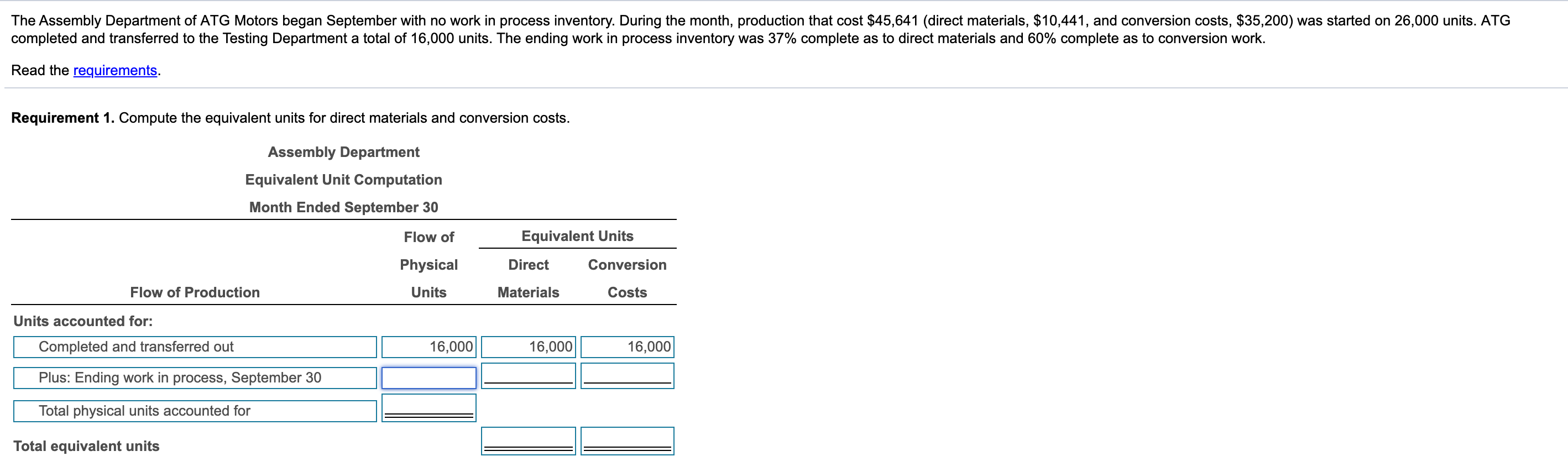

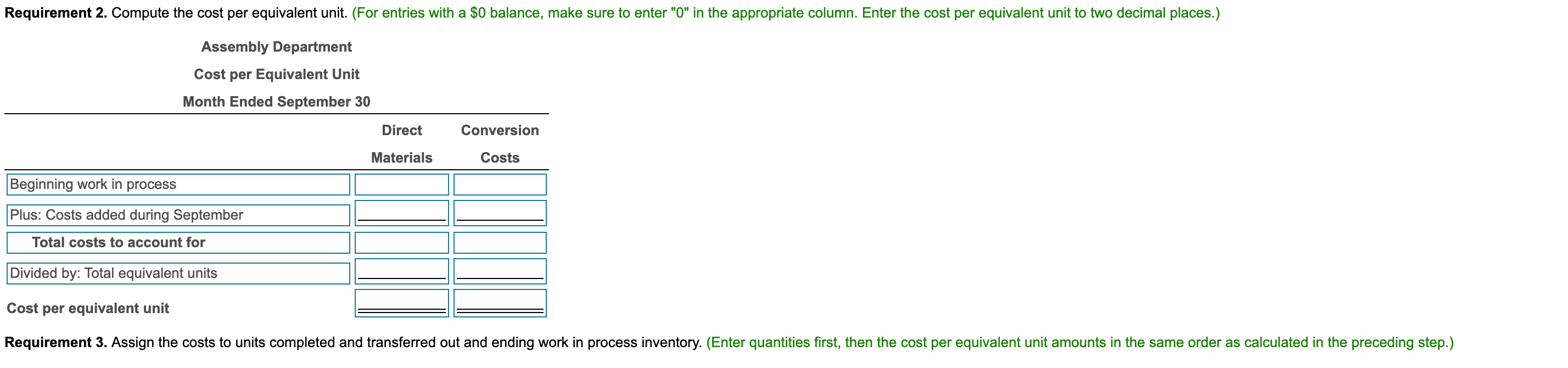

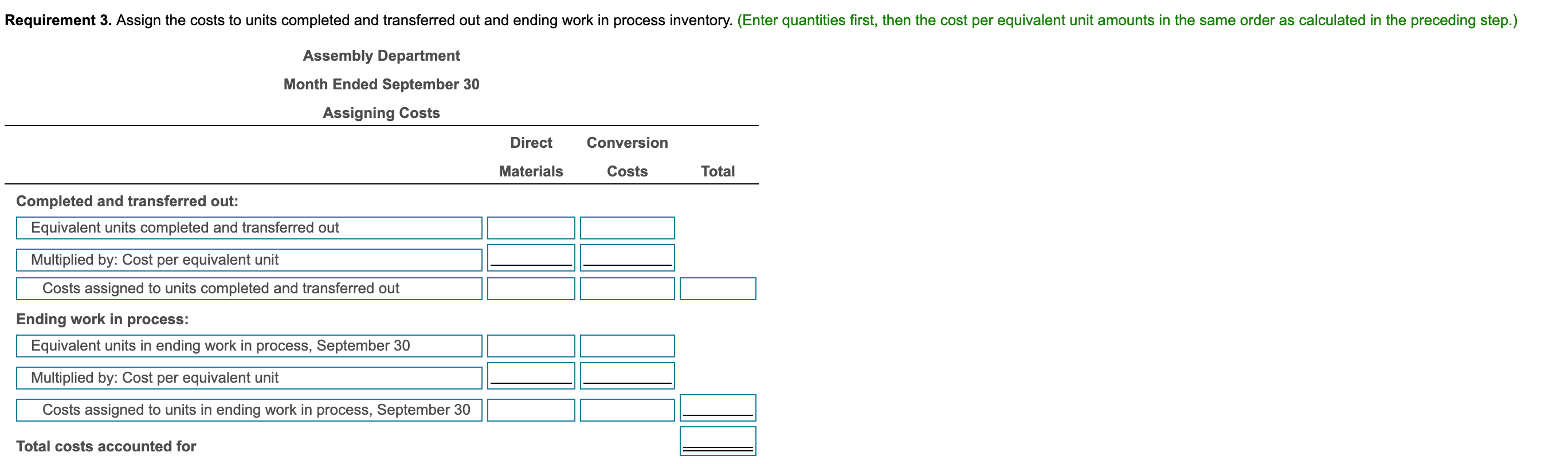

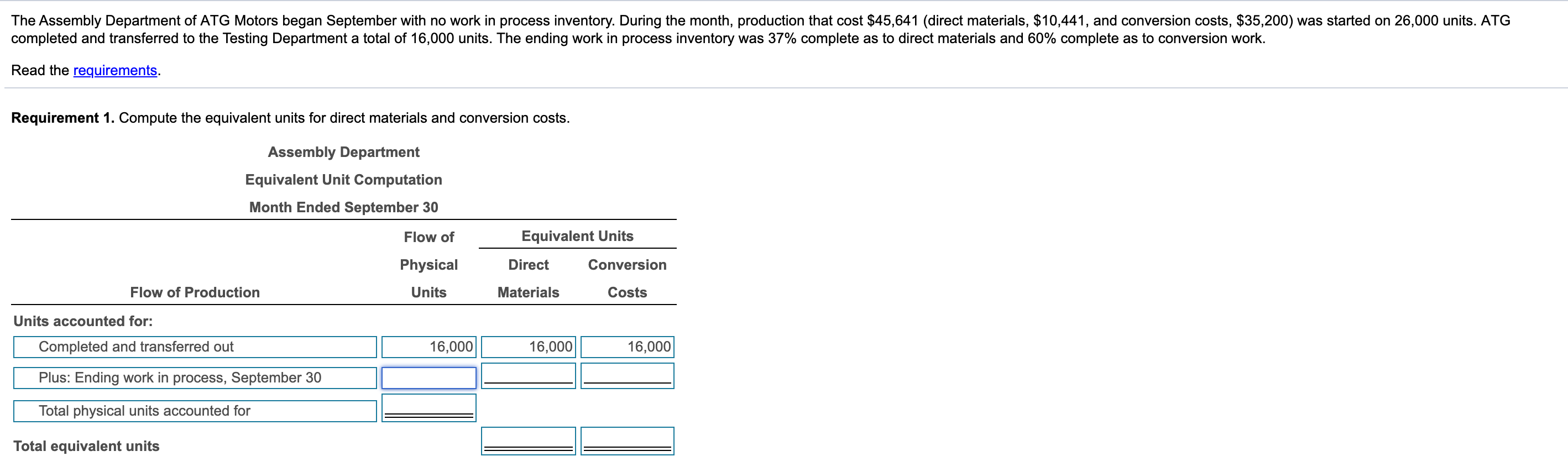

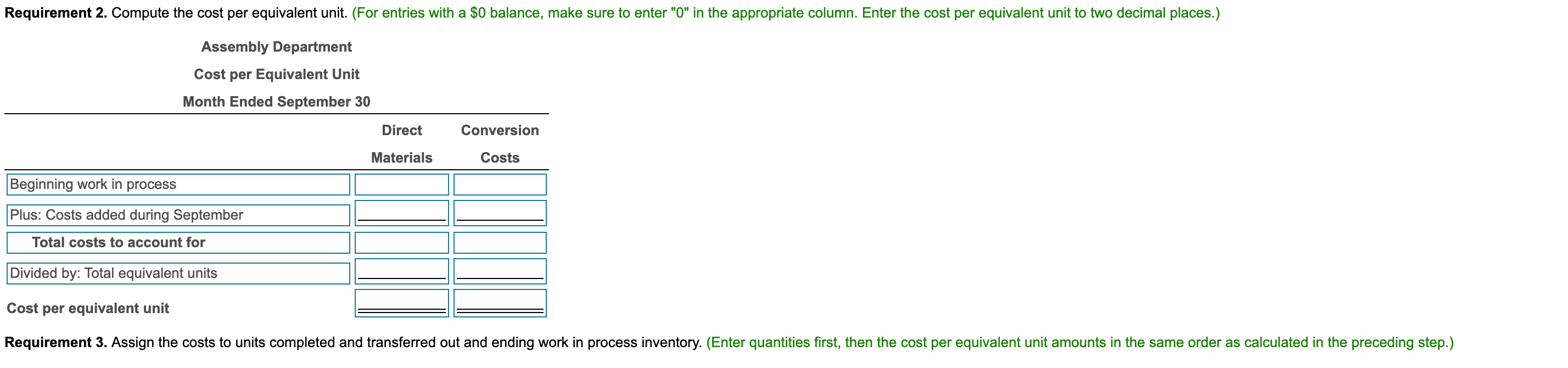

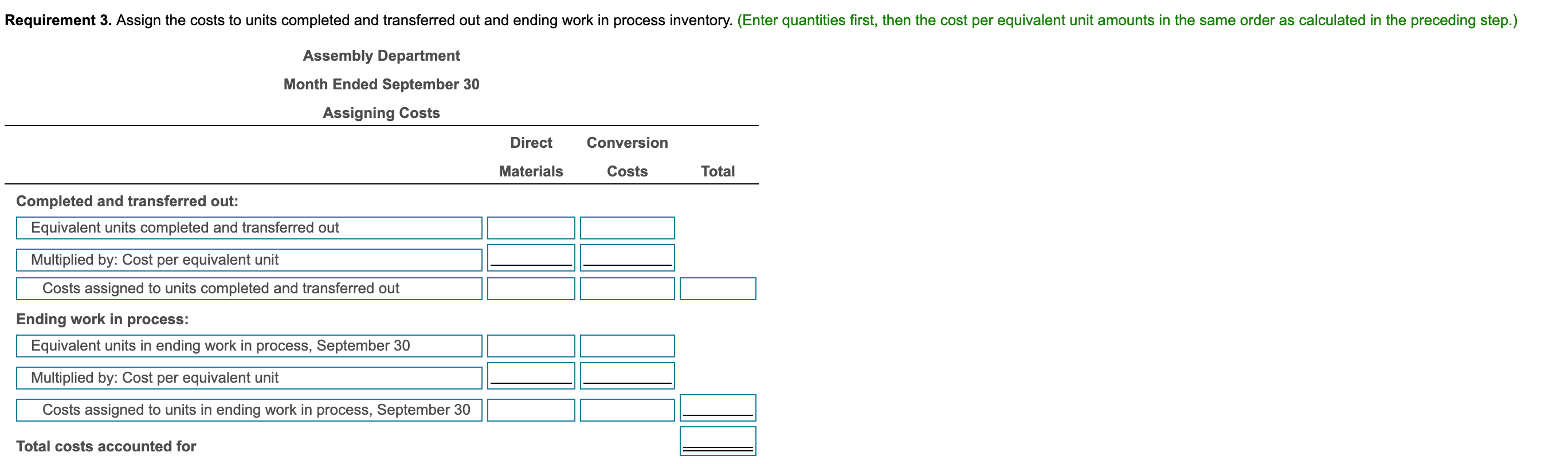

The Assembly Department of ATG Motors began September with no work in process inventory. During the month, production that cost $45,641 (direct materials, $10,441, and conversion costs, $35,200) was started on 26,000 units. ATG completed and transferred to the Testing Department a total of 16,000 units. The ending work in process inventory was 37% complete as to direct materials and 60% complete as to conversion work. Read the requirements. Requirement 1. Compute the equivalent units for direct materials and conversion costs. Assembly Department Equivalent Unit Computation Month Ended September 30 Flow of Equivalent Units Physical Direct Conversion Flow of Production Units Materials Costs Units accounted for: Completed and transferred out 16,000 16,000 16,000 Plus: Ending work in process, September 30 Total physical units accounted for Total equivalent units Requirement 2. Compute the cost per equivalent unit. (For entries with a $0 balance, make sure to enter "0" in the appropriate column. Enter the cost per equivalent unit to two decimal places.) Assembly Department Cost per Equivalent Unit Month Ended September 30 Direct Conversion Materials Costs Beginning work in process Plus: Costs added during September Total costs to account for Divided by: Total equivalent units Cost per equivalent unit Requirement 3. Assign the costs to units completed and transferred out and ending work in process inventory. (Enter quantities first, then the cost per equivalent unit amounts in the same order as calculated in the preceding step.) Requirement 3. Assign the costs to units completed and transferred out and ending work in process inventory. (Enter quantities first, then the cost per equivalent unit amounts in the same order as calculated in the preceding step.) Assembly Department Month Ended September 30 Assigning Costs Direct Conversion Materials Costs Total Completed and transferred out: Equivalent units completed and transferred out Multiplied by: Cost per equivalent unit Costs assigned to units completed and transferred out Ending work in process: Equivalent units in ending work in process, September 30 Multiplied by: Cost per equivalent unit Costs assigned to units in ending work in process, September 30 Total costs accounted for Requirement 4. Record the journal entry for the costs transferred out of the Assembly Department to the Testing Department. (Record debits first, then credits. Exclude explanations from any journal entries.) Journal Entry Date Accounts Debit Credit Work in Process InventoryTesting Work in Process InventoryAssembly Requirement 5. Post all of the transactions in the "Work in Process InventoryAssembly" T-account. What is the ending balance? (For entries with a $0 balance, make sure to enter "0" in the appropriate column.) Work in Process Inventory-Assembly Bal September 1 Direct materials Conversion costs Transferred to Testing Bal September 30