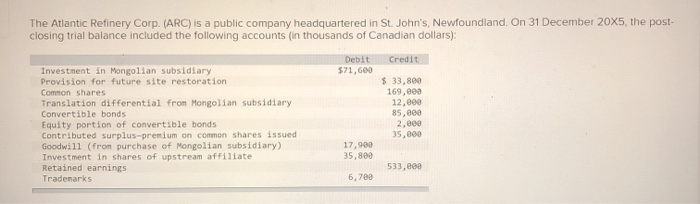

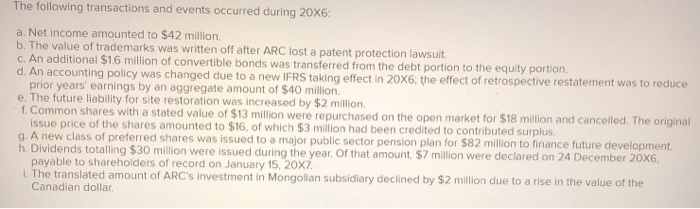

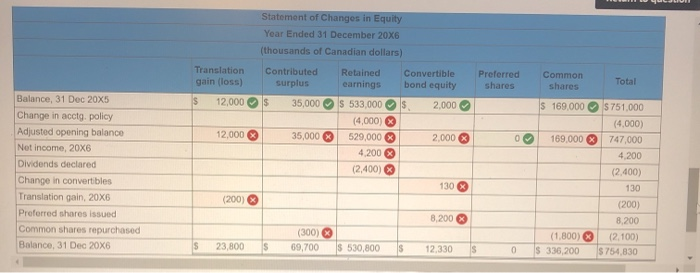

The Atlantic Refinery Corp. (ARC) is a public company headquartered in St. John's, Newfoundland. On 31 December 20X5, the post- closing trial balance included the following accounts (in thousands of Canadian dollars): Debit $71,600 Credit Investment in Mongolian subsidiary Provision for future site restoration Common shares Translation differential from Mongolian subsidiary Convertible bonds Equity portion of convertible bonds Contributed surplus-premium on common shares issued Goodwill (fron purchase of Mongolian subsidiary) Investment in shares of upstream affiliate Retained earnings Trademarks $ 33,800 169,000 12,000 85,000 2.000 35,000 17,990 35,800 533, een 6,789 The following transactions and events occurred during 20X6: a. Net income amounted to $42 million b. The value of trademarks was written off after ARC lost a patent protection lawsuit c. An additional $1.6 million of convertible bonds was transferred from the debt portion to the equity portion. d. An accounting policy was changed due to a new IFRS taking effect in 20X6; the effect of retrospective restatement was to reduce prior years' earnings by an aggregate amount of $40 million e. The future liability for site restoration was increased by $2 million f. Common shares with a stated value of $13 million were repurchased on the open market for $18 million and cancelled. The original issue price of the shares amounted to $16, of which $3 million had been credited to contributed surplus. g. A new class of preferred shares was issued to a major public sector pension plan for $82 million to finance future development h. Dividends totalling $30 million were issued during the year of that amount $7 million were declared on 24 December 20X6, payable to shareholders of record on January 15, 20x7. 1. The translated amount of ARC's investment in Mongolian subsidiary declined by $2 million due to a rise in the value of the Canadian dollar Statement of Changes in Equity Year Ended 31 December 20X6 (thousands of Canadian dollars) Translation gain (loss) Contributed surplus Retained earnings Convertible bond equity Preferred shares Common shares Total $ 12,000 $ 35,000 IS 2.000 12,000 35,000 S 533,000 (4,000) 529,000 4.200 (2,400) 2.000 Balance, 31 Dec 20x5 Change in acct. policy Adjusted opening balance Net income, 20X6 Dividends declared Change in convertibles Translation gain, 20X6 Preferred shares issued Common shares repurchased Balance, 31 Dec 20X6 0 $ 169.000 S 751.000 (4,000) 169.000 747,000 4.200 (2,400) 130 (200) 8.200 (1.800) (2.100) S 336,200 $ 754,830 130 x (200) 8.200 (300) 69,700 s 23,800 S S 530,800 S 12,330 S 0