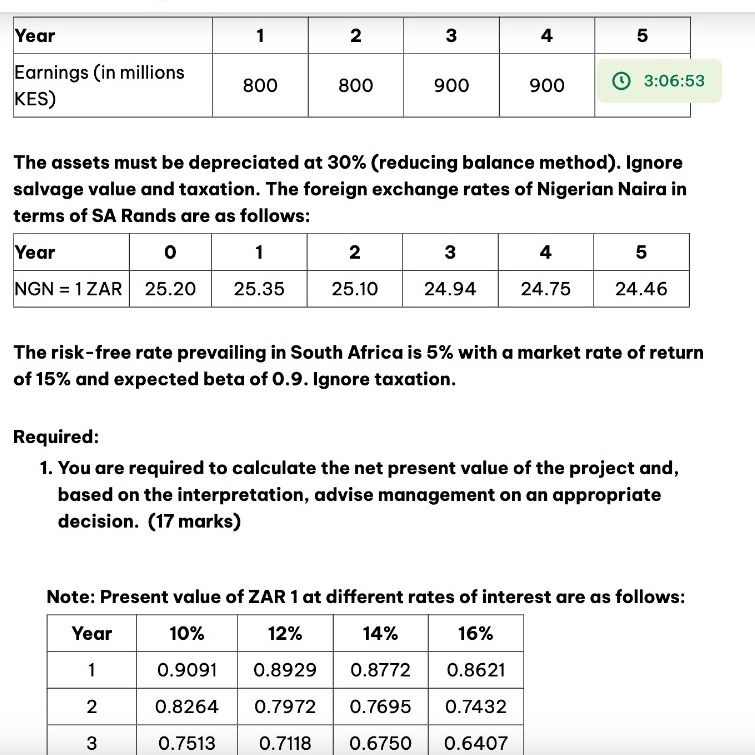

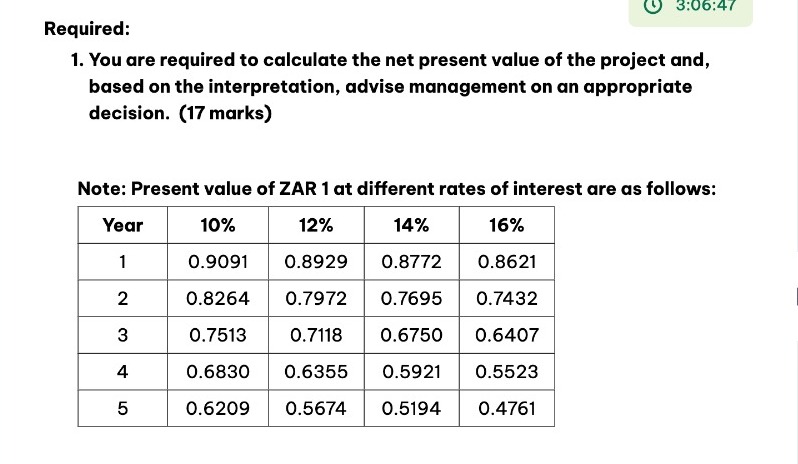

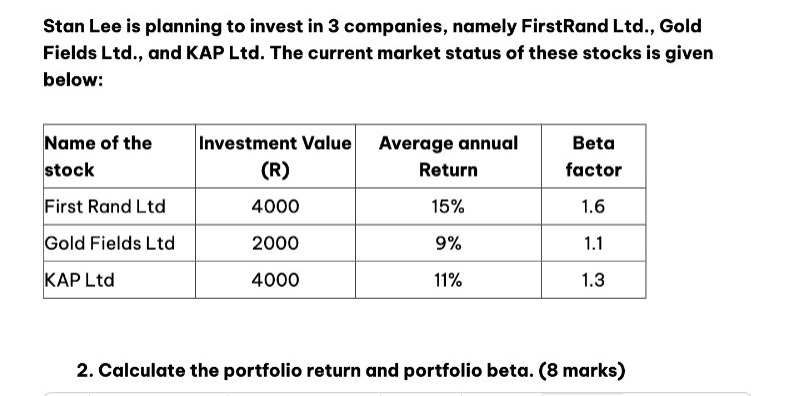

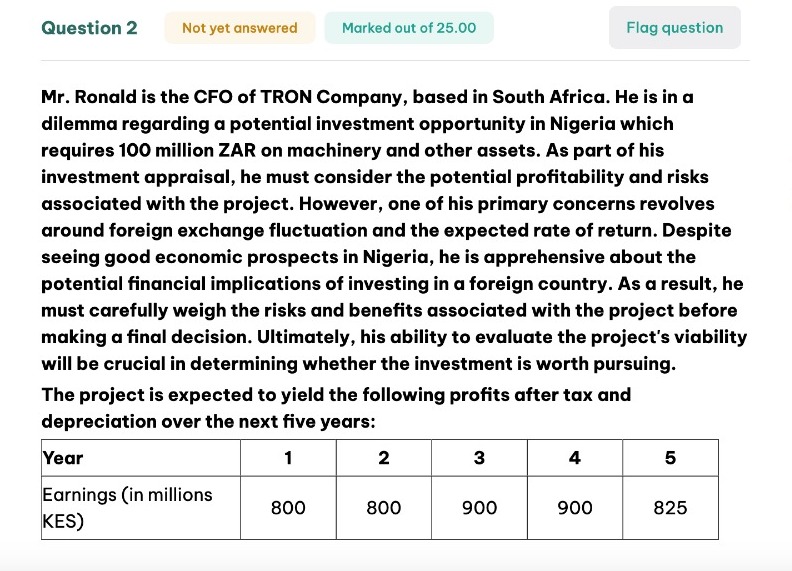

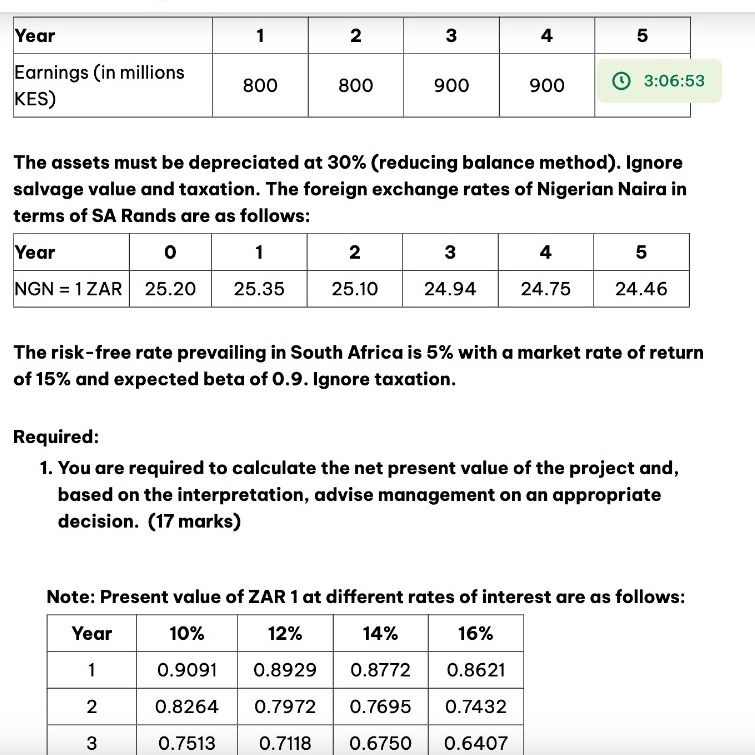

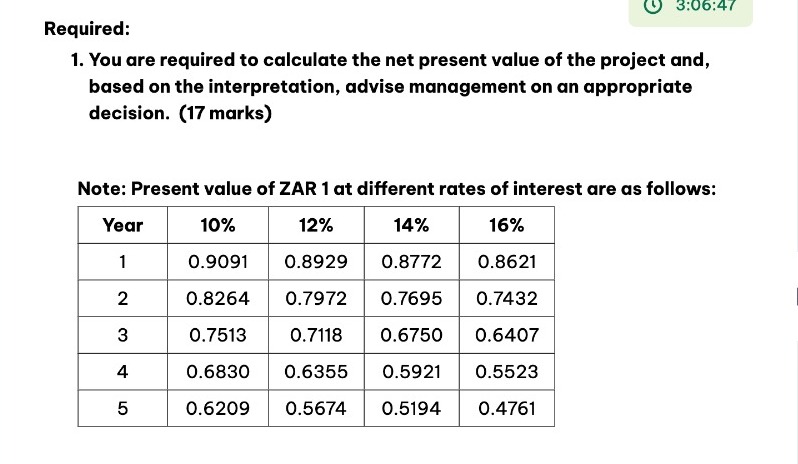

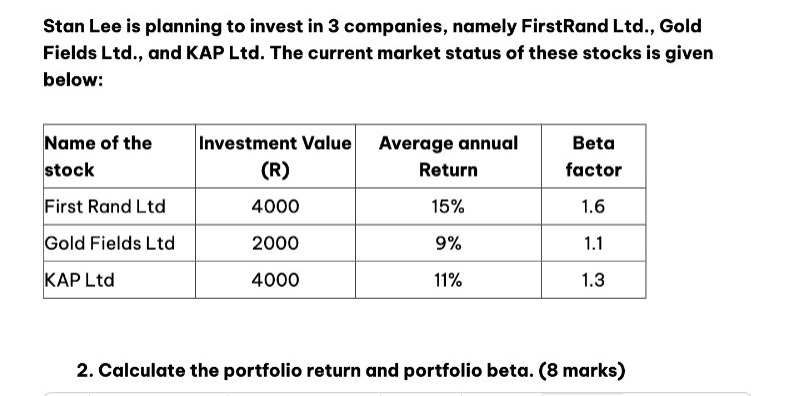

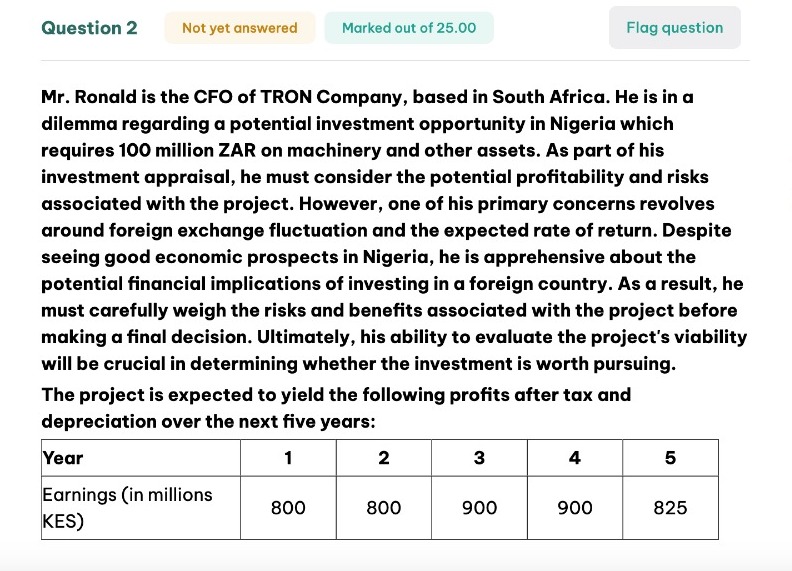

The assets must be depreciated at 30% (reducing balance method). Ignore salvage value and taxation. The foreign exchange rates of Nigerian Naira in terms of SA Rands are as follows: The risk-free rate prevailing in South Africa is 5% with a market rate of return of 15% and expected beta of 0.9 . Ignore taxation. Required: 1. You are required to calculate the net present value of the project and, based on the interpretation, advise management on an appropriate decision. (17 marks) Note: Present value of ZAR 1 at different rates of interest are as follows: lequired: 1. You are required to calculate the net present value of the project and, based on the interpretation, advise management on an appropriate decision. (17 marks) Note: Present value of ZAR 1 at different rates of interest are as follows: Stan Lee is planning to invest in 3 companies, namely FirstRand Ltd., Gold Fields Ltd., and KAP Ltd. The current market status of these stocks is given below: 2. Calculate the portfolio return and portfolio beta. ( 8 marks) Mr. Ronald is the CFO of TRON Company, based in South Africa. He is in a dilemma regarding a potential investment opportunity in Nigeria which requires 100 million ZAR on machinery and other assets. As part of his investment appraisal, he must consider the potential profitability and risks associated with the project. However, one of his primary concerns revolves around foreign exchange fluctuation and the expected rate of return. Despite seeing good economic prospects in Nigeria, he is apprehensive about the potential financial implications of investing in a foreign country. As a result, he must carefully weigh the risks and benefits associated with the project before making a final decision. Ultimately, his ability to evaluate the project's viability will be crucial in determining whether the investment is worth pursuing. The project is expected to yield the following profits after tax and depreciation over the next five years: The assets must be depreciated at 30% (reducing balance method). Ignore salvage value and taxation. The foreign exchange rates of Nigerian Naira in terms of SA Rands are as follows: The risk-free rate prevailing in South Africa is 5% with a market rate of return of 15% and expected beta of 0.9 . Ignore taxation. Required: 1. You are required to calculate the net present value of the project and, based on the interpretation, advise management on an appropriate decision. (17 marks) Note: Present value of ZAR 1 at different rates of interest are as follows: lequired: 1. You are required to calculate the net present value of the project and, based on the interpretation, advise management on an appropriate decision. (17 marks) Note: Present value of ZAR 1 at different rates of interest are as follows: Stan Lee is planning to invest in 3 companies, namely FirstRand Ltd., Gold Fields Ltd., and KAP Ltd. The current market status of these stocks is given below: 2. Calculate the portfolio return and portfolio beta. ( 8 marks) Mr. Ronald is the CFO of TRON Company, based in South Africa. He is in a dilemma regarding a potential investment opportunity in Nigeria which requires 100 million ZAR on machinery and other assets. As part of his investment appraisal, he must consider the potential profitability and risks associated with the project. However, one of his primary concerns revolves around foreign exchange fluctuation and the expected rate of return. Despite seeing good economic prospects in Nigeria, he is apprehensive about the potential financial implications of investing in a foreign country. As a result, he must carefully weigh the risks and benefits associated with the project before making a final decision. Ultimately, his ability to evaluate the project's viability will be crucial in determining whether the investment is worth pursuing. The project is expected to yield the following profits after tax and depreciation over the next five years