Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the assigning of accounts receivable in general as collateral for a Explain any possible differences between accounting for an account receivable factored with recourse compared

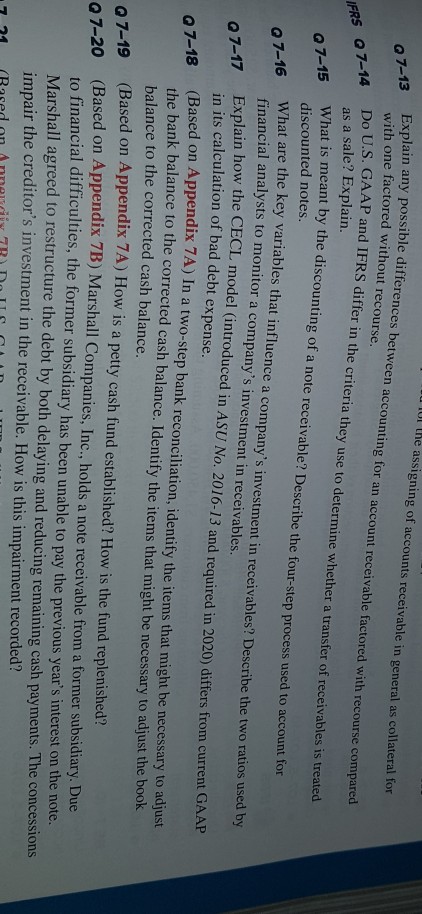

the assigning of accounts receivable in general as collateral for a Explain any possible differences between accounting for an account receivable factored with recourse compared Q7-13 with one factored without recourse, Do U.S. GAAP and IFRS differ in the criteria they use to determine whether a transfer of receivables is treated as a sale? Explain. hat is meant by the discounting of a note receivable? Describe the four-step process used to account for discounted notes. o 7-15 What are the key variables that influence a company's investment in receivables? Describe the two rati fi nancial analysts to monitor a company's investment in receivables xplain how the CECL model (introduced in ASU No. 2016-13 and required in 2020) differs from cur in its calculation of bad debt expense o 7-17 7-18 Based on Appendix 7A) In a two-step bank reconciliation, identify the items that might be necessary to adjust the bank balance to the corrected cash balance. Identify the items that might be necessary to adjust the book balance to the corrected cash balance. Q7-19 (Based on Appendix 7A) How is a petty cash fund established? How is the fund replenished? 7-20 (Based on Appendix 7B) Marshall Companies, Inc., holds a note receivable from a former subsidiary. Due to financial difficulties, the former subsidiary has been unable to pay the previous year's interest on the note. Marshall agreed to restructure the debt by both delaying and reducing remaining cash payments. The concessions impair the creditor's investment in the receivable. How is this impairment recorded? the assigning of accounts receivable in general as collateral for a Explain any possible differences between accounting for an account receivable factored with recourse compared Q7-13 with one factored without recourse, Do U.S. GAAP and IFRS differ in the criteria they use to determine whether a transfer of receivables is treated as a sale? Explain. hat is meant by the discounting of a note receivable? Describe the four-step process used to account for discounted notes. o 7-15 What are the key variables that influence a company's investment in receivables? Describe the two rati fi nancial analysts to monitor a company's investment in receivables xplain how the CECL model (introduced in ASU No. 2016-13 and required in 2020) differs from cur in its calculation of bad debt expense o 7-17 7-18 Based on Appendix 7A) In a two-step bank reconciliation, identify the items that might be necessary to adjust the bank balance to the corrected cash balance. Identify the items that might be necessary to adjust the book balance to the corrected cash balance. Q7-19 (Based on Appendix 7A) How is a petty cash fund established? How is the fund replenished? 7-20 (Based on Appendix 7B) Marshall Companies, Inc., holds a note receivable from a former subsidiary. Due to financial difficulties, the former subsidiary has been unable to pay the previous year's interest on the note. Marshall agreed to restructure the debt by both delaying and reducing remaining cash payments. The concessions impair the creditor's investment in the receivable. How is this impairment recorded

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started