the assignments is about "How will Air Wick extend its distribution channels beyond the grocery channel for the Airwick Botanica Product?", however, Air Wick is a air cleaner brand.

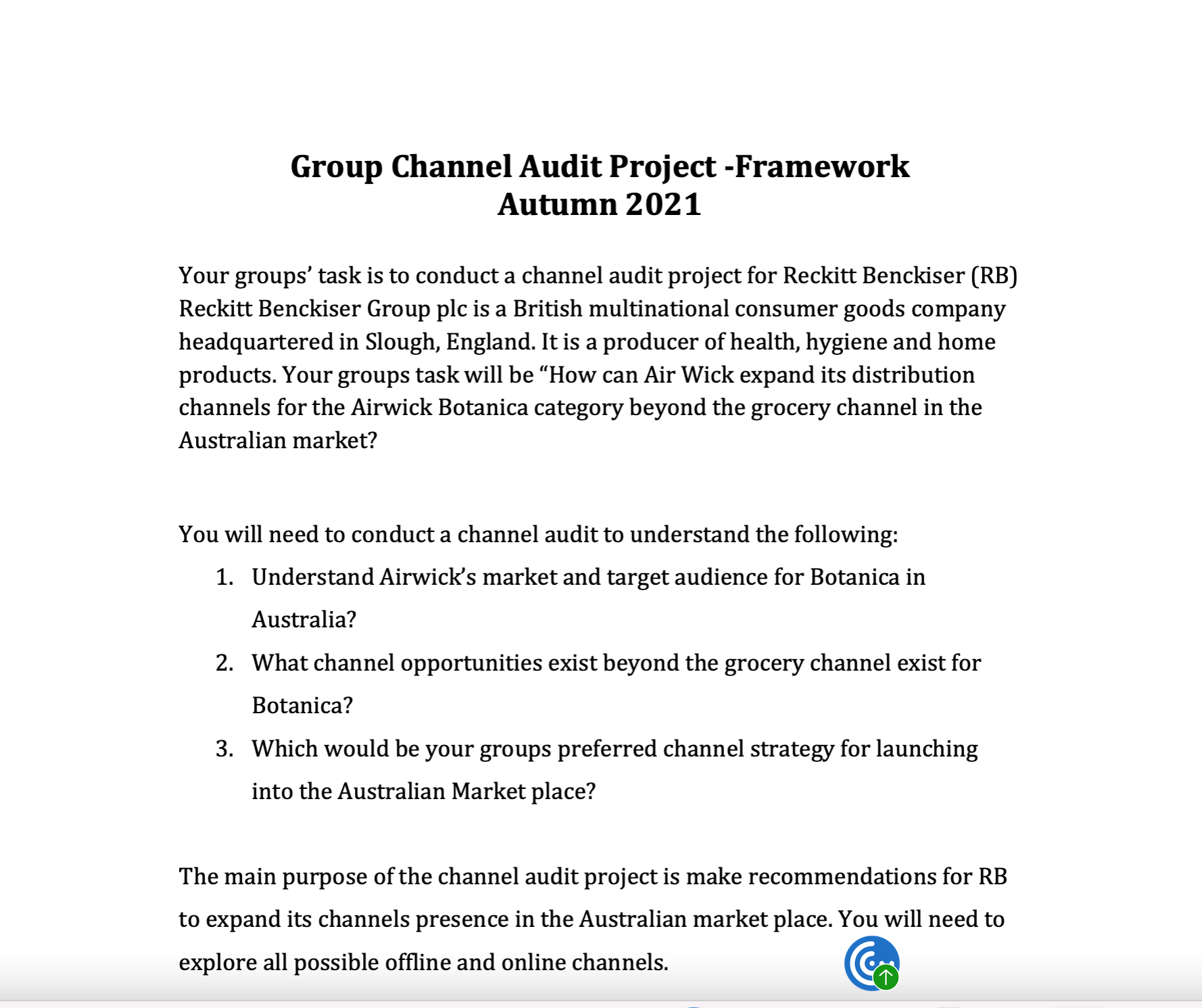

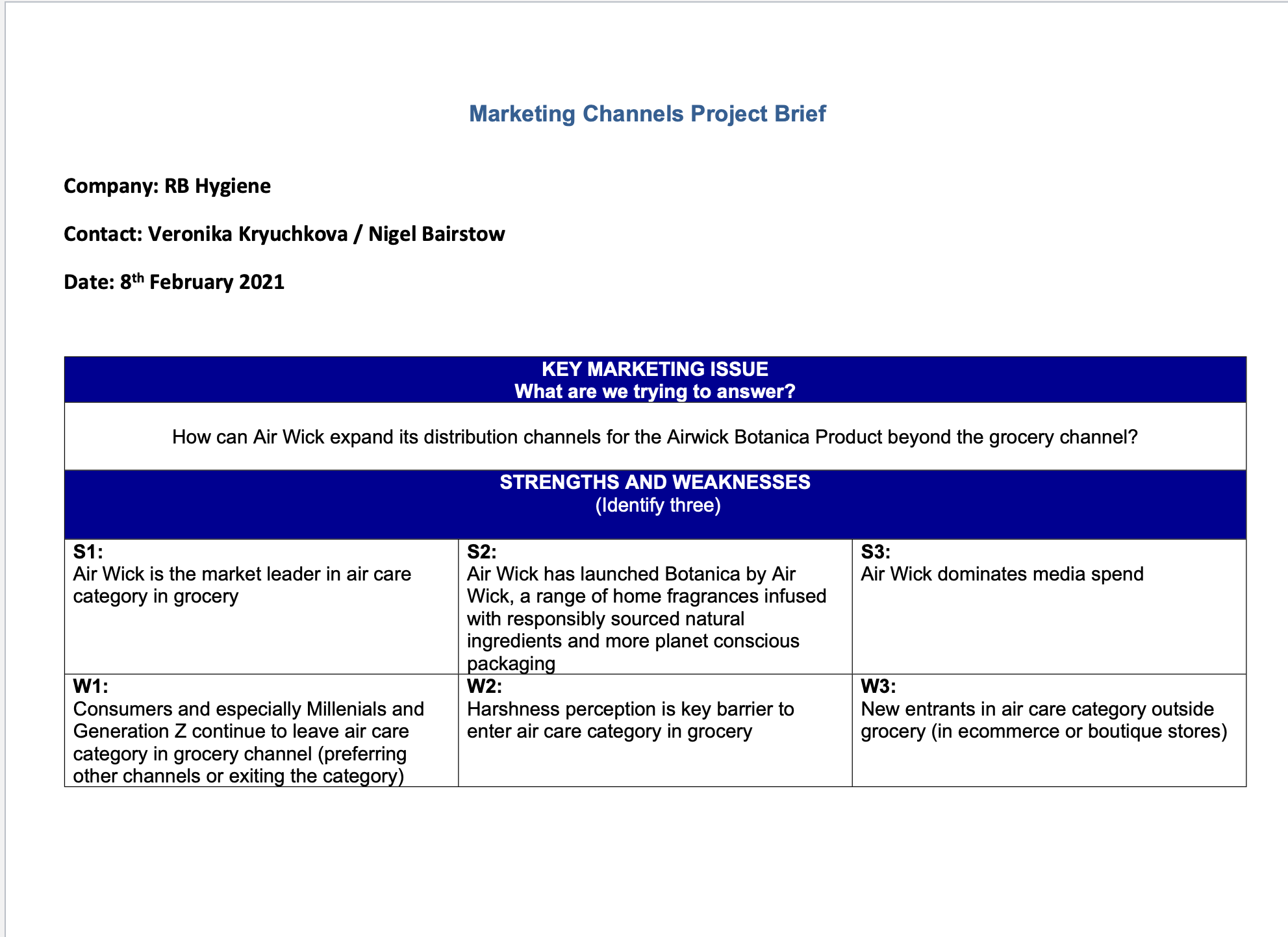

Group Channel Audit Project -Framework Autumn 2021 Your groups' task is to conduct a channel audit project for Reckitt Benckiser (RB) Reckitt Benckiser Group plc is a British multinational consumer goods company headquartered in Slough, England. It is a producer of health, hygiene and home products. Your groups task will be "How can Air Wick expand its distribution channels for the Airwick Botanica category beyond the grocery channel in the Australian market? You will need to conduct a channel audit to understand the following: 1. Understand Airwick's market and target audience for Botanica in Australia? 2. What channel opportunities exist beyond the grocery channel exist for Botanica? 3. Which would be your groups preferred channel strategy for launching into the Australian Market place? The main purpose of the channel audit project is make recommendations for RB to expand its channels presence in the Australian market place. You will need to explore all possible offline and online channels.The main purpose of the channel audit project is make recommendations for RB to expand its channels presence in the Australian market place. You will need to explore all possible offline and online channels.Channel Structure Develop a diagram of the organisations current distribution system. V Is it a direct, indirect or multi-channel distribution system Develop a Channel Efficiency Flow analysis for your channel only V Explain the channel flows and which flows are critical for your organisations .Company: RB Hygiene Marketing Channels Project Brief Contact: Veronika Kryuchkova / Nigel Bairstow Date: 8th February 2021 KEY MARKETING ISSUE What are we trying to answer? 51: Air Wick is the market leader in air care category in grocery 52: Air Wick has launched Botanica by Air Wick, a range of home fragrances infused with responsibly sourced natural ingredients and more planet conscious packaging How can Air Wick expand its distribution channels for the Airwick Botanica Product beyond the grocery channel? STRENGTHS AND WEAKN ESSES (Identify three) 83: Air Wick dominates media spend W1: Consumers and especially Millenials and Generation Z continue to leave air care category in grocery channel (preferring other channels or exiting the category) W2: Harshness perception is key barrier to enter air care category in grocery W3: New entrants in air care category outside grocery (in ecommerce or boutique stores) RELEVANT INDUSTRY TRENDS TOTAL OUTLOOK 1. Air Care products include a variety of formats. The most common are room spray, aerosol, automatic aerosol, car air freshener, reed, diffuser, plug in, and candle. Air care products could be purchased in different channels including grocery (Coles, Woolworths, IGA), discounters (Big W, Kmart), home dcor shops, boutique shops (dusk, ecoya) or online. Ecommerce channel has been growing double digit: Coles and Woolworths along with Amazon have been leading the way. 4. There are multiple price segments in air care category: from $2 for an aerosol to $100 for a candle. Grocery channel has more budget and mainstream air care products while boutique stores offer more premium brands and formats. In recent years there has been a growth of green/sustainable brands as consumers demand more environmentally friendly propositions. CONSUMERS 1. Consumers are seeking to satisfy a range of needs when buying air care products: from malodor removal, continuous freshness to creating an ambience at home. 2. While fragrance is #1 driver to enter air care category, an increased number of consumers are leaving traditional air care formats due to harshness perception and concerns around safety. This trend is especially growing among younger shoppers: millennials and generation 2. Consumers demonstrate growing interest in alternative, natural products within air care. Substitute products such as air purifiers that use essential oil diffusers from brands such as Air Wick Essential Mist, doTERRA and Young Living have gained popularity and are slowly replacing sales of traditional liquid air fresheners and electric air fresheners due to their ethically-sourced formats. 4. The COVlD-19 pandemic has brought people closer to their personal spaces and consumers are now reassessing the value they provide. Air care products are an effective way for consumers to feel more comfortable at home, while mood-enhancing scents have proven attractive to consumers during stressful times. As more people work from home due to COVlD-19, formats that help Australians remove malodours, bring continuous freshness andlor create ambiance in the moment are in double digit growth. AIR WICK 1. Air Wick is a global brand by RB Hygiene and is the #1 player in Grocery in Australia. 2. Air Wick is supported by the extensive product line and is present across all categories of air care in grocery. 3. Moreover. Air Wick dominates media. TV ads could be accessed here https:llwww.youtube.com/c/AirWickAustralia/videos 4. Early 2020 RB Hygiene launched Botanica by Air Wick, a range of home fragrances infused with responsibly sourced natural ingredients and more planet conscious packaging. The launch has been supported by extensive media campaign (https:l/www.youtube.com/watch?v=chQNe0w4Fc) and has been recognised as best in class. Botanica by Air Wick is over- indexing among shoppers