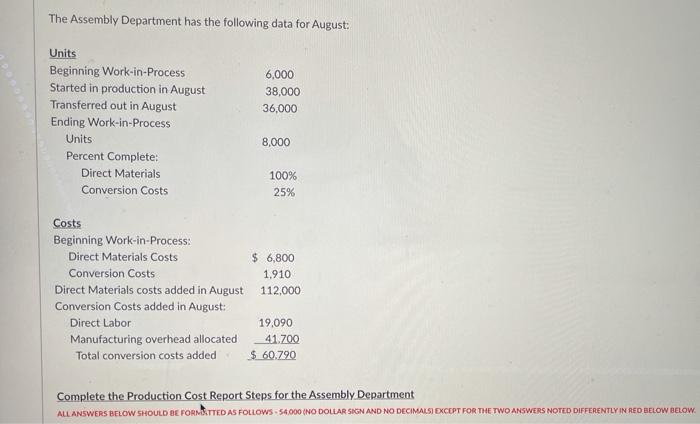

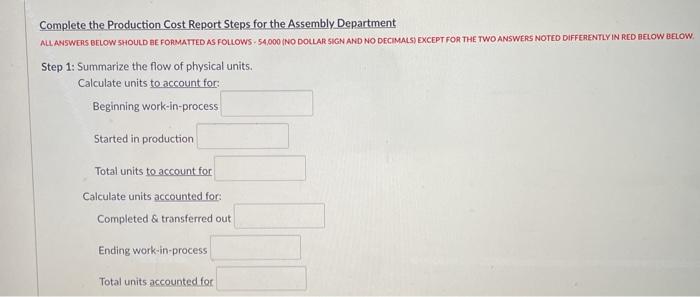

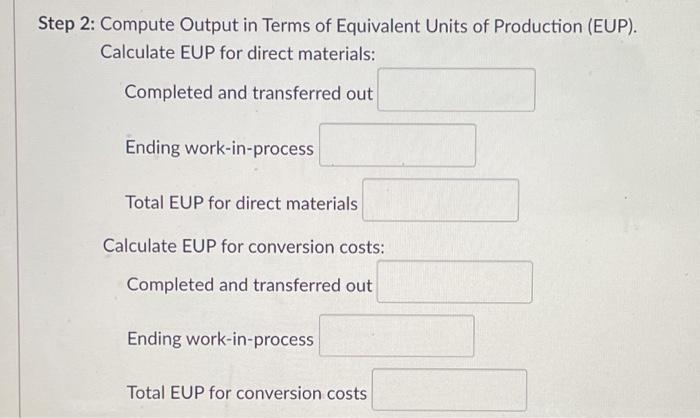

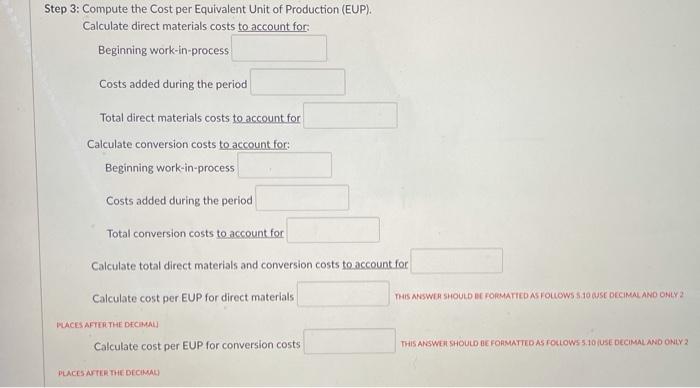

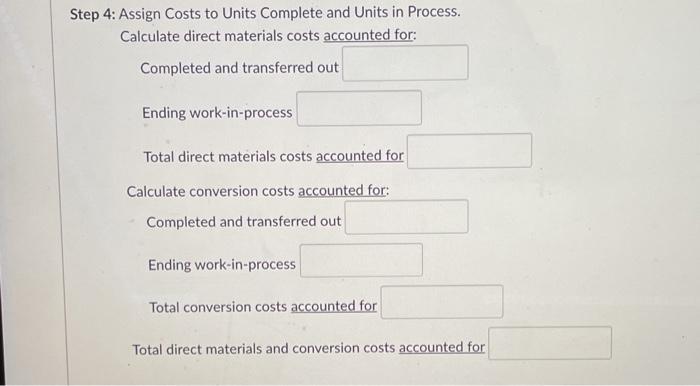

The Assembly Department has the following data for August: 6,000 38.000 36,000 Units Beginning Work-in-Process Started in production in August Transferred out in August Ending Work-in-Process Units Percent Complete: Direct Materials Conversion Costs 8,000 100% 25% Costs Beginning Work-in-Process: Direct Materials Costs $ 6,800 Conversion Costs 1,910 Direct Materials costs added in August 112,000 Conversion Costs added in August: Direct Labor 19,090 Manufacturing overhead allocated 41.700 Total conversion costs added $ 60.790 Complete the Production Cost Report Steps for the Assembly Department ALL ANSWERS BELOW SHOULD BEFORMITTED AS FOLLOWS. 54.000 (NO DOLLAR SIGN AND NO DECIMALSI EXCEPT FOR THE TWO ANSWERS NOTED DIFFERENTLY IN RED BELOW BELOW. Complete the Production Cost Report Steps for the Assembly Department ALL ANSWERS BELOW SHOULD BE FORMATTED AS FOLLOWS 54,000 INO DOLLAR SIGN AND NO DECIMALS) EXCEPT FOR THE TWO ANSWERS NOTED DIFFERENTLY IN RED BELOW BELOW. Step 1: Summarize the flow of physical units. Calculate units to account for: Beginning work-in-process Started in production Total units to account for Calculate units accounted for: Completed & transferred out Ending work-in-process Total units accounted for Step 2: Compute Output in Terms of Equivalent Units of Production (EUP). Calculate EUP for direct materials: Completed and transferred out Ending work-in-process Total EUP for direct materials Calculate EUP for conversion costs: Completed and transferred out Ending work-in-process Total EUP for conversion costs Step 3: Compute the cost per Equivalent Unit of Production (EUP). Calculate direct materials costs to account for Beginning work-in-process Costs added during the period Total direct materials costs to account for Calculate conversion costs to account for: Beginning work-in-process Costs added during the period Total conversion costs to account for Calculate total direct materials and conversion costs to account for Calculate cost per EUP for direct materials THIS ANSWER SHOULD BE FORMATTED AS FOLLOWS 10 SEDECIMAL AND ONLY 2 PLACES AFTER THE DECIMALI Calculate cost per EUP for conversion costs THIS ANSWER SHOULD BE FORMATTED AS FOLLOWS 5.10 USE DECIMAL AND ONLY 2 PLACES AFTER THE DECIMAL) Step 4: Assign Costs to Units Complete and Units in Process. Calculate direct materials costs accounted for: Completed and transferred out Ending work-in-process Total direct materials costs accounted for Calculate conversion costs accounted for: Completed and transferred out Ending work-in-process Total conversion costs accounted for Total direct materials and conversion costs accounted for