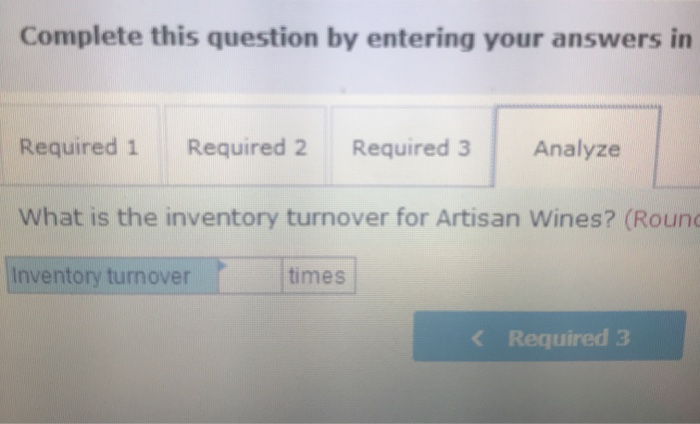

The Artisan Wines is a retail store selling vintage wines. On December 31, 2019, the firm's general ledger contained the accounts and balances below. All account balances are normal. Account Name Cash Accounts Receivable Prepaid Advertising Supplies Merchandise Inventory Store Equipment Accumulated Depreciation Store Equipment Office Equipment Accumulated Depreciation-Office Equipment Notes Payable, due 2020 Accounts Payable Wages Payable Social Security Tax Payable Medicare Tax Payable Unearned Seminar Fees Interest Payable Vincent Arroyo, Capital Vincent Arroyo, Drawing Income Summary Sales Sales Discounts Seminar Fee Income Purchases Purchases Retums and Allowances Freight in Rent Expense Wages Expense Payroll Taxes Expense Depreciation ExpenseStore Equipment Depreciation Expense-Office Equipment Advertising Expense Supplies Expense Interest Expense Totals Net Income Artisan Wines Worksheet Year Ended December 31, 2019 Trial Balance Adjustments Adjusted TI Debit Credit Debit Credit Debit $ 27,586.00 $ 27,586.00 420.00 420 00 1,560.00 520.00 1,040.00 220.00 160.00 60.00 14,200.00 11,200.00 14,200.00 11,200.00 21,000.00 21,000.00 2,200.00 2,925.00 4,200.00 4,200.00 1.420.00 920.00 16,000.00 1,905.00 500.00 31.00 7.25 3,600.00 2,400.00 80.00 35,940.00 13,310.00 13,310.00 14,200.00 11,200.00 14,200.00 145,970.00 120.00 120.00 2.400.00 87,000.00 87,000.00 920.00 145.00 145.00 12,400.00 12,400.00 23,200.00 500.00 23,700.00 2,524.00 38.25 2,562.25 2,925.00 2.925.00 920.00 920.00 520.00 520.00 160.00 160.00 70.00 80.00 150.00 $207,955.00 $207.955.00 $32.943.25 $32,943.25 $223,618.25 Required: 1. Prepare a classified income statement for the year ended December 31, 2019. The company does not classify its operating expenses as selling expenses and general and administrative expenses. 2. Prepare a statement of owner's equity for the year ended December 31, 2019. No additional investments were made during the year. 3. Prepare a classified balance sheet as of December 31, 2019 Analyze: What is the inventory turnover for Artisan Wines? red Analyse P res DEL sited income statement for the year ended December 31, 2019. The company does not clash as selling openses and general and administrative Expenses. Round your answers to decimal Operating revenue Net sales Cost of goods sold Merchandise inventory, January 1, 2019 Delivered cost of purch Net delivered cost of purchases Goods Sable for sale 0.00 Cost of goods sold Operating expenses Complete this question by entering your answers in the tabs below Required 1 Required 2 Required Analyse Prepare a statement of owner's equity for the year ended December 3 made during the year. (Round your answers to 2 decimal places.) ARTISAN WINES Statement of Owner's Equity $ $ 0.00 0.00 Rein Recured Assets Current assets: Total current assets Plant and equipment: Store equipment Office equipment 00 Total plant and equipment Total assets Liabilities and Owner's Equity Current liabilities TOTS Current Complete this question by entering your answers in Required 1 Required 2 Required 3 Analyze What is the inventory turnover for Artisan Wines? (Round Inventory turnover times 1. prepare a classified income statement for the year ended December 31, 2019 the company does not classified operating expenses are selling expenses and general and administrative expenses.

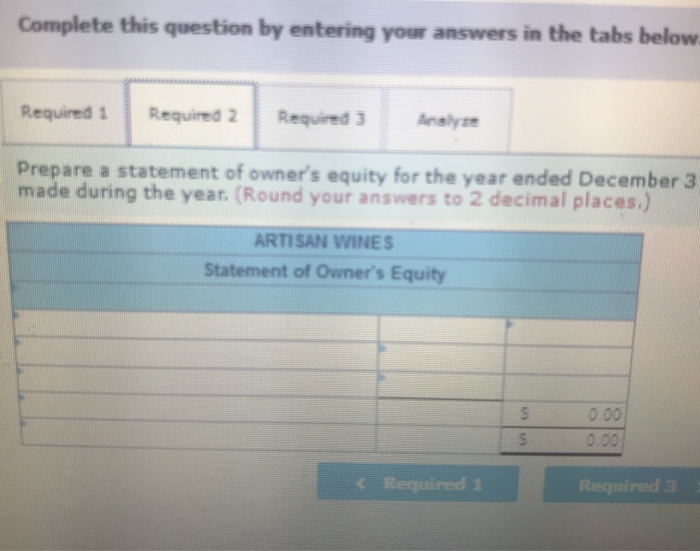

2. prepare a statement of owners equity for the year ended December 31, 2019 no additional investments were made during the year.

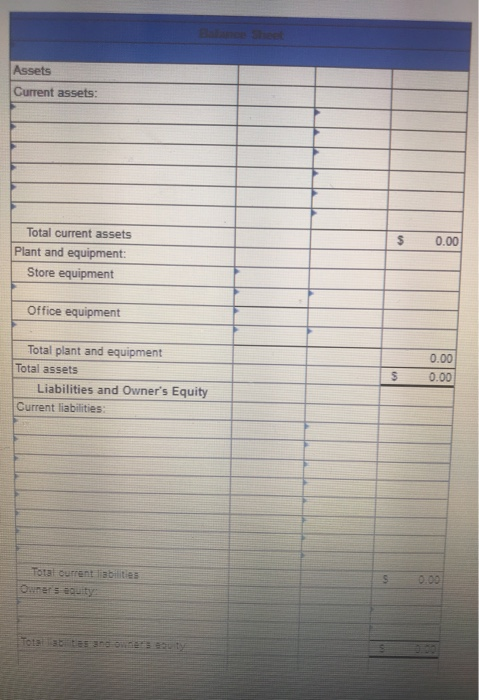

3. prepare a classified balance sheet as of December 31, 2019.

analyse: what is the inventory turnover for artisan wines?

please help with all sections, i am unable to add additional photos for clarity. thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started