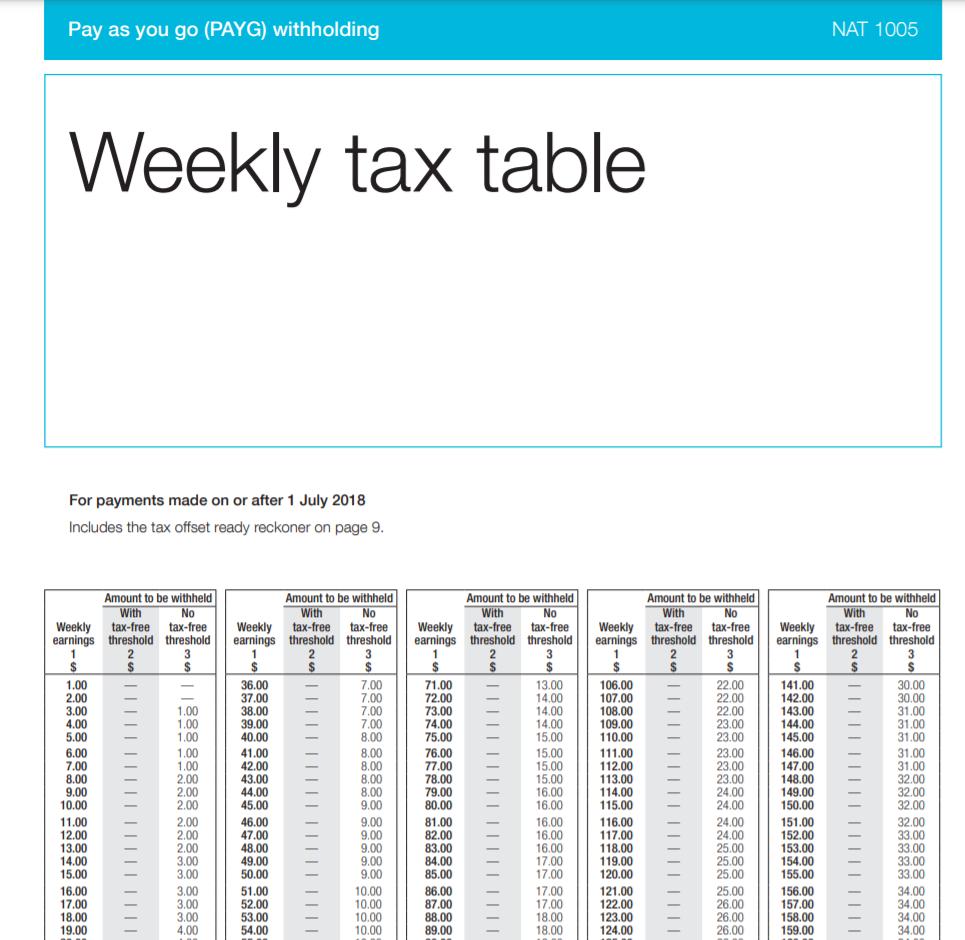

a) Prepare the schedule of payroll information for wages paid, including PAYG withholding deductions, and net wages for each employee by week. b) Calculate the

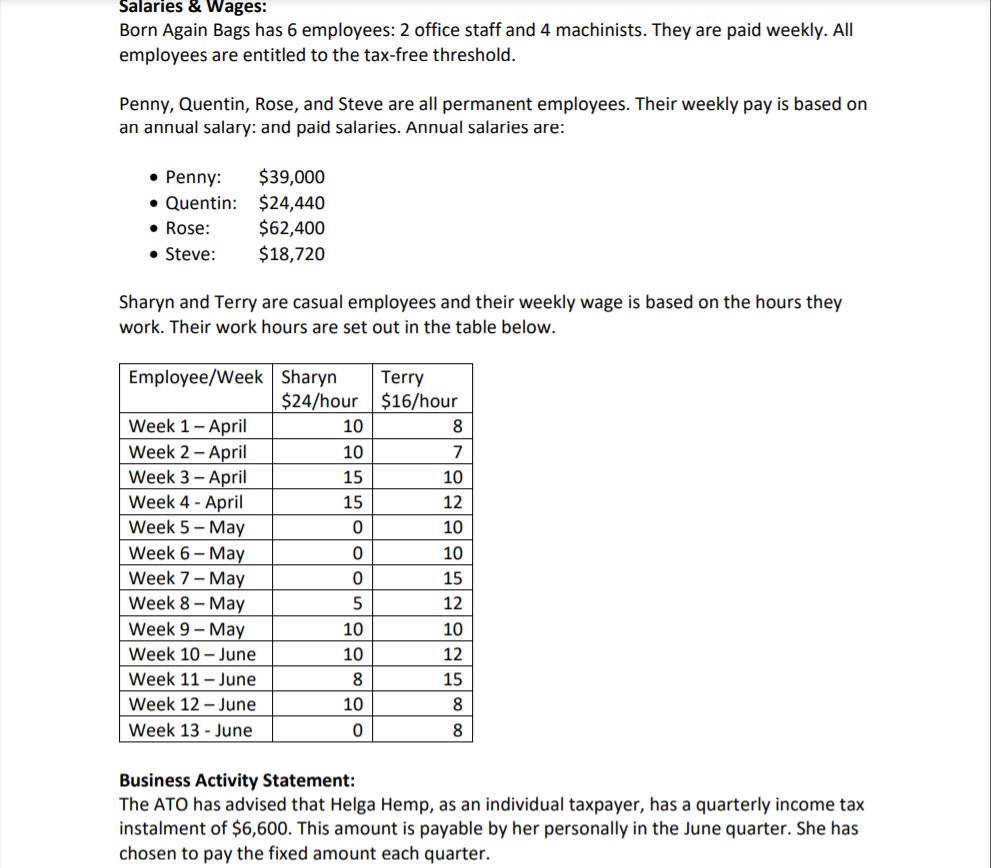

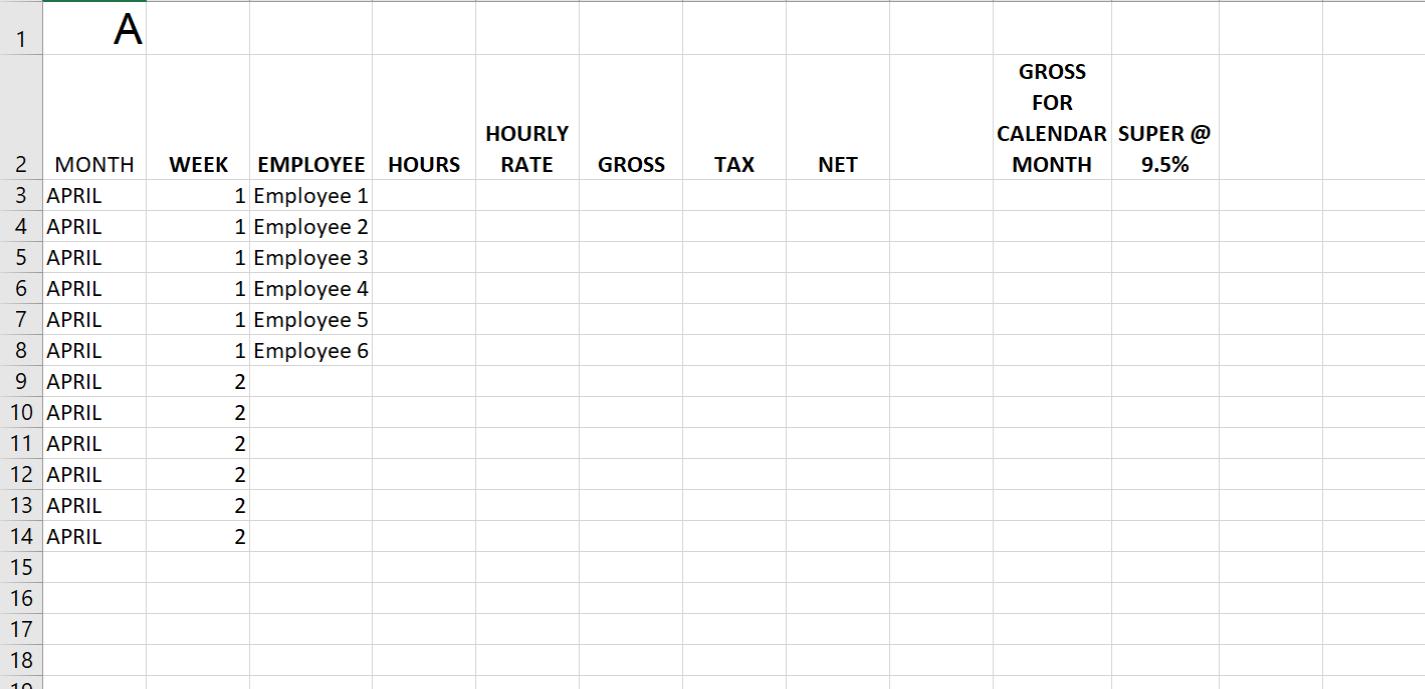

a) Prepare the schedule of payroll information for wages paid, including PAYG withholding deductions, and net wages for each employee by week.

b) Calculate the employer’s statutory Superannuation Guarantee obligations for each employee for the quarter.

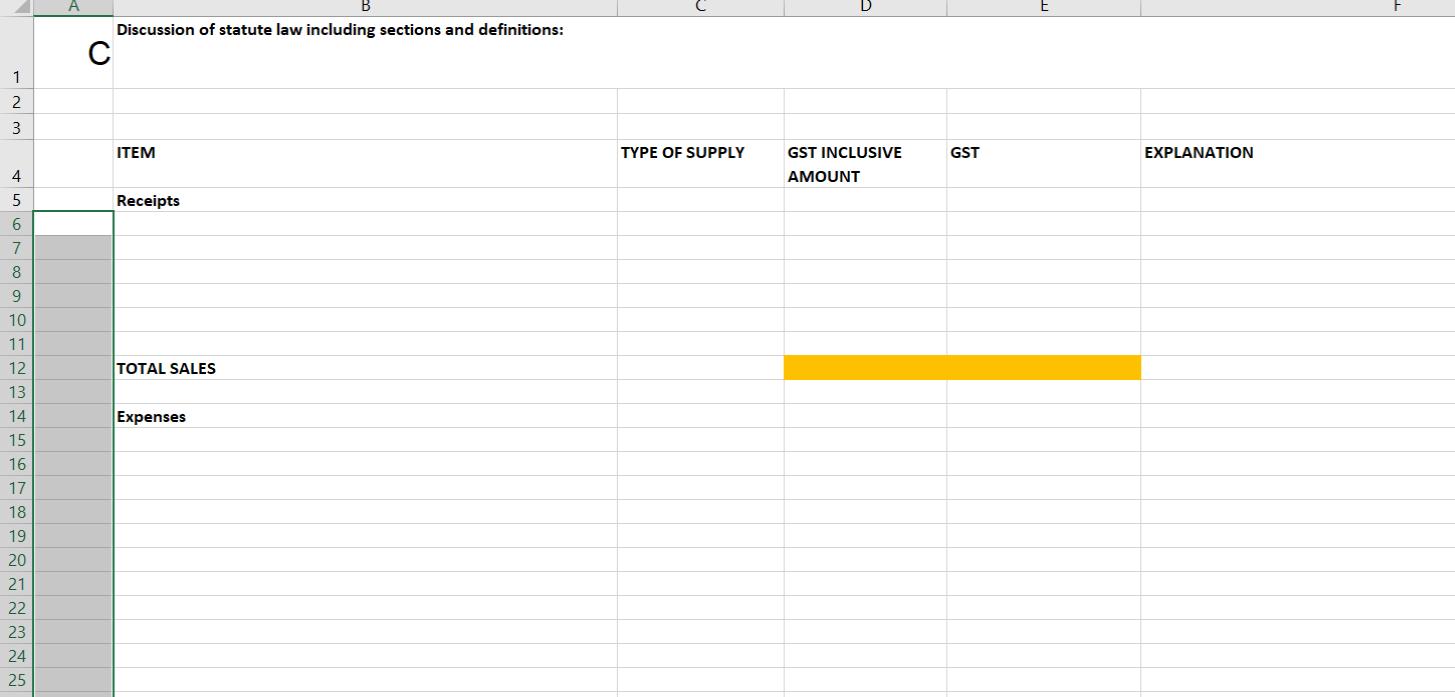

c) Provide a short definition and discussion of GST taxable supplies. Explain and classify each transaction item listed, including wages and superannuation, by the type of GST supply, and calculate any GST included in the price.

d) Provide a short definition and discussion of creditable acquisitions and discuss what conditions need to be met before Born Again Bags can claim input tax credits in relation to the expenses listed? Explain whether each of the acquisitions is a creditable acquisition.

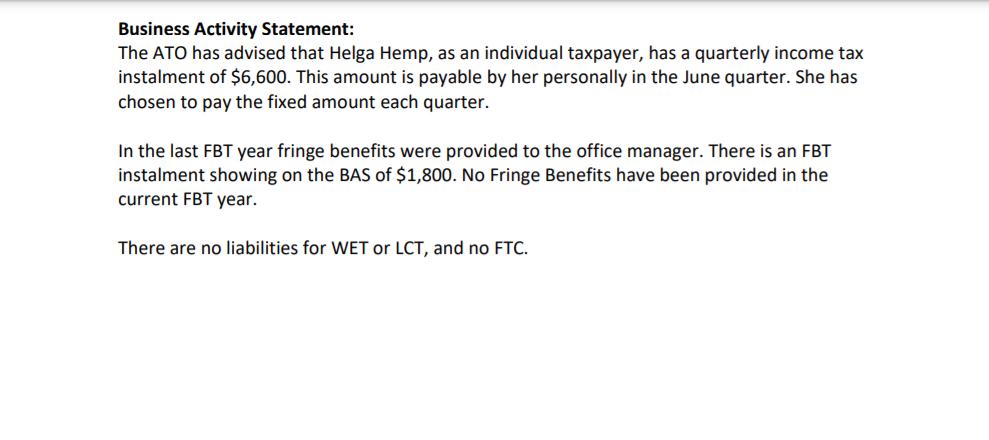

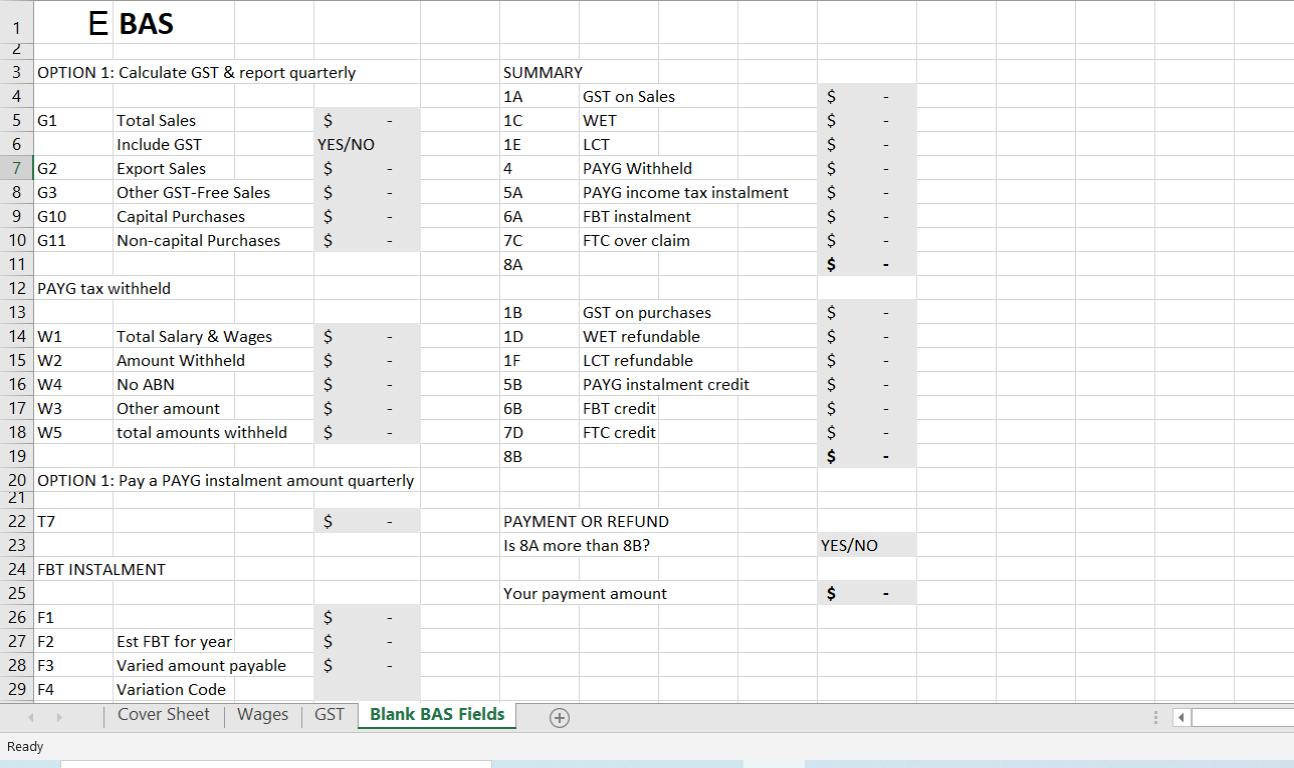

e) prepare to complete a fully labelled Business Activity Statement for the quarter ended 30 June 2020.

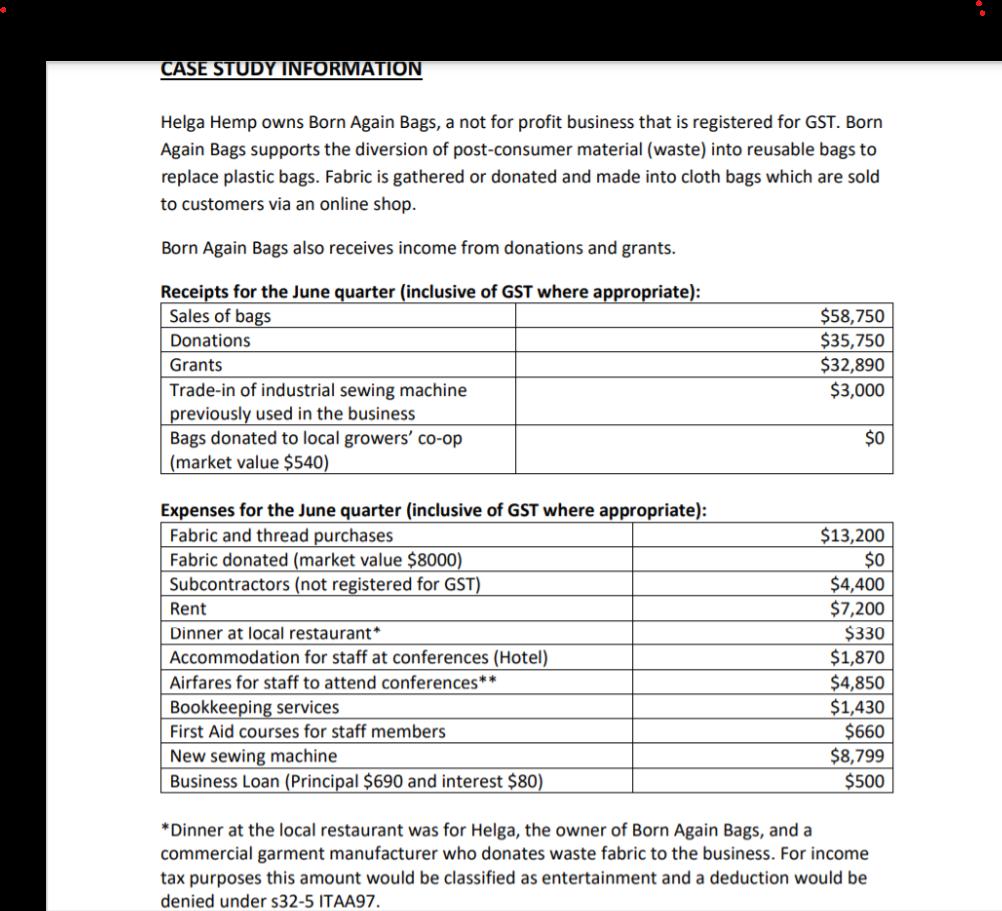

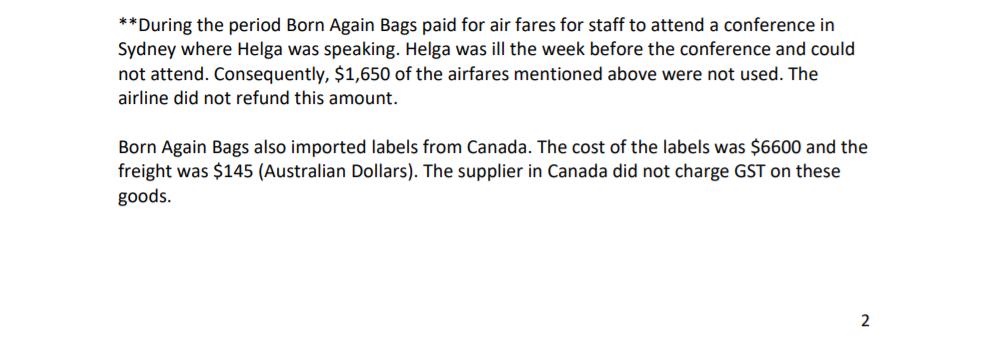

CASE STUDY INFORMATION Helga Hemp owns Born Again Bags, a not for profit business that is registered for GST. Born Again Bags supports the diversion of post-consumer material (waste) into reusable bags to replace plastic bags. Fabric is gathered or donated and made into cloth bags which are sold to customers via an online shop. Born Again Bags also receives income from donations and grants. Receipts for the June quarter (inclusive of GST where appropriate): Sales of bags Donations Grants Trade-in of industrial sewing machine previously used in the business Bags donated to local growers' co-op (market value $540) Expenses for the June quarter (inclusive of GST where appropriate): Fabric and thread purchases Fabric donated (market value $8000) Subcontractors (not registered for GST) Rent Dinner at local restaurant* Accommodation for staff at conferences (Hotel) Airfares for staff to attend conferences** Bookkeeping services First Aid courses for staff members New sewing machine Business Loan (Principal $690 and interest $80) $58,750 $35,750 $32,890 $3,000 $0 $13,200 $0 $4,400 $7,200 $330 $1,870 $4,850 $1,430 $660 $8,799 $500 *Dinner at the local restaurant was for Helga, the owner of Born Again Bags, and a commercial garment manufacturer who donates waste fabric to the business. For income tax purposes this amount would be classified as entertainment and a deduction would be denied under s32-5 ITAA97.

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Tax The ATO has advised that Helga Hemp as an individual taxpayer has a quarterly income ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started